Answered step by step

Verified Expert Solution

Question

1 Approved Answer

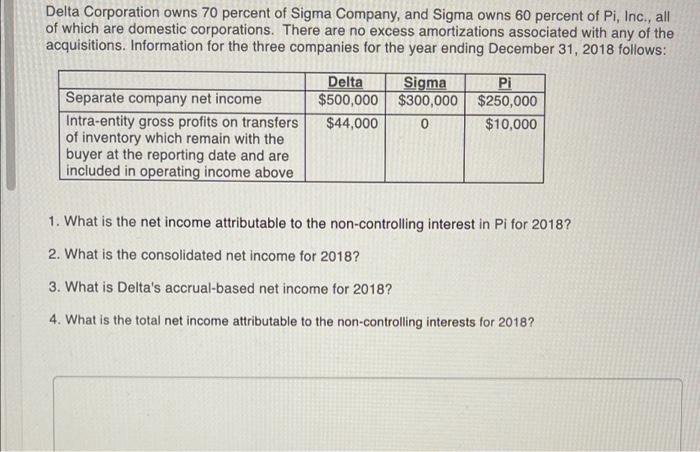

Delta Corporation owns 70 percent of Sigma Company, and Sigma owns 60 percent of Pi, Inc., all of which are domestic corporations. There are

Delta Corporation owns 70 percent of Sigma Company, and Sigma owns 60 percent of Pi, Inc., all of which are domestic corporations. There are no excess amortizations associated with any of the acquisitions. Information for the three companies for the year ending December 31, 2018 follows: Separate company net income Intra-entity gross profits on transfers of inventory which remain with the buyer at the reporting date and are included in operating income above Delta $500,000 $44,000 Sigma $300,000 0 Pi $250,000 $10,000 1. What is the net income attributable to the non-controlling interest in Pi for 2018? 2. What is the consolidated net income for 2018? 3. What is Delta's accrual-based net income for 2018? 4. What is the total net income attributable to the non-controlling interests for 2018?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution The data interpretation and workings In the context of the given question The chain holding concept was adopted by the three companies Here D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started