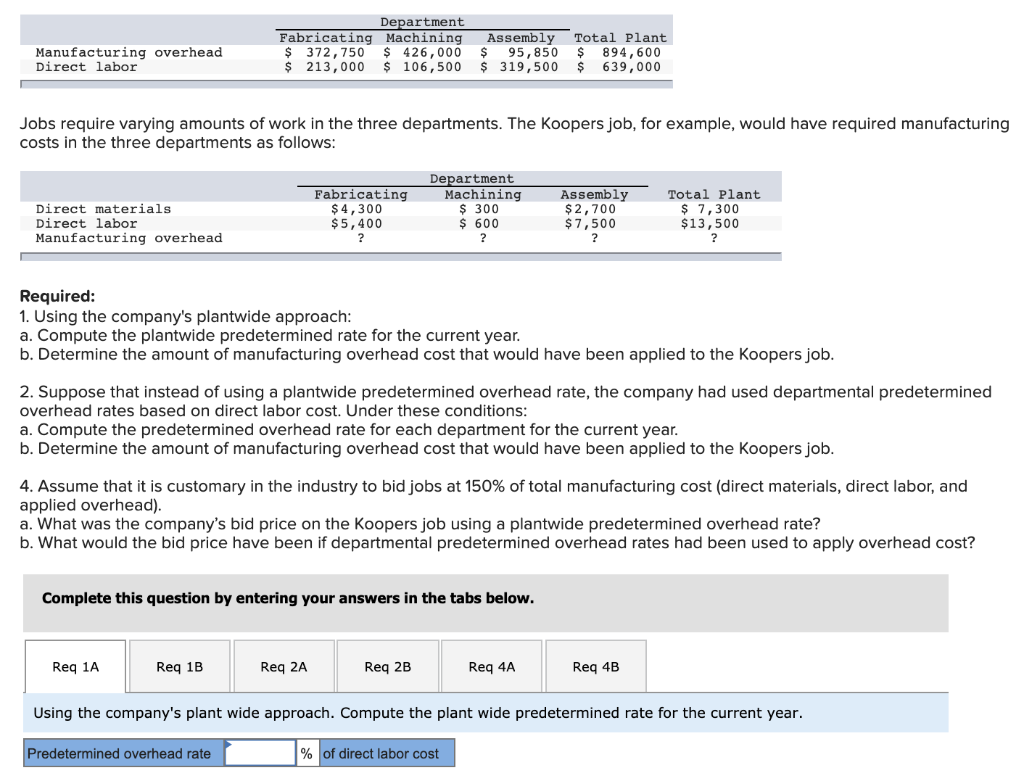

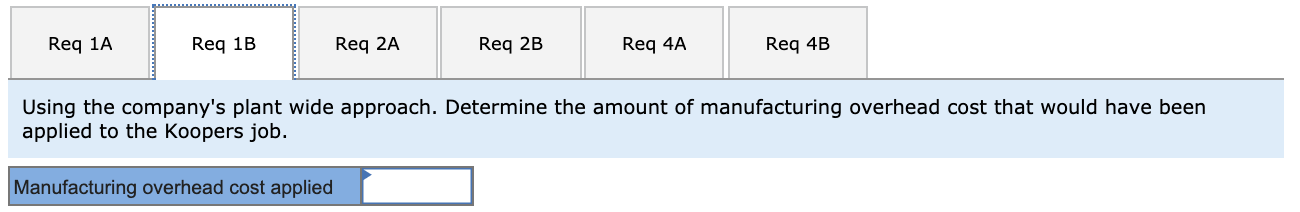

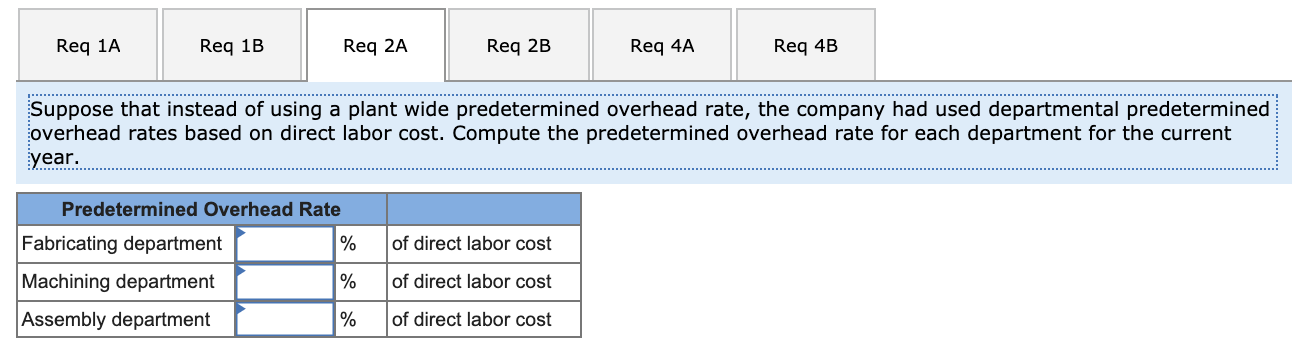

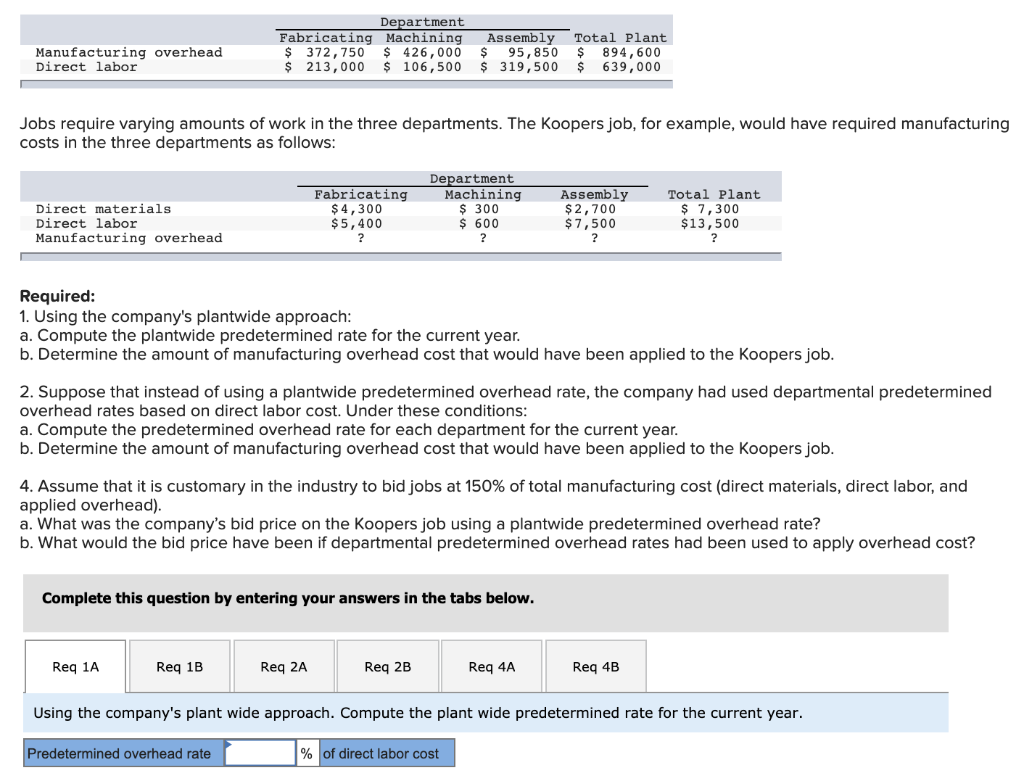

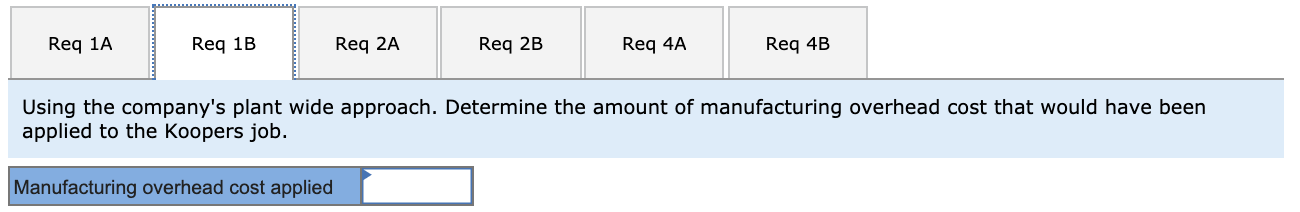

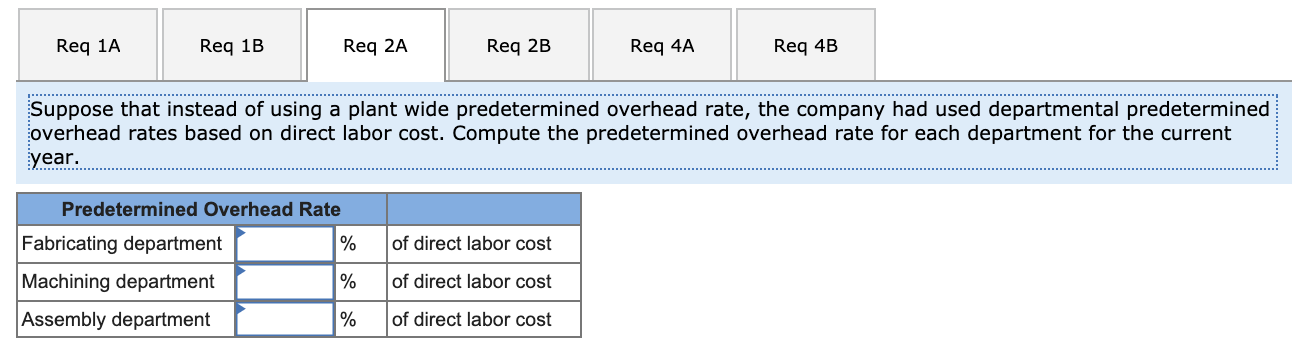

Department Fabricating Machining $ 372, 750 $ 426,000 $ 213,000 $ 106,500 Manufacturing overhead Direct labor Assembly Total Plant $ 95,850 $ 894,600 $ 319,500 $ 639,000 Jobs require varying amounts of work in the three departments. The Koopers job, for example, would have required manufacturing costs in the three departments as follows: Direct materials Direct labor Manufacturing overhead Fabricating $ 4,300 $5,400 ? Department Machining $ 300 $ 600 ? Assembly $ 2,700 $ 7,500 Total Plant $ 7,300 $13,500 ? ? Required: 1. Using the company's plantwide approach: a. Compute the plantwide predetermined rate for the current year. b. Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job. 2. Suppose that instead of using a plantwide predetermined overhead rate, the company had used departmental predetermined overhead rates based on direct labor cost. Under these conditions: a. Compute the predetermined overhead rate for each department for the current year. b. Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job. 4. Assume that it is customary in the industry to bid jobs at 150% of total manufacturing cost (direct materials, direct labor, and applied overhead). a. What was the company's bid price on the Koopers job using a plantwide predetermined overhead rate? b. What would the bid price have been if departmental predetermined overhead rates had been used to apply overhead cost? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Reg 2A Req 2B Req 4A Req 4B Using the company's plant wide approach. Compute the plant wide predetermined rate for the current year. Predetermined overhead rate % of direct labor cost Req 1A Req 1B Req 2A Req 2B Req 4A Req 4B Using the company's plant wide approach. Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job. Manufacturing overhead cost applied Req 1A Req 1B Req 2A Req 2B Req 4A Req 4B Suppose that instead of using a plant wide predetermined overhead rate, the company had used departmental predetermined overhead rates based on direct labor cost. Compute the predetermined overhead rate for each department for the current year. Predetermined Overhead Rate % of direct labor cost Fabricating department Machining department Assembly department % of direct labor cost % of direct labor cost Req 1A Req 1B Req 2A Req 2B Req 4A Req 4B Suppose that instead of using a plant wide predetermined overhead rate, the company had used departmental predetermined overhead rates based on direct labor cost. Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job. Manufacturing overhead cost applied Req 1A Req 1B Req 2A Req 2B Req 4A Req 4B Assume that it is customary in the industry to bid jobs at 150% of total manufacturing cost (direct materials, direct labor, and applied overhead). What was the company's bid price on the Koopers job using a plant wide predetermined overhead rate? Company's bid price Req 1A Req 1B Req 2A Req 2B Req 4A Req 4B Assume that it is customary in the industry to bid jobs at 150% of total manufacturing cost (direct materials, direct labor, and applied overhead). What would the bid price have been if departmental predetermined overhead rates had been used to apply overhead cost? Manufacturing overhead cost applied