Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Delivery Service Express (DSE) has a fleet of trucks and specializes in the delivery of refrigerated foods. The warehouse manager purchased a delivery truck

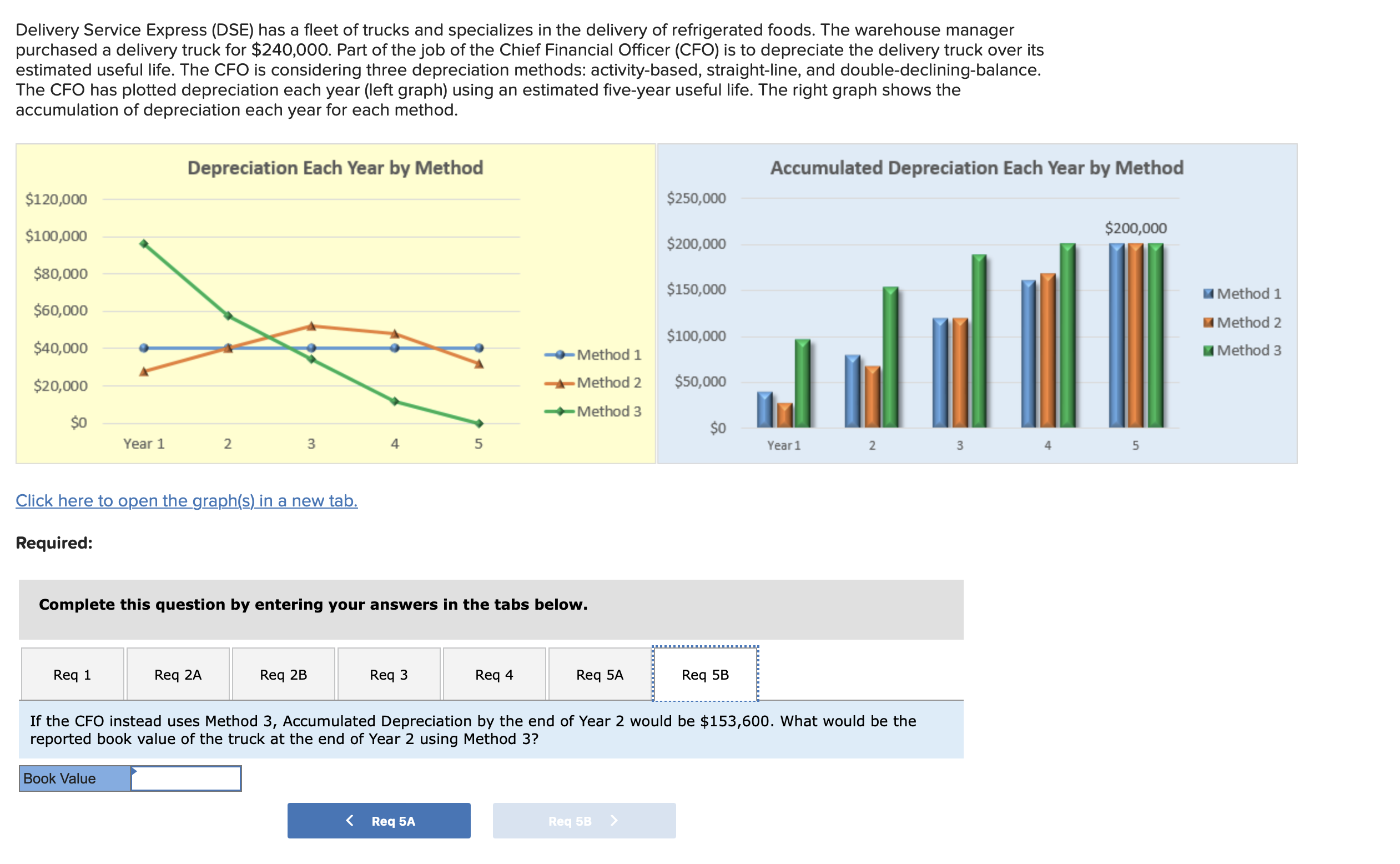

Delivery Service Express (DSE) has a fleet of trucks and specializes in the delivery of refrigerated foods. The warehouse manager purchased a delivery truck for $240,000. Part of the job of the Chief Financial Officer (CFO) is to depreciate the delivery truck over its estimated useful life. The CFO is considering three depreciation methods: activity-based, straight-line, and double-declining-balance. The CFO has plotted depreciation each year (left graph) using an estimated five-year useful life. The right graph shows the accumulation of depreciation each year for each method. Depreciation Each Year by Method Accumulated Depreciation Each Year by Method $120,000 $250,000 $100,000 $200,000 $200,000 $80,000 $150,000 $60,000 $100,000 $40,000 -Method 1 $20,000 -Method 2 $50,000 -Method 3 $0 $0 Year 1 2 3 4 5 Year 1 2 3 5 Click here to open the graph(s) in a new tab. Required: Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3 Req 4 Req 5A Req 5B If the CFO instead uses Method 3, Accumulated Depreciation by the end of Year 2 would be $153,600. What would be the reported book value of the truck at the end of Year 2 using Method 3? Book Value Req 5A Req 5B Method 1 Method 2 Method 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started