al Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic University at 1986 Campus Drive, Boca Raton, FL 33434.

al Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic University at 1986 Campus Drive, Boca Raton, FL 33434. Denise is a material participant in the business, she is a cash basis taxpayer, and her Social Security number is 123-45-6781. Denise lives at 2020 Oakcrest Road, Boca Raton, FL 33431. Denise wants to designate $3 to the Presidential Election Campaign Fund. She has never owned or used any virtual currency. Denise received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored. During 2021, Denise had the following income and expense items:

| a. | $100,000 salary from Legal Services, Inc. | |||||||||||||

| b. | $20,000 gross receipts from her typing services business. | |||||||||||||

| c. | $700 interest income from Third National Bank. | |||||||||||||

| d. | $1,000 Christmas bonus from Legal Services, Inc. | |||||||||||||

| e. | $60,000 life insurance proceeds on the death of her sister. | |||||||||||||

| f. | $5,000 check given to her by her wealthy aunt. | |||||||||||||

| g. | $100 won in a bingo game. | |||||||||||||

| h. | Expenses connected with the Typing Services: | |||||||||||||

| ||||||||||||||

| i. | $9,500 interest expense on a home mortgage (paid to Boca Raton Savings and Loan). | |||||||||||||

| j. | $15,000 fair market value of silverware stolen from her home by a burglar on October 12, 2021. Denise had paid $14,000 for the silverware on July 1, 2011. She was reimbursed $10,000 by her insurance company. | |||||||||||||

| k. | Denise had loaned $2,100 to a friend, Joan Jensen, on June 3, 2017. Joan declared bankruptcy on August 14, 2021, and was unable to repay the loan. Assume that the loan is a bona fide debt. | |||||||||||||

| l. | Legal Services, Inc., withheld Federal income tax of $15,000 and the appropriate amount of FICA tax from her wages. | |||||||||||||

| m. | Alimony of $10,000 received from her former husband, Omar Guzman; divorce was finalized on December 2, 2013, and no changes have been made to the divorce decree since that time. | |||||||||||||

| n. | Interest income of $800 on City of Boca Raton bonds. | |||||||||||||

| o. | Denise made estimated Federal tax payments of $2,000. | |||||||||||||

| p. | Sales taxes from the sales tax table of $953. | |||||||||||||

| q. | Property taxes on her residence of $3,200. | |||||||||||||

| r. | Charitable contribution of $2,500 to her alma mater, Citrus State College. | |||||||||||||

| s. | On November 1, 2021, Denise was involved in an automobile accident. At the time of the accident, her automobile's FMV was $45,000. After the accident, the automobile's FMV was $38,000. Denise acquired the car on May 2, 2020, at a cost of $52,000. Denise's car was covered by insurance, but because the policy had a $5,000 deduction clause, Denise decided not to file a claim for the damage. |

Required:

Compute Denise Lopez's 2021 Federal income tax payable (or refund due). Use Form 1040, Schedule 1, Schedule A, Schedule C, Schedule D and Form 8995.

- Make realistic assumptions about any missing data.

- If an amount box does not require an entry or the answer is zero, enter "0".

- Enter all amounts as positive numbers. However, unless instructed otherwise, use the minus sign to indicate a loss.

- It may be necessary to complete the tax schedules before completing Form 1040.

- Use the tax rate schedules provided (do not use the tax tables). When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar.

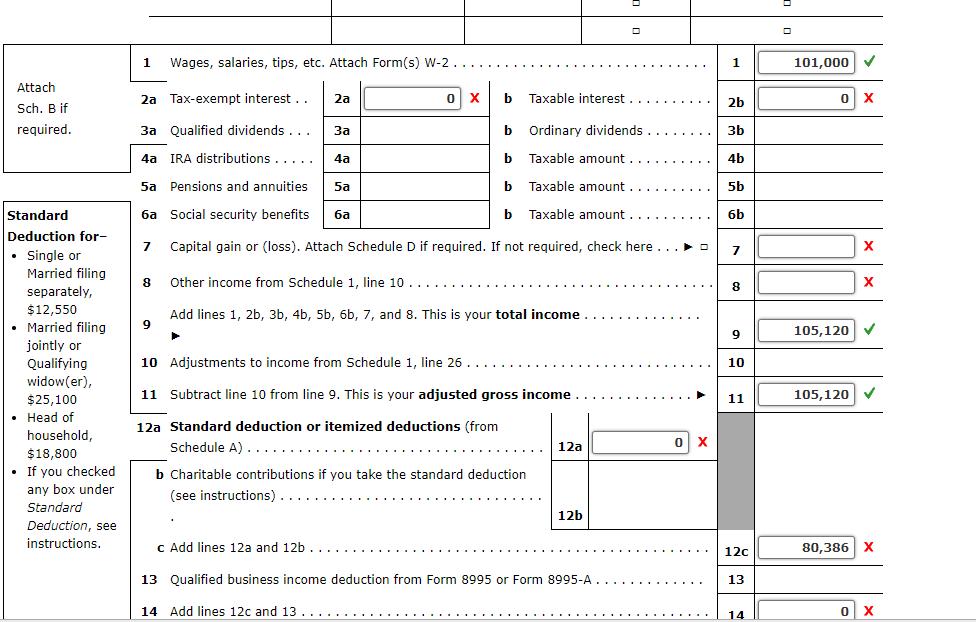

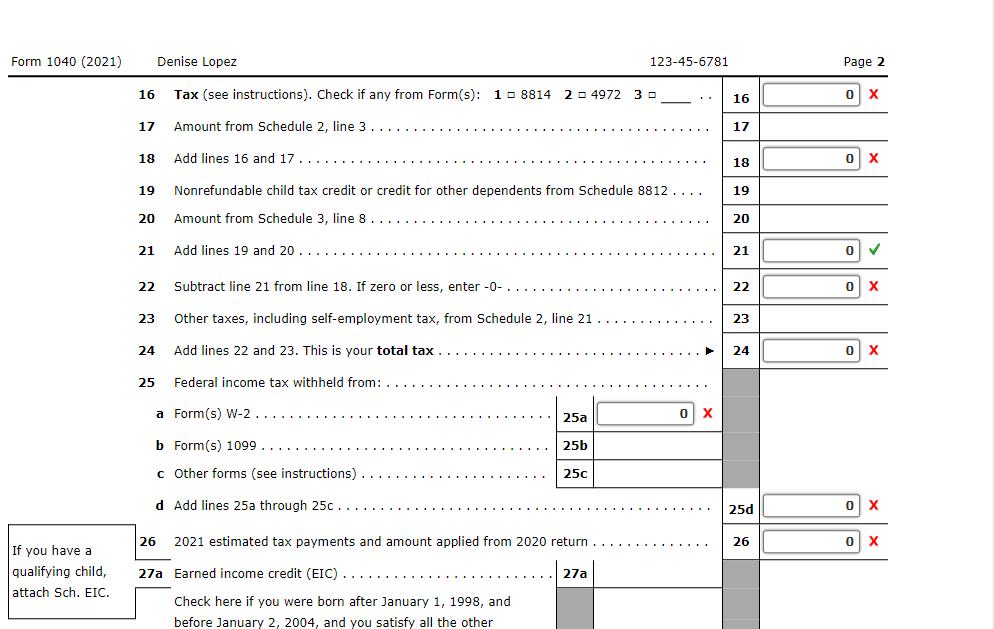

0 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 Attach Sch. B if required. 3a Qualified dividends.... 4a IRA distributions ..... 5a Pensions and annuities 2a Tax-exempt interest... 0X b Taxable interest. 2b b Ordinary dividends . . . 3b b Taxable amount. 4b b Taxable amount 5b b Taxable amount.. 6b Standard 6a Social security benefits Deduction for- Single or Married filing separately, $12,550 Married filing 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here... I 8 Other income from Schedule 1, line 10..... Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income. 9 . 7 8 . 101,000 0 X X jointly or Qualifying 10 Adjustments to income from Schedule 1, line 26..... widow(er), $25,100 11 Subtract line 10 from line 9. This is your adjusted gross income.. 9 105,120 10 11 105,120 Head of household, $18,800 If you checked 12a Standard deduction or itemized deductions (from Schedule A)..... 0 X 12a any box under b Charitable contributions if you take the standard deduction (see instructions) ... Standard 12b Deduction, see instructions. c Add lines 12a and 12b. 12c 80,386 X 13 Qualified business income deduction from Form 8995 or Form 8995-A.. 13 14 Add lines 12c and 13.. 14 0x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question seems incomplete primarily because it relies on specific software ProConnect Tax for computation and completion of federal tax forms whic...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started