Answered step by step

Verified Expert Solution

Question

1 Approved Answer

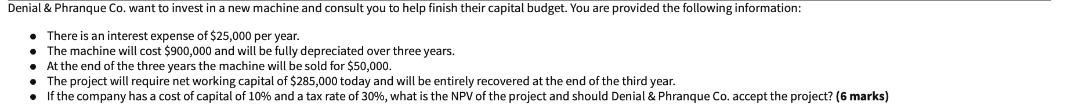

Denial & Phranque Co. want to invest in a new machine and consult you to help finish their capital budget. You are provided the

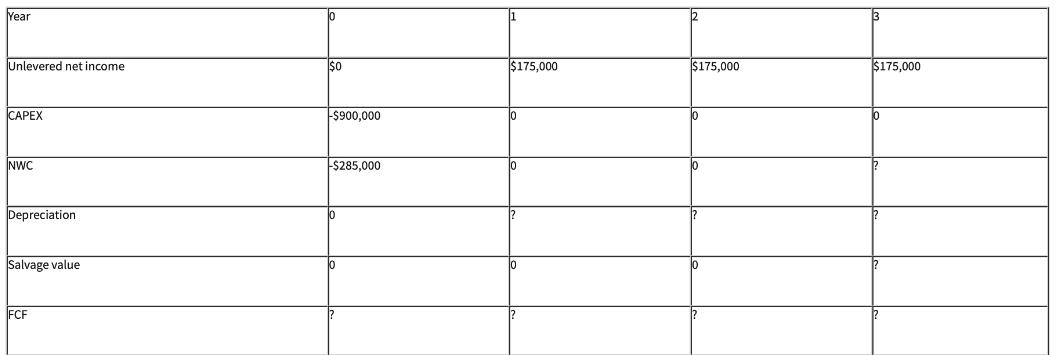

Denial & Phranque Co. want to invest in a new machine and consult you to help finish their capital budget. You are provided the following information: There is an interest expense of $25,000 per year. The machine will cost $900,000 and will be fully depreciated over three years. . At the end of the three years the machine will be sold for $50,000. The project will require net working capital of $285,000 today and will be entirely recovered at the end of the third year. If the company has a cost of capital of 10% and a tax rate of 30%, what is the NPV of the project and should Denial & Phranque Co. accept the project? (6 marks) Year Unlevered net income CAPEX NWC Depreciation Salvage value FCF $0 -$900,000 -$285,000 $175,000 10 10 $175,000 10 10 $175,000 10

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this question 1 Calculate depreciation per year Machine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started