Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Depreciation and amortization expenses are: After - tax expenses that reduce a firm's cash flows. Long - term liabilities that reduce a firm's net worth.

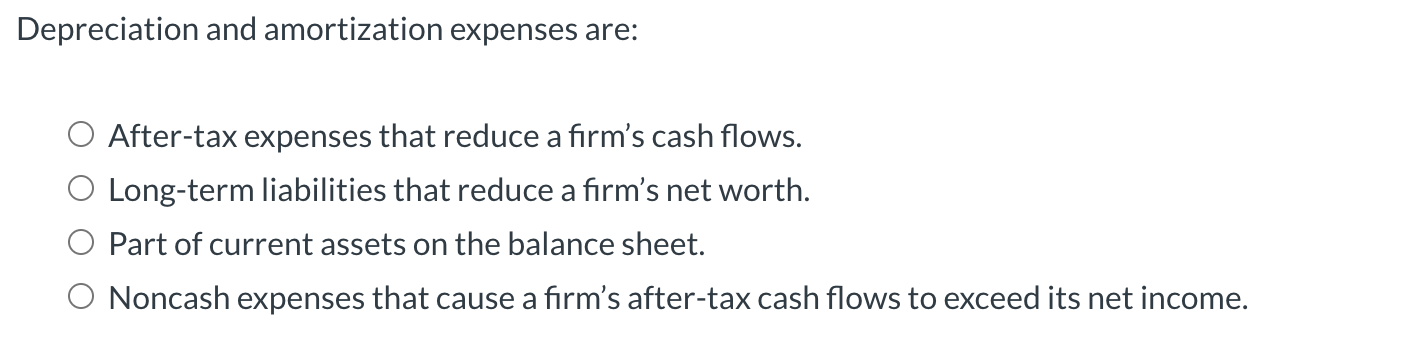

Depreciation and amortization expenses are:

Aftertax expenses that reduce a firm's cash flows.

Longterm liabilities that reduce a firm's net worth.

Part of current assets on the balance sheet.

Noncash expenses that cause a firm's aftertax cash flows to exceed its net income.Which of the following statements is true of financial statements?

The ending cash balance from the statement of cash flows is used as the cash balance on the balance sheet.

The net income reported in the income statement is transferred to assets on the balance sheet.

The ending balance on the statement of retained earnings is transferred to cash flow from operating activities.

The ending balance on the balance sheet is transferred to cash flow from investing activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started