Question

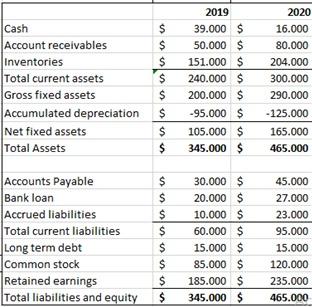

DELTA COMPANY 'S INCOME STATEMENT DELTAS COMPANY'S BALANCE SHEET Based on the data above, then: a . Calculate the Liquidity ratio which includes the current

DELTA COMPANY 'S INCOME STATEMENT

DELTAS COMPANY'S BALANCE SHEET

Based on the data above, then:

a. Calculate the Liquidity ratio which includes the current ratio, quick ratio, and NWC to total assets ratio

b. Calculate the leverage ratio which includes total debt to total assets ratio, equity multiplier, debt to

equity ratio, current liabilities to total debt ratio, interest coverage, and fixed charges

coverage.

c. Calculate the profitability ratio which includes gross profit margin, operating profit margin, net

profit margin, and NOPAT margin

d. Calculate the Efficiency ratio which includes the sales to total assets ratio, operating return on assets,

return on assets, ROA Model, return on equity, and ROE Model

e. Interpret the data on each of the required ratio calculations from points a-d

2020 450.000 Net sales COGS Gross profit Operating expenses Depreciation Interest EBIT Income taxes Net income Cash dividends $ $ $ $ $ $ $ $ $ $ 2019 375.000 $ -225.000 $ 150.000$ -46.000 $ -25.000 $ -4.000 $ 75.000 $ -20.000 $ 55.000 $ 17.000 $ -270.000 180.000 -46.000 -30.000 -4.000 100.000 -30.000 70.000 20.000 Cash Account receivables Inventories Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total Assets $ $ $ $ $ $ $ $ 2019 39.000 $ 50.000 $ 151.000 $ 240.000 $ 200.000 $ -95.000 $ 105.000 $ 345.000 $ 2020 16.000 80.000 204.000 300.000 290.000 - 125.000 165.000 465.000 Accounts Payable Bank loan Accrued liabilities Total current liabilities Long term debt Common stock Retained earnings Total liabilities and equity $ $ $ $ $ $ $ $ 30.000 $ 20.000 $ 10.000 $ 60.000 $ 15.000 $ 85.000 $ 185.000 $ 345.000 $ 45.000 27.000 23.000 95.000 15.000 120.000 235.000 465.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started