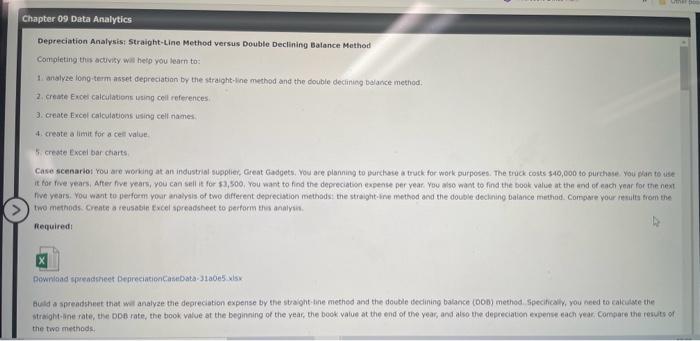

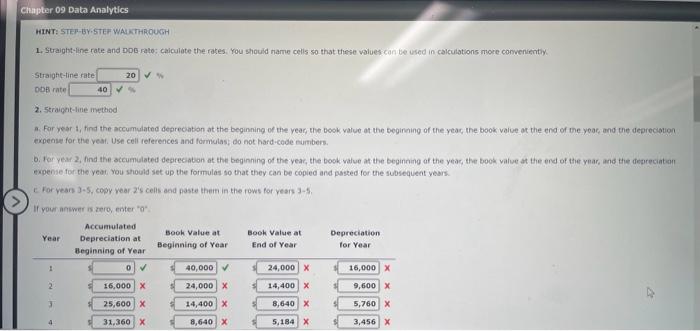

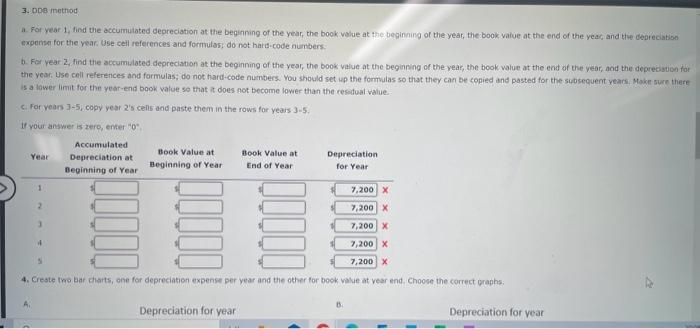

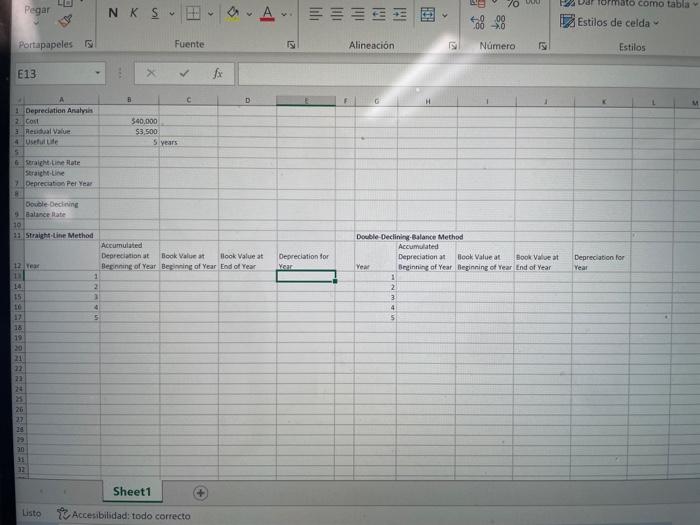

Depreciation Analysis: Straight-Line Method versus Doubte Declining Balance Mathod Completing thes activisy wat helb you learn to: 1. andlyze long-terit asset depreciation by the straight-ine method and the double decining beance method. 2. create Excel calculations using ceil references: 3. create Excel calculations using cell names. 4. creote a limit for a cell value. 5. creste Excel bar charts. it for five years, After five years, you can seil it for 81,500 , rou want to find the depreciation exsense per year. You also wamt to find the book value at the and of each year for the next fequiredt Buld a sprendsheet that wet analyze the depreciation expense by the stajig-tine methed and the double secining balance (000) method. speciticaly, you heed to calculse the straight-ine rate, the DOE rate, the book value at the beginning of the year, the book value at the end of the year, and also the depreciatoon ewpense each year, Compare the resuts of the two methods. HINT: SE-BY.STEF WAUMTHROUGH 1. Straight-ine rate and DOE rate: calculate the rates, You should name celis so that these walues can be wed in calculations more convenientiy. Straighe-tine rate obe rate 2. 5traight-line inethod a. For year i, find the accumulated deprecabion at the beginning of the yeac, the beok vatue at the begining of the yeac, the book value of the end of the yeac, and the depreciotion expense for the vear. Use cell felerences and formulas; do not hardiccode eumbers. b. for year 2, find the accumblated deprecabon at the beginning of the yeac, the book value at the begining af the yeac, the book value at the end of the ynar, and the denreciatedi expense for the yeal. You should set up the formulas so that they can be copied and pasted for the subsequent vears. 1. For yean 3-5, copy year 24 cells and paste thein in the rows for years 3-5, a. For year 1 , find the accumutated depreciation at the beginning of the year, the book volue at the beginning of the year, the book value at the end of the yeat, and the depreciation expensen for the war. Use cell references and formulas; do not hatid-code numbers. b. For year z, find the accumilated. depreciation at the beginning of the year, the book value at the beginning of the year, the book walue at the end of the year, and the deprecisuion for the year: Use coli references and farmulas; do not hard-code numbers. You should set up the formulas so that they can be copied and pasted for the subsequent years, Moke sure there is a lower limit for the year-end book value so that it does not become lower than the cesefual value- c. For years 7-5, copy year 2 's cells and paste them in the rows for years 35. Sheet1 Listo Z Accesibilidad: todo correcto