Answered step by step

Verified Expert Solution

Question

1 Approved Answer

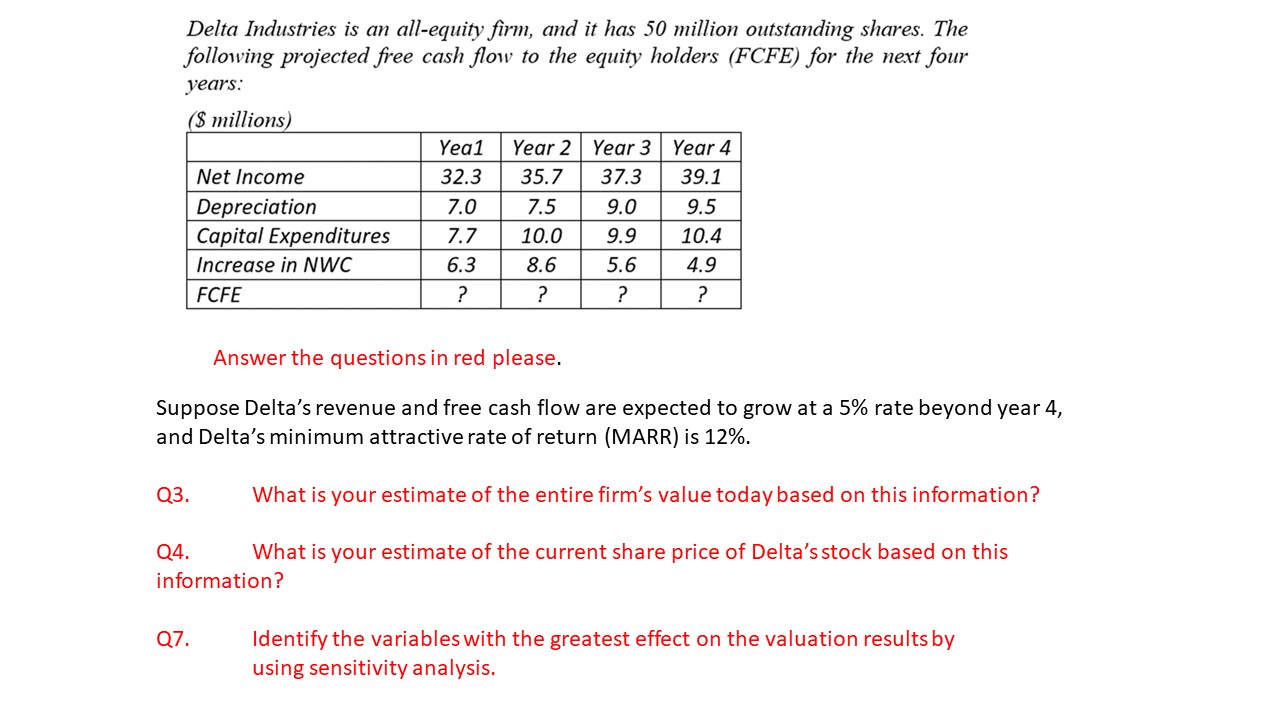

Delta Industries is an all - equity firm, and it has 5 0 million outstanding shares. The following projected free cash flow to the equity

Delta Industries is an allequity firm, and it has million outstanding shares. The

following projected free cash flow to the equity holders FCFE for the next four

years:

$ millions

Answer the questions in red please.

Suppose Delta's revenue and free cash flow are expected to grow at a rate beyond year

and Delta's minimum attractive rate of return MARR is

Q What is your estimate of the entire firm's value today based on this information?

Q What is your estimate of the current share price of Delta's stock based on this

information?

Q Identify the variables with the greatest effect on the valuation results by

using sensitivity analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started