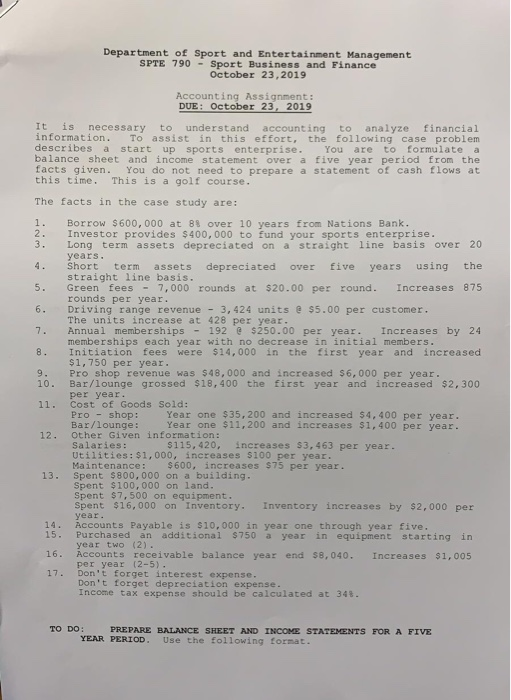

Department of Sport and Entertainment Management SPTE 790 - Sport Business and Finance October 23, 2019 Accounting Assignment: DUE: October 23, 2019 It is necessary to understand accounting to analyze financial information. To assist in this effort, the following case problem describes a start up sports enterprise. You are to formulate a balance sheet and income statement over a five year period from the facts given. You do not need to prepare a statement of cash flows at this time. This is a golf course. The facts in the case study are: 3. 7. 8. 10. 11. Borrow $600,000 at B8 over 10 years from Nations Bank. Investor provides $400,000 to fund your sports enterprise. Long term assets depreciated on a straight line basis over 20 years. Short term assets depreciated over five years using the straight line basis. Green fees - 7,000 rounds at $20.00 per round. Increases 875 rounds per year. Driving range revenue - 3,424 units @ $5.00 per customer. The units increase at 428 per year. Annual memberships - 192 @ $250.00 per year. Increases by 24 memberships each year with no decrease in initial members. Initiation fees were $14,000 in the first year and increased $1,750 per year. Pro shop revenue was $48,000 and increased $6,000 per year. Bar/lounge grossed $18,400 the first year and increased $2,300 per year. Cost of Goods Sold: Pro - shop: Year one $35,200 and increased $4,400 per year. Bar/lounge: Year one $11,200 and increases $1,400 per year. Other Given information: Salaries $115,420, increases $3,463 per year. Utilities: $1,000, increases $100 per year. Maintenance: $600, increases $75 per year. Spent $800,000 on a building. Spent $100,000 on land. Spent $7,500 on equipment. Spent $16,000 on Inventory. Inventory increases by $2,000 per year. Accounts Payable is $10,000 in year one through year five Purchased an additional $750 a year in equipment starting in year two (2) Accounts receivable balance year end 58.040. Increases $1,005 per year (2-5). Don't forget interest expense. Don't forget depreciation expense. Income tax expense should be calculated at 345. 12. 15 16. 17. TO DO: PREPARE BALANCE SHEET AND INCOME STATEMENTS FOR A FIVE YEAR PERIOD. Use the following format. Department of Sport and Entertainment Management SPTE 790 - Sport Business and Finance October 23, 2019 Accounting Assignment: DUE: October 23, 2019 It is necessary to understand accounting to analyze financial information. To assist in this effort, the following case problem describes a start up sports enterprise. You are to formulate a balance sheet and income statement over a five year period from the facts given. You do not need to prepare a statement of cash flows at this time. This is a golf course. The facts in the case study are: 3. 7. 8. 10. 11. Borrow $600,000 at B8 over 10 years from Nations Bank. Investor provides $400,000 to fund your sports enterprise. Long term assets depreciated on a straight line basis over 20 years. Short term assets depreciated over five years using the straight line basis. Green fees - 7,000 rounds at $20.00 per round. Increases 875 rounds per year. Driving range revenue - 3,424 units @ $5.00 per customer. The units increase at 428 per year. Annual memberships - 192 @ $250.00 per year. Increases by 24 memberships each year with no decrease in initial members. Initiation fees were $14,000 in the first year and increased $1,750 per year. Pro shop revenue was $48,000 and increased $6,000 per year. Bar/lounge grossed $18,400 the first year and increased $2,300 per year. Cost of Goods Sold: Pro - shop: Year one $35,200 and increased $4,400 per year. Bar/lounge: Year one $11,200 and increases $1,400 per year. Other Given information: Salaries $115,420, increases $3,463 per year. Utilities: $1,000, increases $100 per year. Maintenance: $600, increases $75 per year. Spent $800,000 on a building. Spent $100,000 on land. Spent $7,500 on equipment. Spent $16,000 on Inventory. Inventory increases by $2,000 per year. Accounts Payable is $10,000 in year one through year five Purchased an additional $750 a year in equipment starting in year two (2) Accounts receivable balance year end 58.040. Increases $1,005 per year (2-5). Don't forget interest expense. Don't forget depreciation expense. Income tax expense should be calculated at 345. 12. 15 16. 17. TO DO: PREPARE BALANCE SHEET AND INCOME STATEMENTS FOR A FIVE YEAR PERIOD. Use the following format