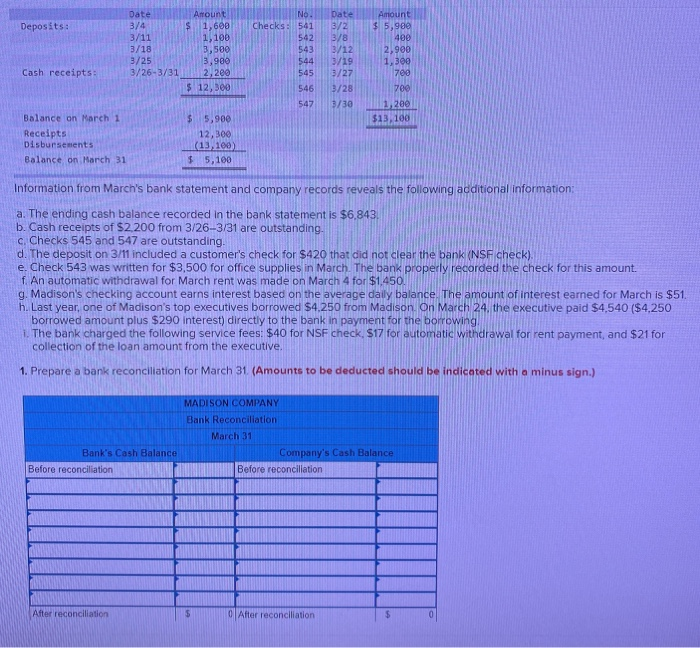

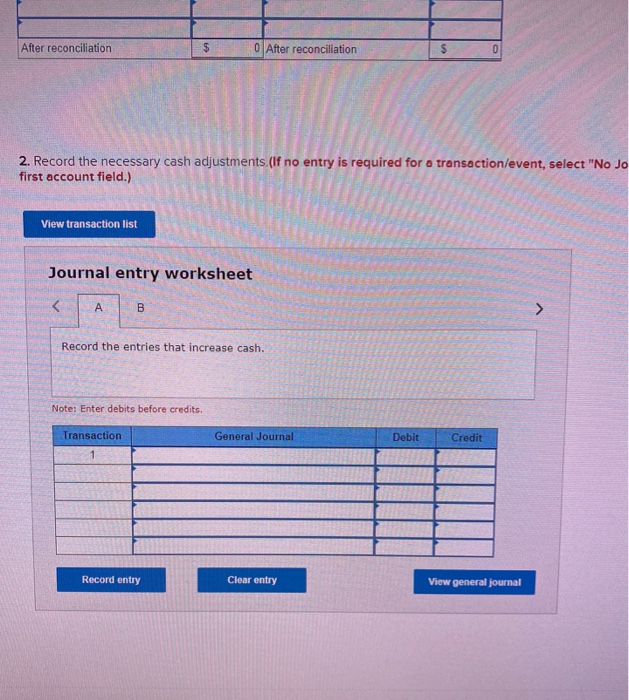

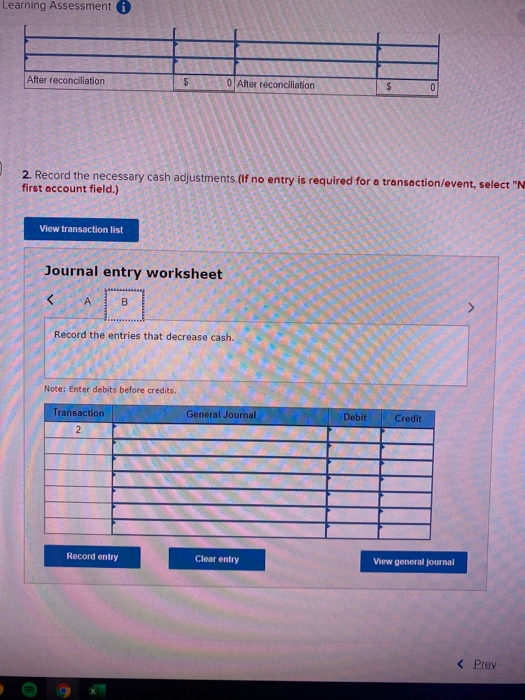

Deposits: Date 3/4 3/11 3/18 3/25 3/26-3/31 Amount $ 1,600 1,100 3,500 3,900 2,200 $ 12,300 No. Checks: 541 542 543 544 545 Date 3/2 3/8 3/12 3/19 3/27 3/28 3/30 Amount $ 5,980 400 2,900 1,300 700 700 1,200 $13,100 Cash receipts: $46 547 Balance on March 1 Receipts Disbursements Balance on March 31 $ 5,900 12,300 (13, 100) $ 5,100 Information from March's bank statement and company records reveals the following additional information: a. The ending cash balance recorded in the bank statement is $6,843. b. Cash receipts of $2,200 from 3/26-3/31 are outstanding c. Checks 545 and 547 are outstanding. d. The deposit on 3/11 included a customer's check for $420 that did not clear the bank (NSF check). e. Check 543 was written for $3,500 for office supplies in March. The bank properly recorded the check for this amount. f. An automatic withdrawal for March rent was made on March 4 for $1.450. g. Madison's checking account earns interest based on the average daily balance. The amount of interest earned for March is $51. h. Last year, one of Madison's top executives borrowed $4,250 from Madison On March 24. the executive paid $4,540 ($4,250 borrowed amount plus $290 interest) directly to the bank in payment for the borrowing, 1. The bank charged the following service fees: $40 for NSF check 517 for automatic withdrawal for rent payment, and $21 for collection of the loan amount from the executive. 1. Prepare a bank reconciliation for March 31 (Amounts to be deducted should be indicated with a minus sign.) MADISON COMPANY Bank Reconciliation March 31 Company's Cash Balance Before reconciliation Bank's Cash Balance Before reconciliation After reconciliation $ o After reconciliation $ After reconciliation $ 0 After reconciliation 0 2. Record the necessary cash adjustments.(If no entry is required for a transaction/event, select "No Jo first account field.) View transaction list Journal entry worksheet Record the entries that increase cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Learning Assessment i After reconciliation $ 0 After reconciliation $ 0 2. Record the necessary cash adjustments.(If no entry is required for a transaction/event, select "N first account field.) View transaction list Journal entry worksheet