Question

Depreciation and Rate of Return Burrell Company purchased a machine for $21,000 on January 2, 2019. The machine has an estimated service life of

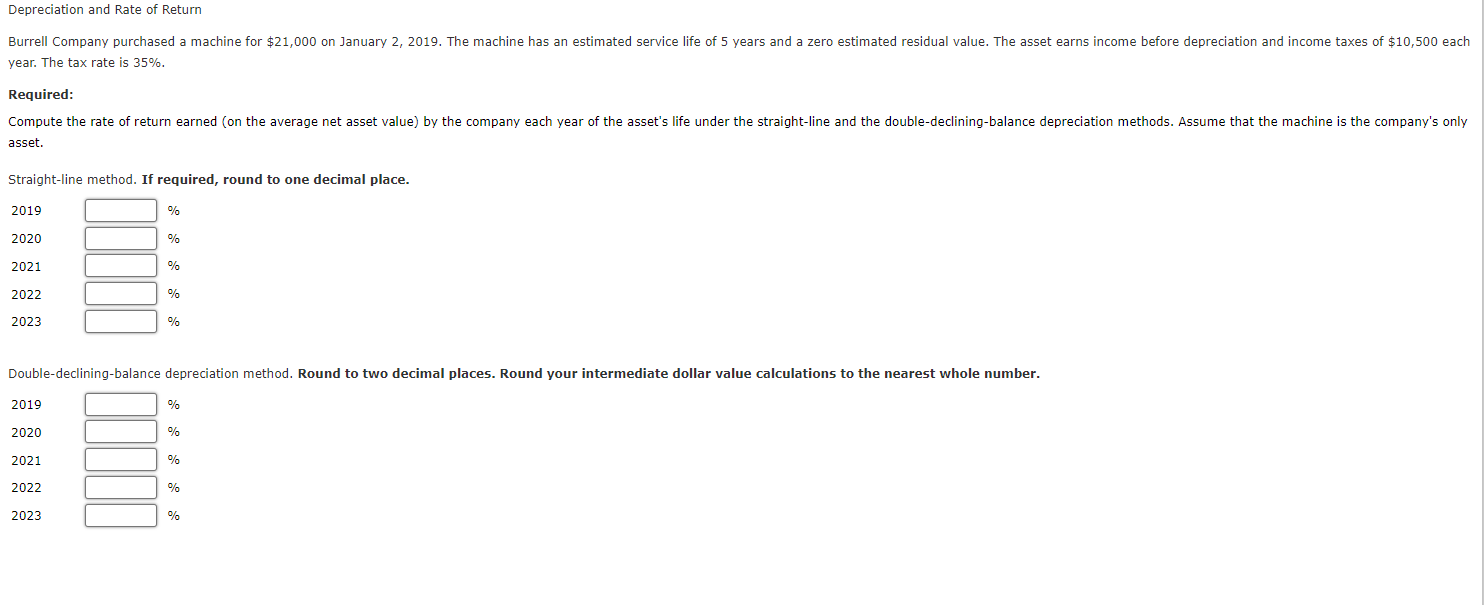

Depreciation and Rate of Return Burrell Company purchased a machine for $21,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $10,500 each year. The tax rate is 35%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 2020 2021 2022 2023 % % % % % Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 % % 2020 % 2021 2022 % 2023 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App