Question

Depreciation 4. Keith began a calendar-year car cleaning business called Cozart's Cars Palace. He bought $100,000 of car cleaning equipment and placed it in

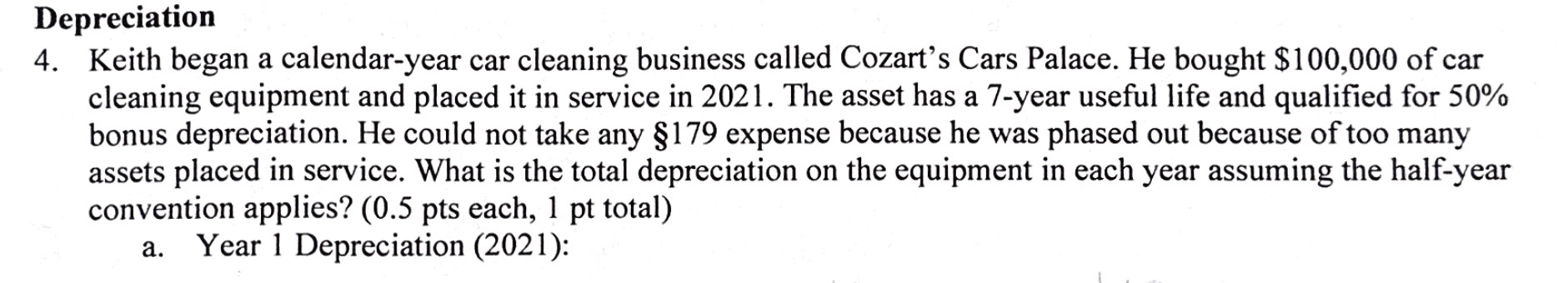

Depreciation 4. Keith began a calendar-year car cleaning business called Cozart's Cars Palace. He bought $100,000 of car cleaning equipment and placed it in service in 2021. The asset has a 7-year useful life and qualified for 50% bonus depreciation. He could not take any 179 expense because he was phased out because of too many assets placed in service. What is the total depreciation on the equipment in each year assuming the half-year convention applies? (0.5 pts each, 1 pt total) a. Year 1 Depreciation (2021): b. Year 2 Depreciation (2022):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the depreciation for each year including the bonus depreciation and ut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2018 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

31st Edition

134532384, 978-0134550893, 134550897, 978-0134532387

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App