Answered step by step

Verified Expert Solution

Question

1 Approved Answer

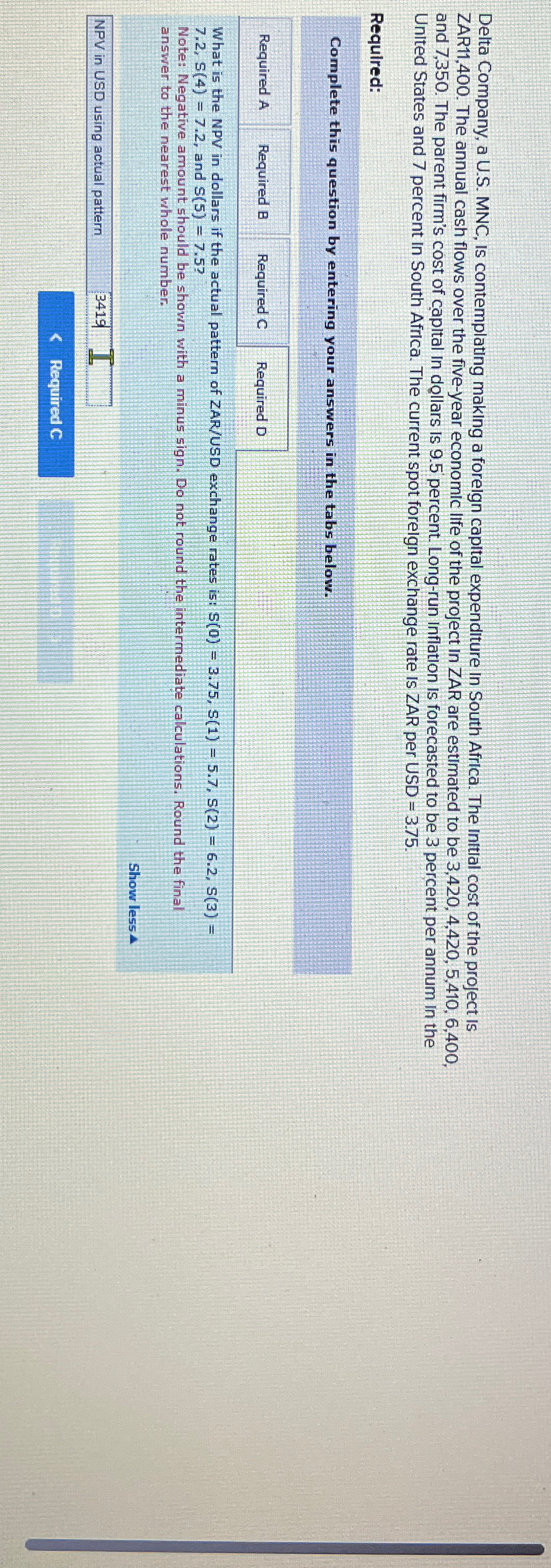

Delta Company, a U . S . MNC , Is contemplating making a forelgn capital expenditure in South Africa. The initial cost of the project

Delta Company, a US MNC Is contemplating making a forelgn capital expenditure in South Africa. The initial cost of the project is ZAR The annual cash flows over the fiveyear economic life of the project in ZAR are estimated to be and The parent firm's cost of capital in dellars is percent. Longrun inflation is forecasted to be percent per annum in the United States and percent in South Africa. The current spot forelgn exchange rate is ZAR per USD

Required:

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required

Required D

What is the NPV in dollars if the actual pattern of ZARUSD exchange rates is: and

Note: Negative amount should be shown with a minus sign. Do not round the intermediate calculations. Round the final answer to the nearest whole number.

Show less

NPV in USD using actual pattern

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started