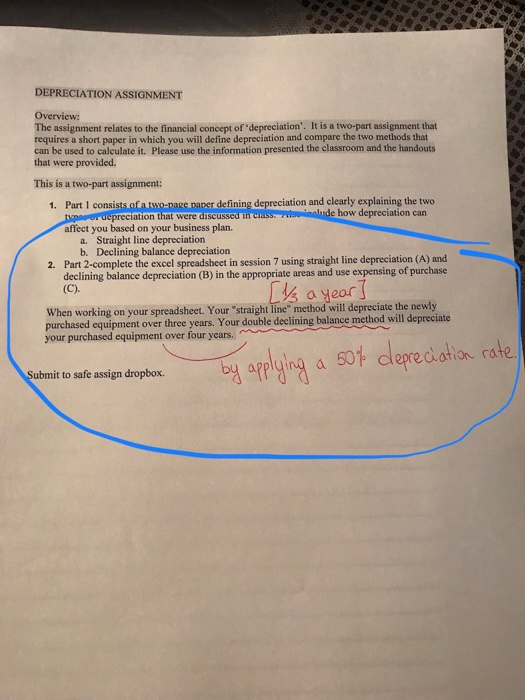

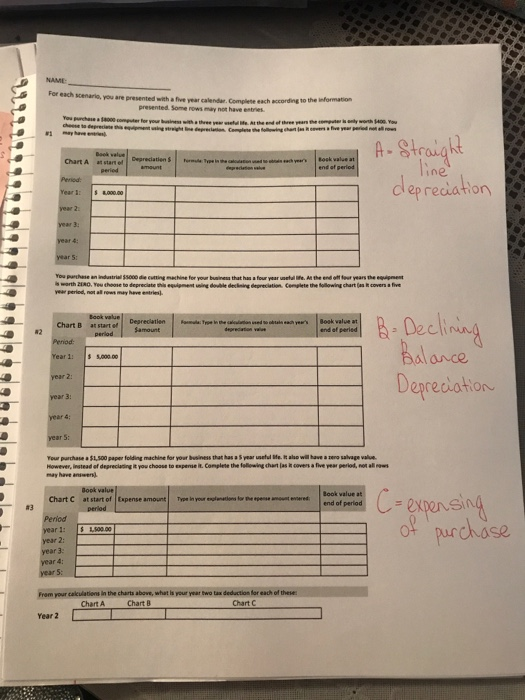

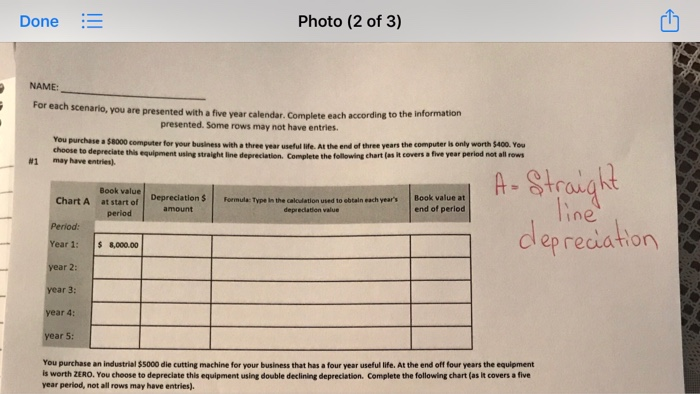

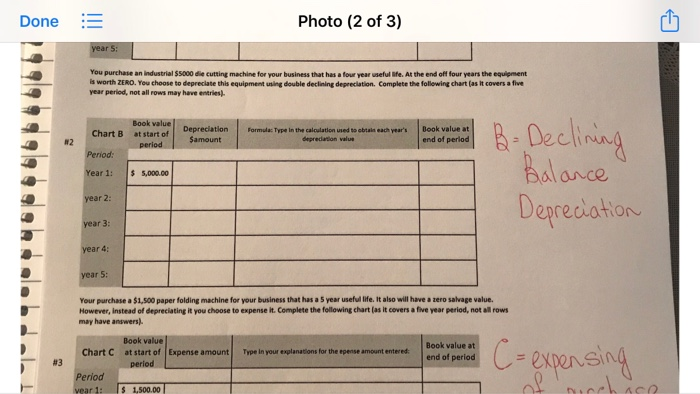

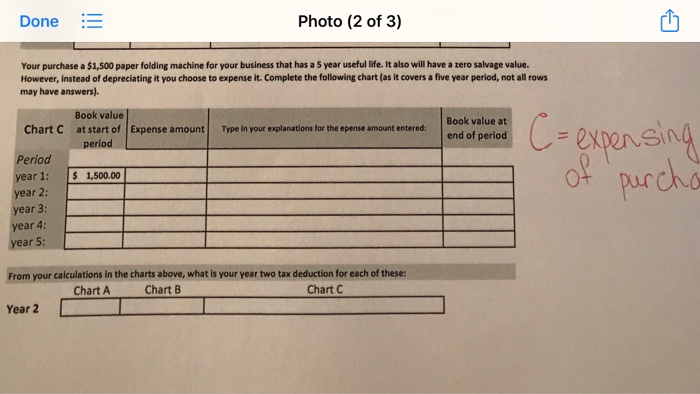

DEPRECIATION ASSIGNMENT Overview: The assignment relates to the financial concept of depreciation. It is a two-part assignment that requires a short paper in which you will define depreciation and compare the two methods that can be used to calculate it. Please use the information presented the classroom and the handouts that were provided. This is a two-part assignment: 1. Part I consists of two page paper defining depreciation and clearly explaining the two ucpreciation that were discussed in class include how depreciation can affect you based on your business plan. a. Straight line depreciation b. Declining balance depreciation 2. Part 2-complete the excel spreadsheet in session 7 using straight line depreciation (A) and declining balance depreciation (B) in the appropriate areas and use expensing of purchase (C). [1 a year When working on your spreadsheet. Your "straight line" method will depreciate the newly purchased equipment over three years. Your double declining balance method will depreciate your purchased equipment over four years. Submit to safe assign dropbox. by applying a 50% depreciation rate. As Straight Chan Awal line depreciation warh D. You the degree m ent wing deute d ing depreciation Concethewing characoven a five Bok valve start of Deprecaten Chart B B. Declining Period Year 11 Balance Depreciation year 4 year 5: You purchase $1.500 per folding machine for your business that has a year . It How t o deprecate you choose to expense. Complete the following chart where will have a ser alveg covers a five year periodo Chart C start of txpense amount Book value at end of period Period year 1: (= expensing of purchase L800.00 par 2 Year 2 Done E Photo (2 of 3) NAME For each scenario, you are presented with a five year calendar Complete each according to the information presented. Some rows may not have entries. You purchase a $6000 computer for your business with these we are end of three years the computer is only worth $400. You choose to depreciate this equipment using straight line derecesi Com e the following chart as it covers a five year period not allows #1 may have entries). Chart A Book value at start of period Depreciations amount Formula Type in the calculation used to obtain each year's depredation value Book value at end of period A. Straight depreciation line Period: Year 1: $ 8.000.00 year 2 year 3: year 4: year 5: You purchase an industrial $500 die cutting machine for your business that has a four year useful life. At the end off four years the equipment is worth ZERO. You choose to depreciate this equipment using double declining depreciation. Complete the following chart (as it covers a five year period, not allows may have entries). Done = Photo (2 of 3) Your purchase a $1,500 paper folding machine for your business that has a 5 year useful life. It also will have a zero salvage value. However, instead of depreciating it you choose to expense it. Complete the following chart (as it covers a five year period, not allows may have answers). Chart C Book value at start of Expense amount period Type in your explanations for the epense amount entered: Book value at end of period Period year 1: and of period C = expensing of purcha $ 1.500,00 year 2: year 3: year 4: year 5: From your calculations in the charts above, what is your year two tax deduction for each of these: Chart A Chart B Chart C Year 2