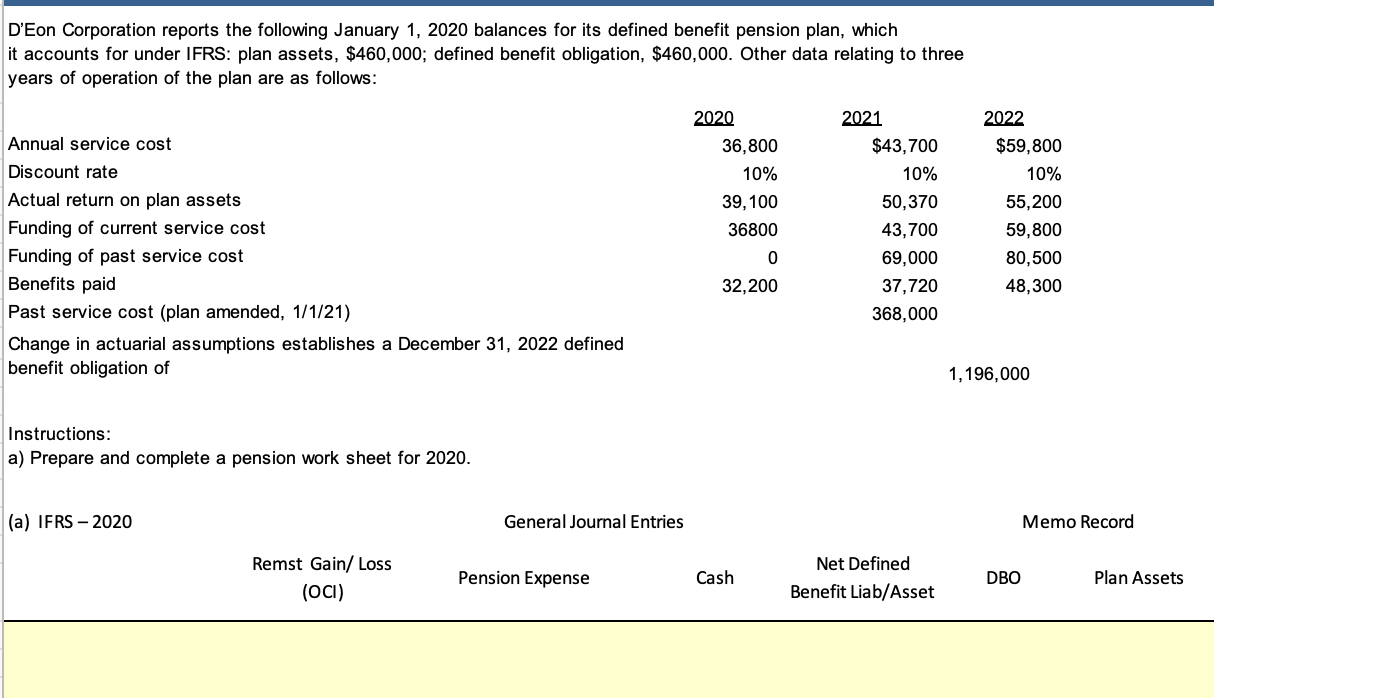

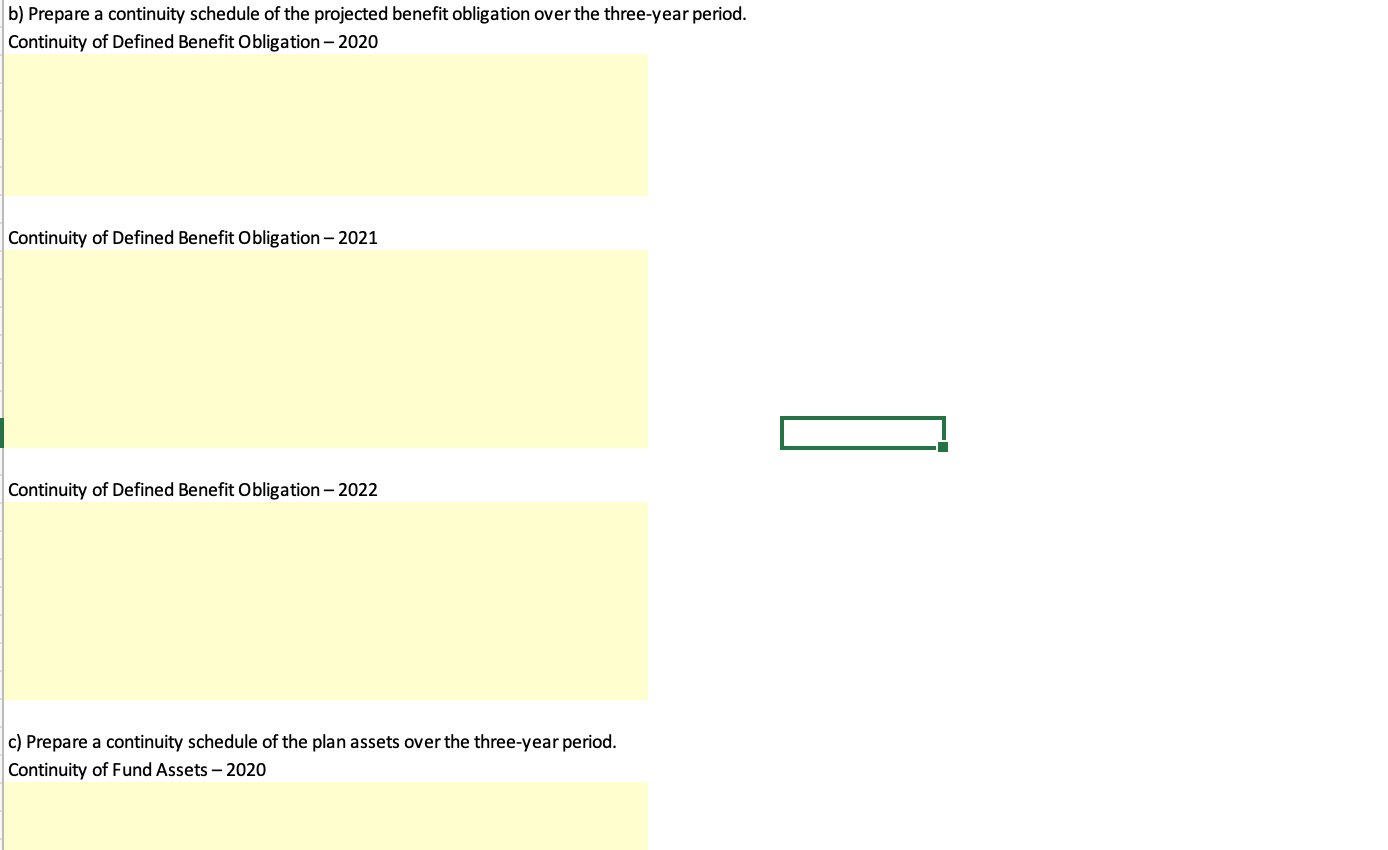

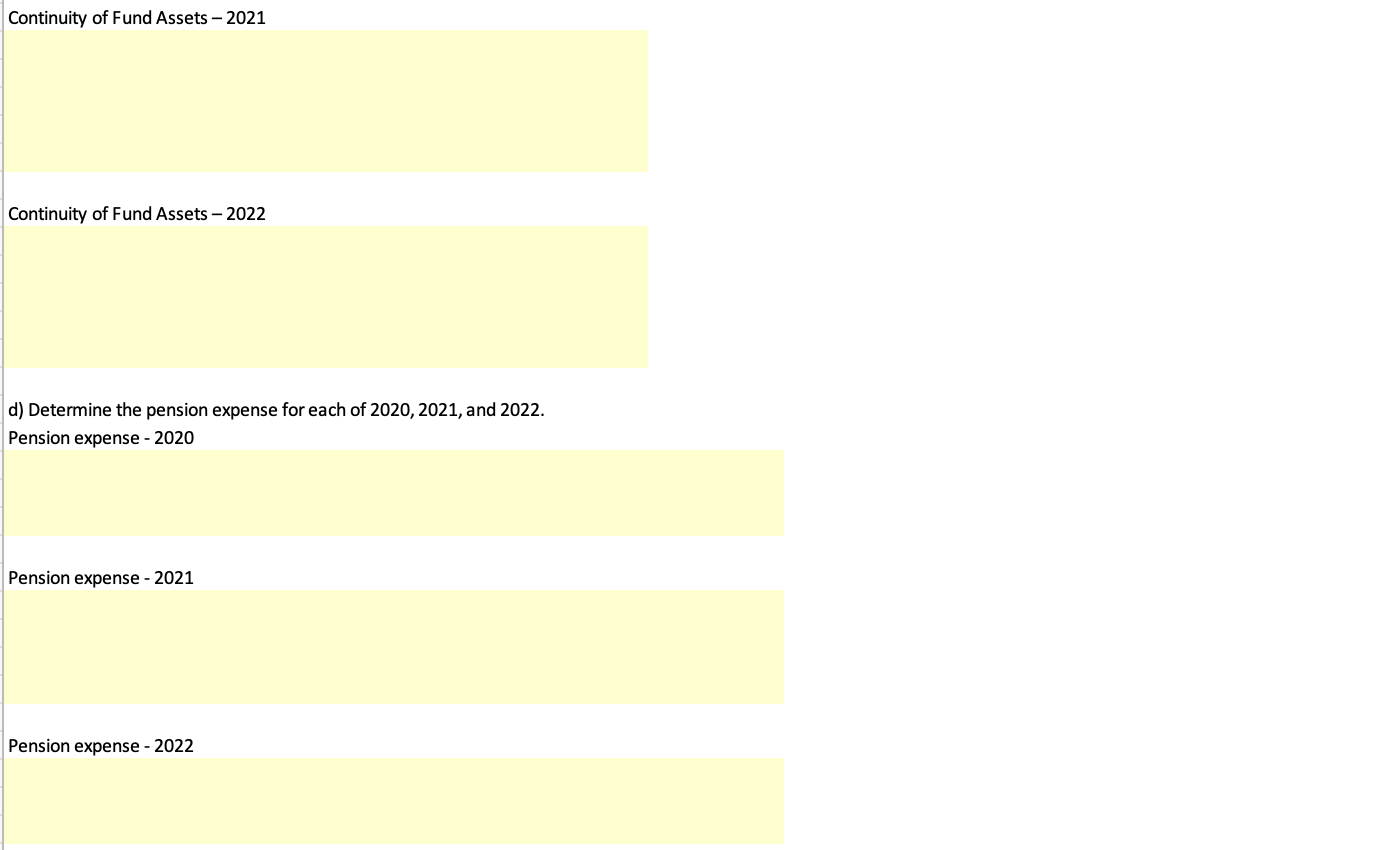

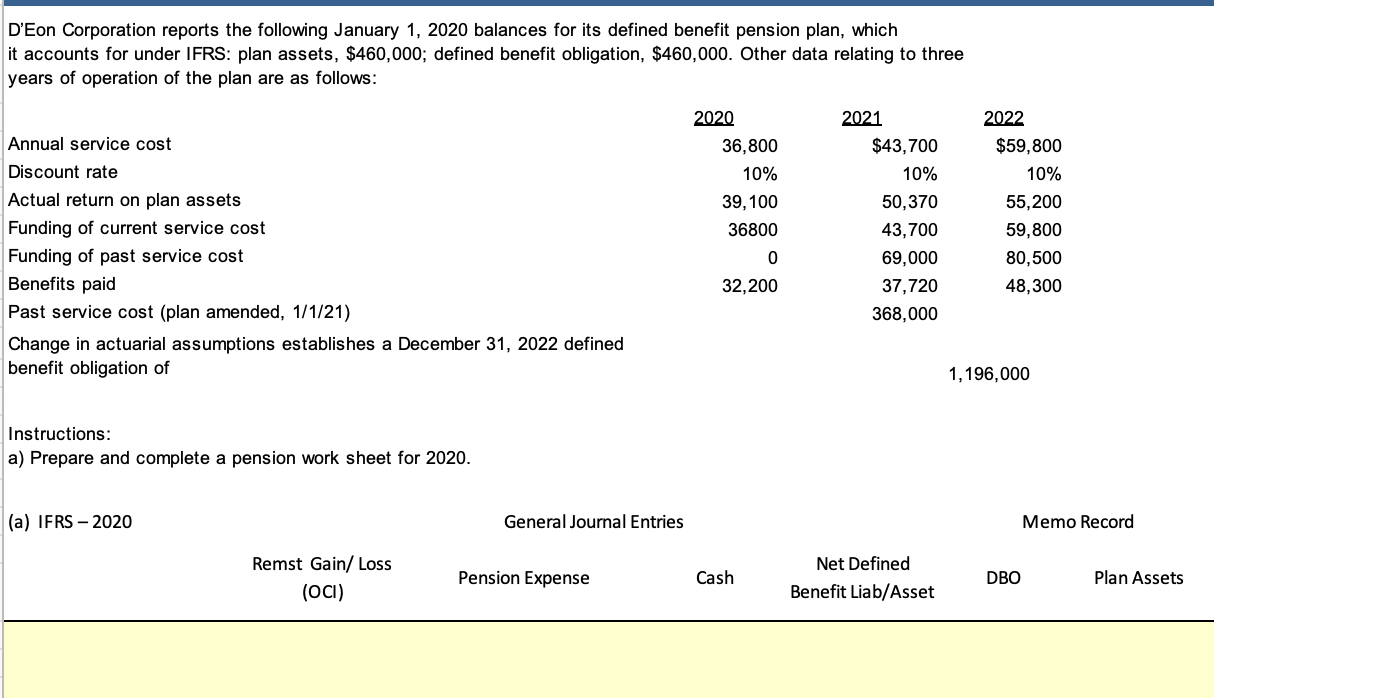

D'Eon Corporation reports the following January 1, 2020 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $460,000; defined benefit obligation, $460,000. Other data relating to three years of operation of the plan are as follows: 2020 36,800 10% 39, 100 36800 2021 $43,700 10% 2022 $59,800 10% Annual service cost Discount rate Actual return on plan assets Funding of current service cost Funding of past service cost Benefits paid Past service cost (plan amended, 1/1/21) Change in actuarial assumptions establishes a December 31, 2022 defined benefit obligation of 50,370 43,700 69,000 37,720 368,000 55,200 59,800 80,500 48,300 32,200 1,196,000 Instructions: a) Prepare and complete a pension work sheet for 2020. (a) IFRS - 2020 General Journal Entries Memo Record Remst Gain/ Loss (OC) Pension Expense Cash Net Defined Benefit Liab/Asset DBO Plan Assets b) Prepare a continuity schedule of the projected benefit obligation over the three-year period. Continuity of Defined Benefit Obligation - 2020 Continuity of Defined Benefit Obligation - 2021 Continuity of Defined Benefit Obligation - 2022 c) Prepare a continuity schedule of the plan assets over the three-year period. Continuity of Fund Assets 2020 Continuity of Fund Assets 2021 Continuity of Fund Assets - 2022 d) Determine the pension expense for each of 2020, 2021, and 2022. Pension expense - 2020 Pension expense - 2021 Pension expense - 2022 D'Eon Corporation reports the following January 1, 2020 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $460,000; defined benefit obligation, $460,000. Other data relating to three years of operation of the plan are as follows: 2020 36,800 10% 39, 100 36800 2021 $43,700 10% 2022 $59,800 10% Annual service cost Discount rate Actual return on plan assets Funding of current service cost Funding of past service cost Benefits paid Past service cost (plan amended, 1/1/21) Change in actuarial assumptions establishes a December 31, 2022 defined benefit obligation of 50,370 43,700 69,000 37,720 368,000 55,200 59,800 80,500 48,300 32,200 1,196,000 Instructions: a) Prepare and complete a pension work sheet for 2020. (a) IFRS - 2020 General Journal Entries Memo Record Remst Gain/ Loss (OC) Pension Expense Cash Net Defined Benefit Liab/Asset DBO Plan Assets b) Prepare a continuity schedule of the projected benefit obligation over the three-year period. Continuity of Defined Benefit Obligation - 2020 Continuity of Defined Benefit Obligation - 2021 Continuity of Defined Benefit Obligation - 2022 c) Prepare a continuity schedule of the plan assets over the three-year period. Continuity of Fund Assets 2020 Continuity of Fund Assets 2021 Continuity of Fund Assets - 2022 d) Determine the pension expense for each of 2020, 2021, and 2022. Pension expense - 2020 Pension expense - 2021 Pension expense - 2022