Question

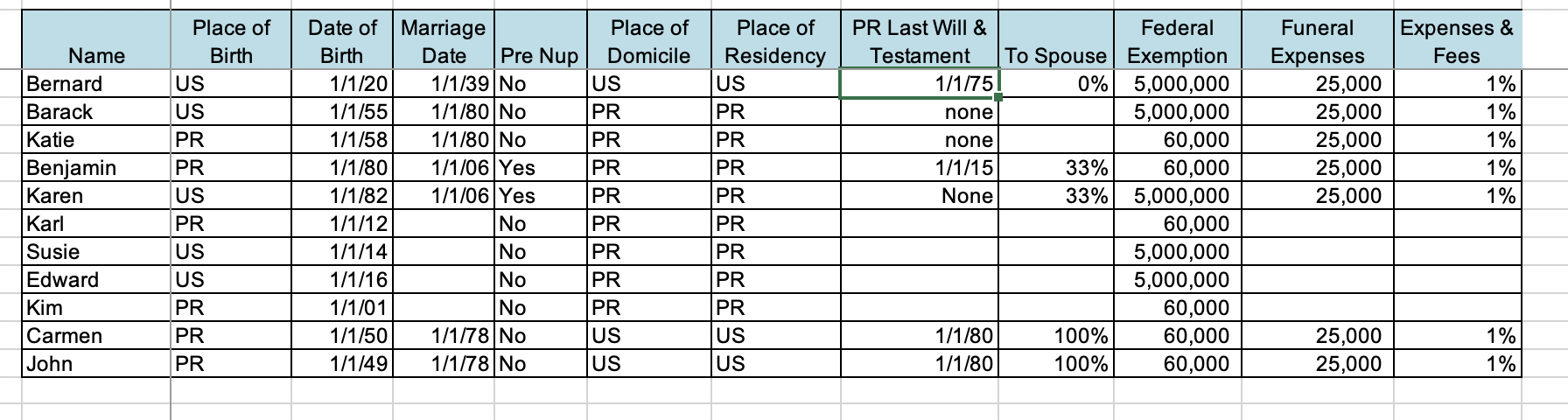

Demographic and Family Information Bernard B. Goode, born 5/15/1920, widow was born in Germany and immigrated to the US in 1925. He became a US

Demographic and Family Information

Bernard B. Goode, born 5/15/1920, widow was born in Germany and immigrated to the US in 1925. He became a US citizen in 1940.

Bernard and Lilly (RIP) had two children: Barack (b. 1955, US) and Carmen (b. 1950, PR)

Barack married Katie (b. 1958, PR) in 1980 and they had one child, Benjamin (b. 1980, PR). They have no prenuptial agreement.

Benjamin married Karen (b. 1982, US) in 2006 and they had three children Karl (b. 2012, PR), Susie (b. 2014, US) and Edward (b. 2016, US). They have a pre-nuptial agreement. Karen was previously married (divorced in 2002) and has one child from that marriage (Kim, b. 2001, PR). Karen and her ex have shared custody (and financial responsibility) of Kim

Carmen married John (b. 1949, PR) in 1978 and they had no children. They have no prenuptial agreement.

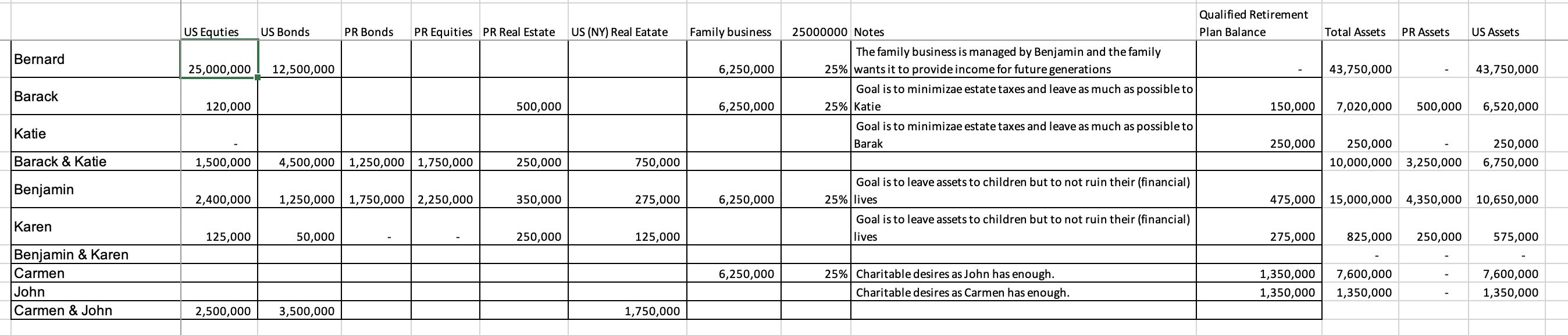

Asset Info in excel spreadsheet

Estate Planning Process

Calculate the distribution of the estate based on the new PR civil code, including the tax ramifications

Identify (name), describe (the uses) and detail (differences) the components of estate planning document (wills, trusts, powers) that are used to facilitate the transfer of ones assets and how you would use these instruments in order to achieve the goal of successful wealth transfer. Consider the tax implications for each instrument considered or recommended in the plan.

Explain the roles of the parties used in the estate planning process (executor, trustee, beneficiaries, heirs, guardians).

Recommend appropriate estate planning tools to achieve the object of successful wealth transfer as described by authors Williams & Preisser.

Recommend appropriate business and transfer techniques such as buy/sell agreements, grantor trusts, family LLCs, and private annuity.

Describe the use of postmortem estate planning techniques such as alternate asset valuation date.

Prepare an estate plan for the family that includes, but is not limited to, the following client reports

- Net worth statement for each Family

- Estate distribution report based on the new PR Civil code as well as the new plan you recommend to the families.

- Family financial mission statement for Barack and Katies family

- Draft a letter of instructions for Barack and Katie, Carmen and John, and Ben and Karen

- Provide at least three (3) estate planning recommendations and at least two (2) positive observations for each generation.

Calculate the following:

- Estate tax on each of the estates (as they are passed from one generation to the next)

- Identify the most appropriate estate planning tools that will help achieve the goal of successful wealth transfer.

- Determine the need for estate liquidity at each generational transfer. To be sure there is a cash flow plan for maintaining a clients estate from date of death to final distribution and payment of taxes (if applicable)

- Calculate and describe the appropriate use of the marital deduction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started