Answered step by step

Verified Expert Solution

Question

1 Approved Answer

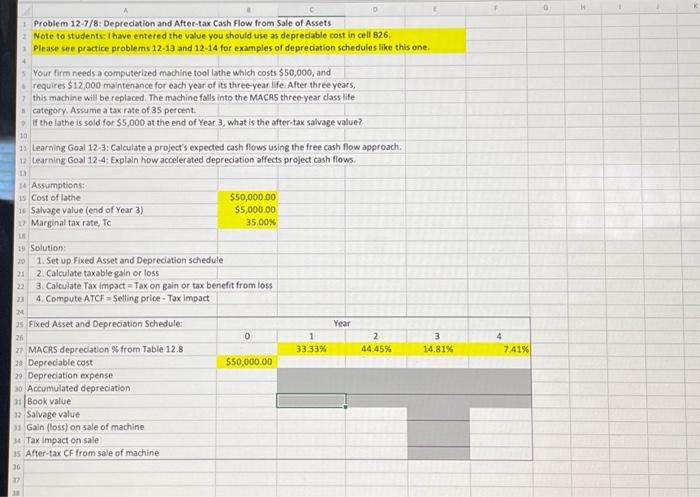

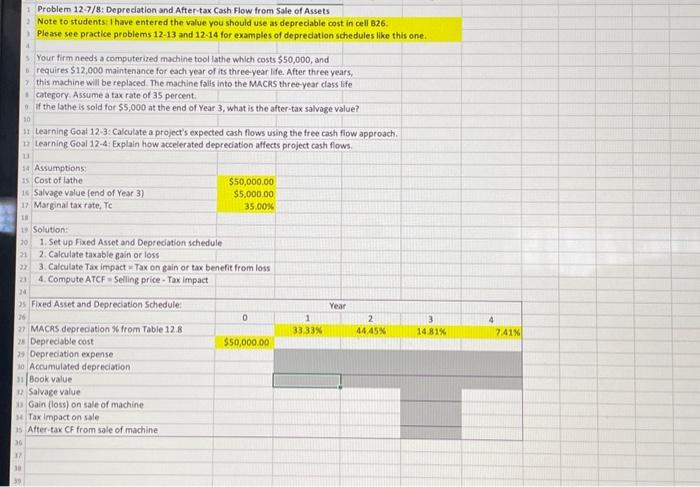

Depreciation and After-tax Cash Flow from Sale of Assets 2 Note to students: I have entered the value you should use as depreciable cost in

Depreciation and After-tax Cash Flow from Sale of Assets 2 Note to students: I have entered the value you should use as depreciable cost in cell B26. 3 Please see practice problems 12-13 and 12-14 for examples of depreciation schedules like this one. 4 5 Your firm needs a computerized machine tool lathe which costs $50,000, and 6 requires $12,000 maintenance for each year of its three-year life. After three years, 7 this machine will be replaced. The machine falls into the MACRS three-year class life 8 category. Assume a tax rate of 35 percent. 9 If the lathe is sold for $5,000 at the end of Year 3, what is the after-tax salvage value? 16 Salvage value (end of Year 3) 17 Marginal tax rate, Tc 18 19 Solution: 20 21 22 23 24 25 Fixed Asset and Depreciation Schedule: 26 27 MACRS depreciation % from Table 12.8 28 Depreciable cost 10 11 Learning Goal 12-3: Calculate a project's expected cash flows using the free cash flow approach. 12 Learning Goal 12-4: Explain how accelerated depreciation affects project cash flows. 13 14 Assumptions: 15 Cost of lathe 1. Set up Fixed Asset and Depreciation schedule 2. Calculate taxable gain or loss C $50,000.00 $5,000.00 35.00% 3. Calculate Tax impact = Tax on gain or tax benefit from loss 4. Compute ATCF = Selling price - Tax impact 29 Depreciation expense 30 Accumulated depreciation 31 Book value 32 Salvage value 33 Gain (loss) on sale of machine 34 Tax impact on sale 35 After-tax CF from sale of machine 36 37 38 0 $50,000.00 D 1 33.33% Year 2 44.45% E 3 14.81% 4 7.41% G H K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started