Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dennis is the Vice President of Digital Banking, Mobile Development at a major Thai bank. Recently, his Aunt Grace, whom he didnt know about, passed

Dennis is the Vice President of Digital Banking, Mobile Development at a major Thai bank. Recently, his Aunt Grace, whom he didnt know about, passed on and left him $1 million as part of her estate. As his job is keeping him busy, he has no time to manage this money and is looking for professional help.

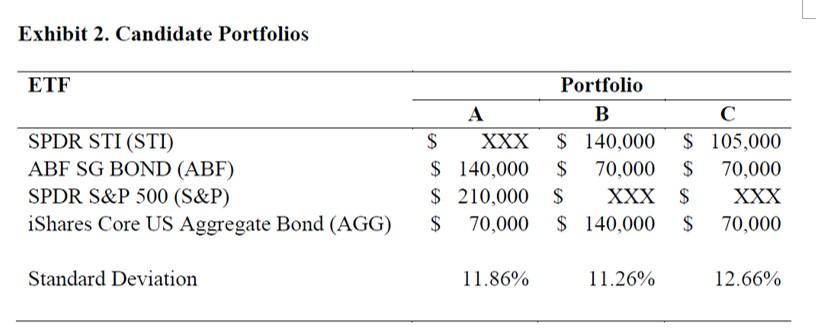

2(c) Assuming returns for the portfolios in Exhibit 2 are normally distributed, compute the five percent yearly Value at Risk for each of the three (3) proposed portfolios.

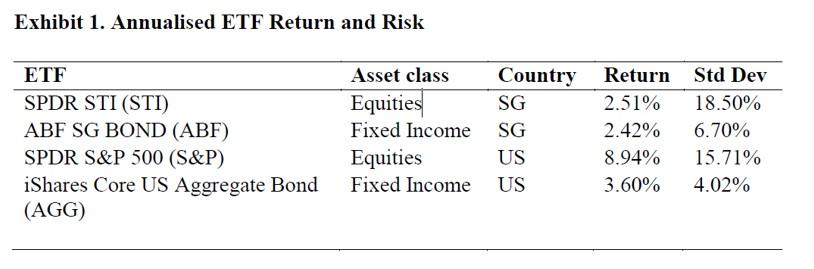

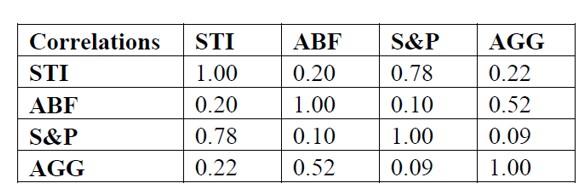

Exhibit 1. Annualised ETF Return and Risk ETF SPDR STI (STI) ABF SG BOND (ABF) SPDR S&P 500 (S&P) iShares Core US Aggregate Bond (AGG) Asset class Equities Fixed Income Equities Fixed Income Country Return Std Dev SG 2.51% 18.50% SG 2.42% 6.70% US 8.94% 15.71% 3.60% 4.02% US Exhibit 2. Candidate Portfolios ETF SPDR STI (STI) ABF SG BOND (ABF) SPDR S&P 500 (S&P) iShares Core US Aggregate Bond (AGG) $ XXX $ 140,000 $ 210,000 $ 70,000 Portfolio B $ 140,000 $ 70,000 $ XXX $ 140,000 $ 105,000 $ 70,000 $ XXX $ 70,000 Standard Deviation 11.86% 11.26% 12.66% Correlations STI ABF S&P AGG STI 1.00 0.20 0.78 0.22 ABF 0.20 1.00 0.10 0.52 S&P 0.78 0.10 1.00 0.09 AGG 0.22 0.52 0.09 1.00 Exhibit 1. Annualised ETF Return and Risk ETF SPDR STI (STI) ABF SG BOND (ABF) SPDR S&P 500 (S&P) iShares Core US Aggregate Bond (AGG) Asset class Equities Fixed Income Equities Fixed Income Country Return Std Dev SG 2.51% 18.50% SG 2.42% 6.70% US 8.94% 15.71% 3.60% 4.02% US Exhibit 2. Candidate Portfolios ETF SPDR STI (STI) ABF SG BOND (ABF) SPDR S&P 500 (S&P) iShares Core US Aggregate Bond (AGG) $ XXX $ 140,000 $ 210,000 $ 70,000 Portfolio B $ 140,000 $ 70,000 $ XXX $ 140,000 $ 105,000 $ 70,000 $ XXX $ 70,000 Standard Deviation 11.86% 11.26% 12.66% Correlations STI ABF S&P AGG STI 1.00 0.20 0.78 0.22 ABF 0.20 1.00 0.10 0.52 S&P 0.78 0.10 1.00 0.09 AGG 0.22 0.52 0.09 1.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started