Question

Delta Inc. What is a reasonable estimate of Delta s equity value at December 31, 2017 ? The value date is December 2017 Two similar

Delta Inc.

What is a reasonable estimate of Deltas equity value at December 31, 2017?

The value date is December 2017

Two similar publicly traded similar firms have (i) no debt; and (ii) a cost of equity of 13% and 15% (essentially their unlevered pre tax WACC return). However, Delta has debt, and its long-term constant D/(D + E) ratio is 0.16.

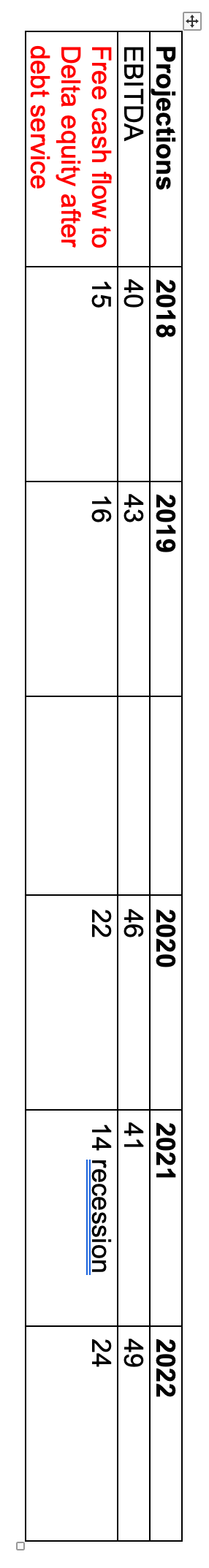

For the DCF method, use these projections, which are in millions. The FCFE projections include income taxes at a 40% rate.

Sale Price in 2022: For the December 31, 2022 terminal enterprise value (TV), you will (a) assume a competitor buys Delta at a ratio of 8x EV/EBITDA in December 2022. On that date, net debt is zero.

\begin{tabular}{|l|l|l|l|l|l|l|} \hline Projections & 2018 & 2019 & & 2020 & 2021 & 2022 \\ \hline EBITDA & 40 & 43 & & 46 & 41 & 49 \\ \hline Free cash flow to Delta equity after debt service & 15 & 16 & 22 & 14 recession & 24 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline Projections & 2018 & 2019 & & 2020 & 2021 & 2022 \\ \hline EBITDA & 40 & 43 & & 46 & 41 & 49 \\ \hline Free cash flow to Delta equity after debt service & 15 & 16 & 22 & 14 recession & 24 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started