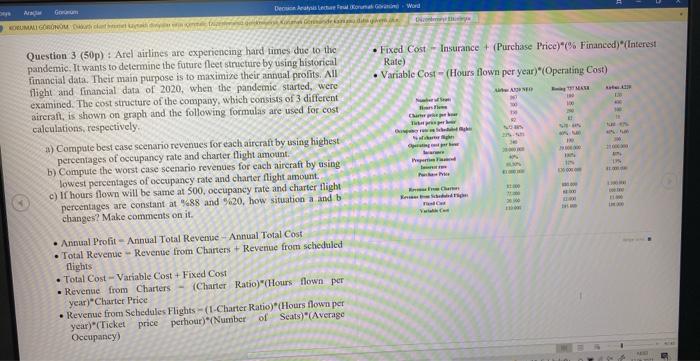

Den Arsch Koruma G Word G CORUMALI GOGORO Fixed Cost - Insurance + (Purchase Price*% Financed)"Interest Rate) Variable Cost - (Hours flown per year)" (Operating Cost) ANTIP MAN ter Time E! Tur Question 3 (50p): Arel airlines are experiencing hard times due to the pandemic. It wants to determine the future fleet structure by using historical financial data. Their main purpose is to maximize their annual profits. All flight and financial data of 2020, when the pandemic started, were examined. The cost structure of the company, which consists of 3 different aircraft, is shown on graph and the following formulas are used for cost calculations, respectively 3) Compute best case scenario revenues for each aircraft by using highest percentages of occupancy rate and charter flight amount b) Compute the worst case scenario revenues for cach aircraft by using lowest percentages of occupancy rate and charter flight amount c) I hours flown will be same at 500, occupancy rate and charter flight percentages are constant at 988 and %20, how situation a and b changes? Make comments on it. Cher dig Annual Profit - Annual Total Revenue Annual Total Cost Total Revenue Revenue from Charters +Revenue from scheduled flights Total Cost - Variable Cost+Fixed Cost Revenue from Charters - (Charter Ratio)"(Hours flown per year)"Charter Price Revenue from Schedules Flights (1-Charter Ratio)" (Hours flown per year)"(Ticket price per hour)*(Number of Scats) (Average Occupancy) Den Arsch Koruma G Word G CORUMALI GOGORO Fixed Cost - Insurance + (Purchase Price*% Financed)"Interest Rate) Variable Cost - (Hours flown per year)" (Operating Cost) ANTIP MAN ter Time E! Tur Question 3 (50p): Arel airlines are experiencing hard times due to the pandemic. It wants to determine the future fleet structure by using historical financial data. Their main purpose is to maximize their annual profits. All flight and financial data of 2020, when the pandemic started, were examined. The cost structure of the company, which consists of 3 different aircraft, is shown on graph and the following formulas are used for cost calculations, respectively 3) Compute best case scenario revenues for each aircraft by using highest percentages of occupancy rate and charter flight amount b) Compute the worst case scenario revenues for cach aircraft by using lowest percentages of occupancy rate and charter flight amount c) I hours flown will be same at 500, occupancy rate and charter flight percentages are constant at 988 and %20, how situation a and b changes? Make comments on it. Cher dig Annual Profit - Annual Total Revenue Annual Total Cost Total Revenue Revenue from Charters +Revenue from scheduled flights Total Cost - Variable Cost+Fixed Cost Revenue from Charters - (Charter Ratio)"(Hours flown per year)"Charter Price Revenue from Schedules Flights (1-Charter Ratio)" (Hours flown per year)"(Ticket price per hour)*(Number of Scats) (Average Occupancy)