Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Delta Airlines Inc. Stock Valuation Using Multiples: - From the selected company's main page, select the Company details tab and then choose Earnings estimates (

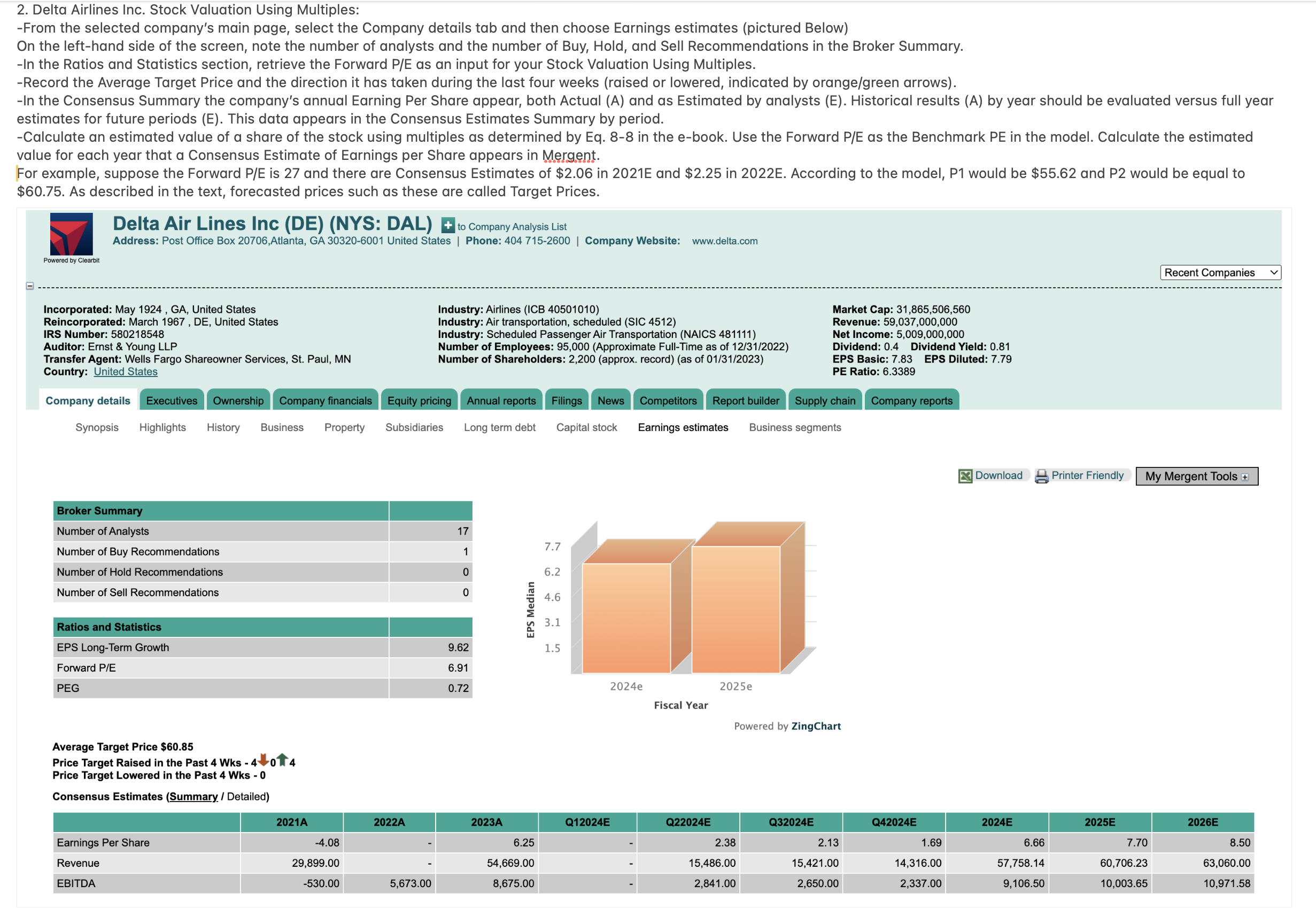

Delta Airlines Inc. Stock Valuation Using Multiples:

From the selected company's main page, select the Company details tab and then choose Earnings estimates pictured Below

On the lefthand side of the screen, note the number of analysts and the number of Buy, Hold, and Sell Recommendations in the Broker Summary.

In the Ratios and Statistics section, retrieve the Forward PE as an input for your Stock Valuation Using Multiples.

Record the Average Target Price and the direction it has taken during the last four weeks raised or lowered, indicated by orangegreen arrows

In the Consensus Summary the company's annual Earning Per Share appear, both Actual A and as Estimated by analysts E Historical results A by year should be evaluated versus full year

estimates for future periods E This data appears in the Consensus Estimates Summary by period.

Calculate an estimated value of a share of the stock using multiples as determined by Eq in the ebook. Use the Forward PE as the Benchmark PE in the model. Calculate the estimated

value for each year that a Consensus Estimate of Earnings per Share appears in Mergent.

For example, suppose the Forward PE is and there are Consensus Estimates of $ in and $ in According to the model, P would be $ and would be equal to

$ As described in the text, forecasted prices such as these are called Target Prices.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started