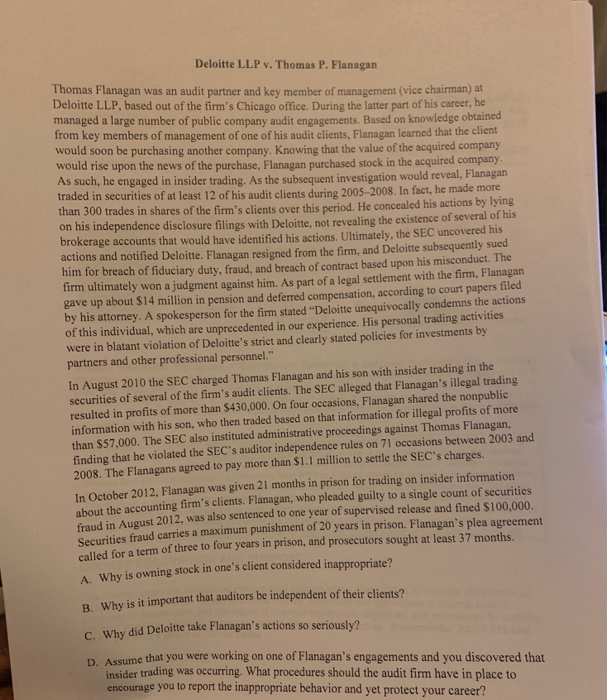

Deloitte LLP v. Thomas P. Flanagan Thomas Flanagan was an audit partner and key member of management (vice chairman) Deloitte LLP, based out of the firm's Chicago office. During the latter part of his career, he managed a large number of public company audit engagements. Based on knowledge obtained from key members of management of one of his audit clients, Flanagan learned that the client would soon be purchasing another would rise upon the news of the purchase, Flanagan purchased stock in the acquired company As such, he engaged in insider trading. As the subsequent investigation would reveal, traded in securities of at least 12 of his audit clients during 2005-2008. In fact, he mad than 300 trades in shares of the firm's clients over this period. company. Knowing that the value of the acquired company Flanagan e more He concealed his actions by lying is independence disclosure filings with Deloitte, not revealing the existence of several of his brokerage accounts that would have identified his actions. Ultimately, the SEC uncovered his actions and notified Deloitte. Flanagan resigned from the firm, and Deloitte subsequently sued him for breach of fiduciary duty, fraud, and breach of contract based upon his misconduct. The tirm ultimately won a judgment against him. As part of a legal settlement with the firm, Flanagan ave up about $14 million in pension and deferred compensation, according to court papers filed by his attorney. A spokesperson for the firm stated "Deloitte unequivocally condemns the actions of this individual, which are unprecedented in our experience. His personal trading activities were in blatant violation of Deloitte's strict and clearly stated policies for investments by partners and other professional personnel. In August 2010 the SEC charged Thomas Flanagan and his son with insider trading in the securities of several of the firm's audit clients. The SEC alleged that Flanagan's illegal trading resulted in profits of more than $430,000. On four occasions, Flanagan shared the nonpublic information with his son, who then traded based on that information for illegal profits of more than $57,000. The SEC also instituted administrative proceedings against Thomas Flanagan, finding that he violated the SEC's auditor independence rules on 71 occasions between 2003 and 2008. The Flanagans agreed to pay more than $1.1 million to settle the SEC's charges. In October 2012, Flanagan was given 21 months in prison for trading on insider information about the accounting firm's clients. Flanagan, who pleaded guilty to a single count of securities fraud in August 2012, was also sentenced to one year of supervised release and fined $100,000 Securities fraud carries a maximum punishment of20 years in prison. Flanagan's plea agreement called for a term of three to four years in prison, and prosecutors sought at least 37 months A. Why is owning stock in one's client considered inappropriate? B. why is it important that auditors be independent of their clients? did Deloitte take Flanagan's actions so seriously? Assume that you were working on one of Flanagan's engagements and you discovered that insider trading was occurring. What procedures should the audit firm have in place to encourage you to report the inappropriate behavior and yet protect your career? D