Dennis, Verell, and Walter are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Dennis $49,000; Verell, $26,000;

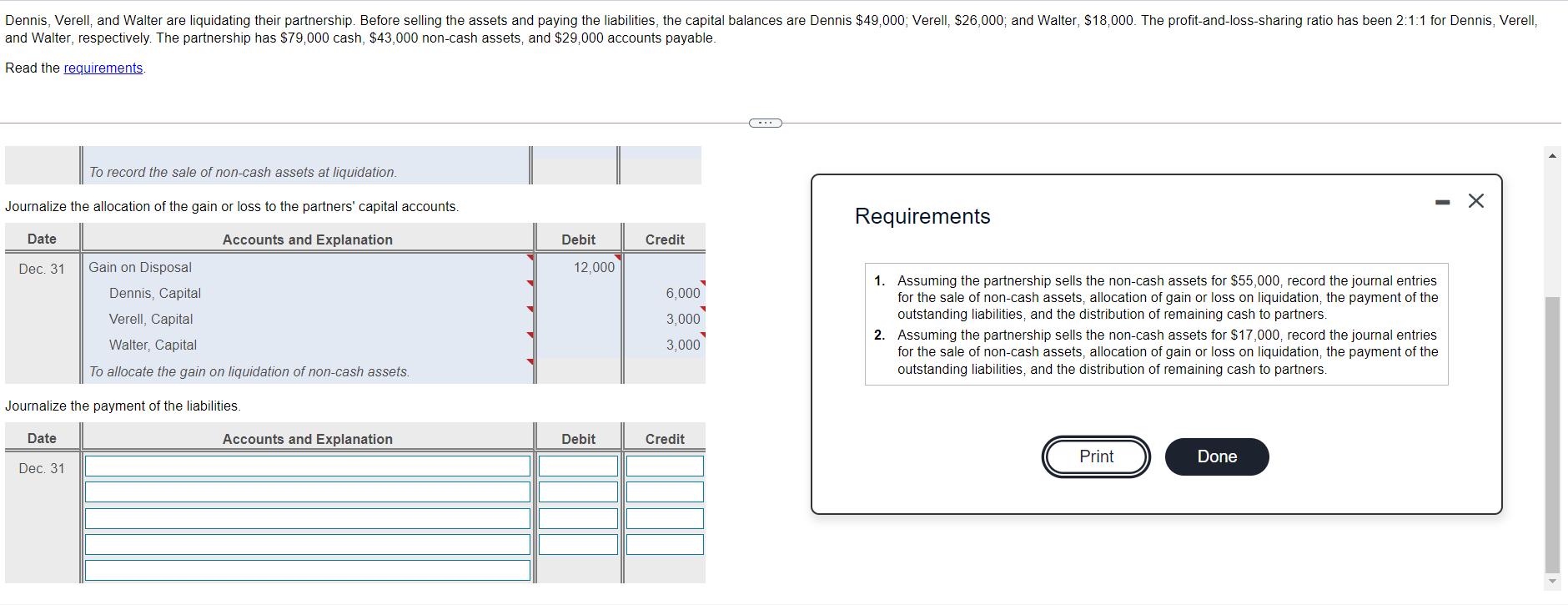

Dennis, Verell, and Walter are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Dennis $49,000; Verell, $26,000; and Walter, $18,000. The profit-and-loss-sharing ratio has been 2:1:1 for Dennis, Verell, and Walter, respectively. The partnership has $79,000 cash, $43,000 non-cash assets, and $29,000 accounts payable. Read the reguirements. To record the sale of non-cash assets at liquidation. Journalize the allocation of the gain or loss to the partners' capital accounts. Requirements Date Accounts and Explanation Debit Credit Dec. 31 Gain on Disposal 12,000 1. Assuming the partnership sells the non-cash assets for $55,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the distribution of remaining cash to partners. Dennis, Capital 6,000 Verell, Capital 3,000 2. Assuming the partnership sells the non-cash assets for $17,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the distribution of remaining cash to partners. Walter, Capital 3,000 To allocate the gain on liquidation of non-cash assets. Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit Print Done Dec. 31

Step by Step Solution

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Journal entry Cash Dr 55000 Non cash assets ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started