Question

Demand as a function of price is D(p) = 100 - p. Supply as a function of price is S(p) = p. The government

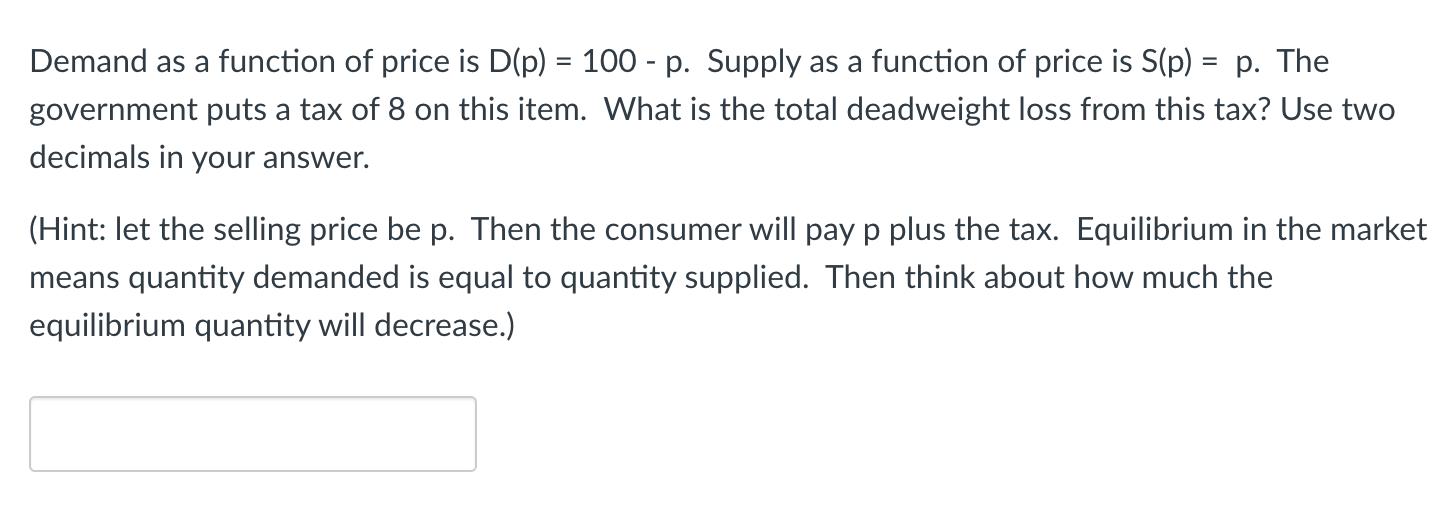

Demand as a function of price is D(p) = 100 - p. Supply as a function of price is S(p) = p. The government puts a tax of 8 on this item. What is the total deadweight loss from this tax? Use two decimals in your answer. (Hint: let the selling price be p. Then the consumer will pay p plus the tax. Equilibrium in the market means quantity demanded is equal to quantity supplied. Then think about how much the equilibrium quantity will decrease.)

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total deadweight loss from the tax we need to determine the change in the equilibri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Microeconomics

Authors: Hal R. Varian

9th edition

978-0393123975, 393123979, 393123960, 978-0393919677, 393919676, 978-0393123968

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App