Question

Depreciation Corporate Taxation MACRS MARR QUESTION: A company is planning to purchase a new barge for use on its river routes. The new barge will

Depreciation Corporate Taxation MACRS MARR

QUESTION: "A company is planning to purchase a new barge for use on its river routes. The new barge will cost $13.2 million and is expected to generate an income of $7.5 million the first year (growing $1 M each year), with additional expenses of $2.6 million the first year (growing $400,000 per year). If this company uses MACRS, is in the 26% tax bracket, and has a MARR of 12%, what is the present worth of the first 4 years of after-tax cash flows from this barge? Would you recommend that the company purchase this barge? Does your answer change at 5 or 6 or 7 or... years?"

Textbook: Engineering Economic Analysis (OUP)

***Please, if you need extra information, indicate what other information you are looking since it isn't clear for me that there is a need for any extra information. Thank you!***

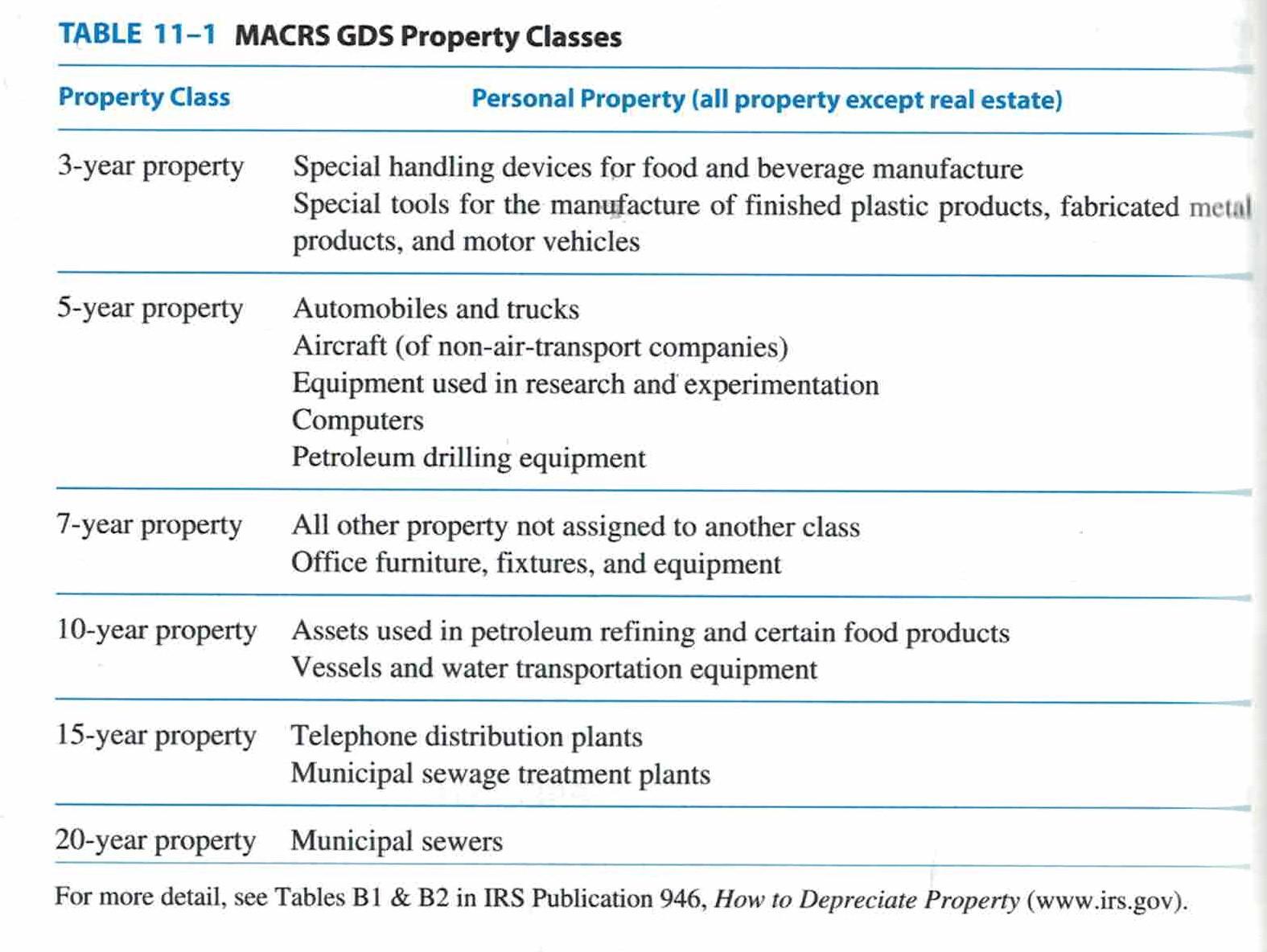

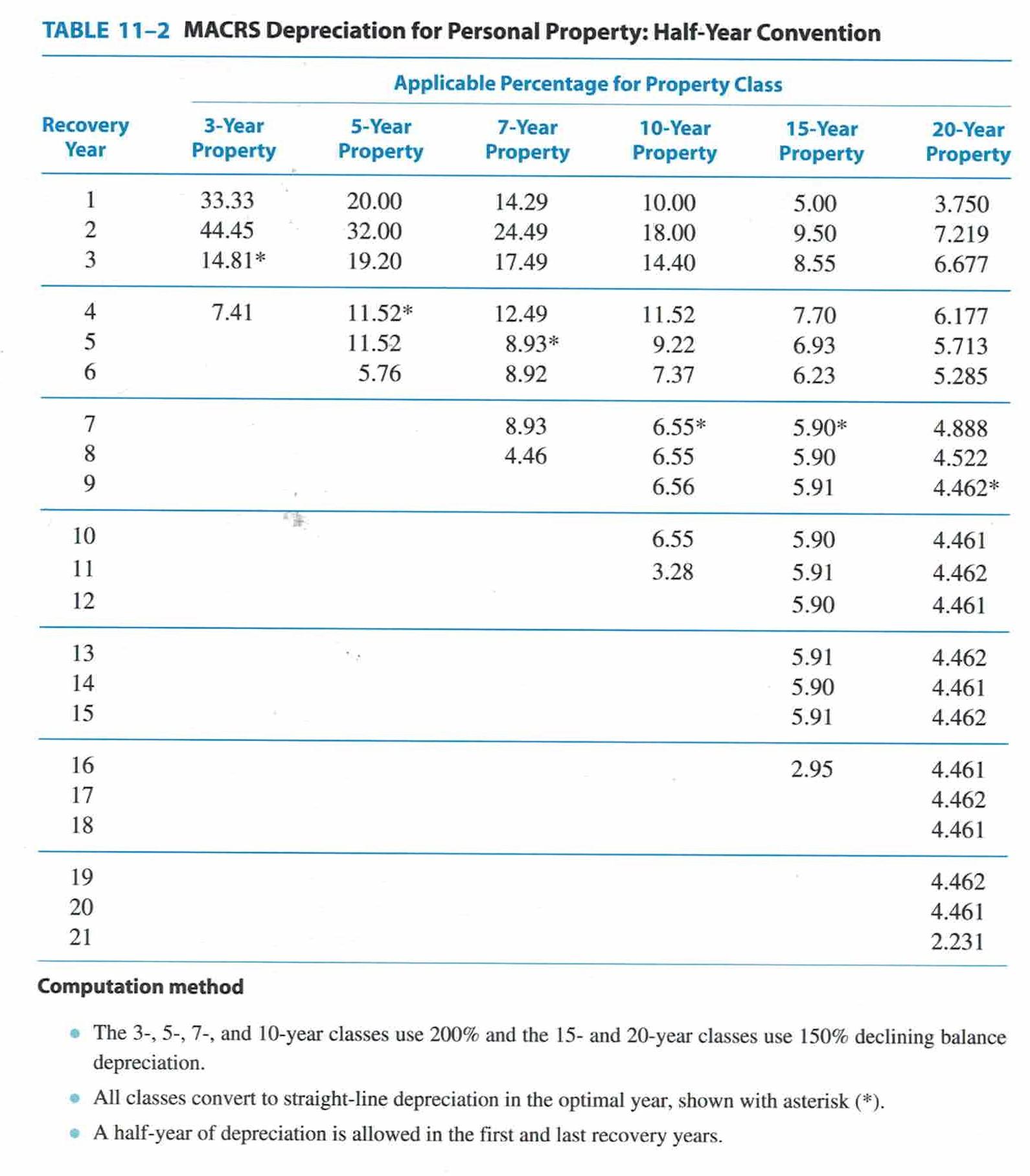

TABLE 11-1 MACRS GDS Property Classes Property Class Personal Property (all property except real estate) 3-year property Special handling devices for food and beverage manufacture Special tools for the manufacture of finished plastic products, fabricated metal products, and motor vehicles 5-year property Automobiles and trucks Aircraft (of non-air-transport companies) Equipment used in research and experimentation Computers Petroleum drilling equipment 7-year property All other property not assigned to another class Office furniture, fixtures, and equipment 10-year property Assets used in petroleum refining and certain food products Vessels and water transportation equipment 15-year property Telephone distribution plants Municipal sewage treatment plants 20-year property Municipal sewers For more detail, see Tables B1 & B2 in IRS Publication 946, How to Depreciate Property (www.irs.gov). TABLE 11-2 MACRS Depreciation for Personal Property: Half-Year Convention Recovery Year 3-Year Property Applicable Percentage for Property Class 5-Year 7-Year 10-Year 15-Year Property Property Property Property 20-Year Property 1 2 3 33.33 44.45 14.81* 20.00 32.00 19.20 14.29 24.49 17.49 10.00 18.00 14.40 5.00 9.50 8.55 3.750 7.219 6.677 7.41 4 5 6 11.52* 11.52 5.76 12.49 8.93* 8.92 11.52 9.22 7.37 7.70 6.93 6.23 6.177 5.713 5.285 7 8 9 8.93 4.46 6.55* 6.55 6.56 5.90* 5.90 5.91 4.888 4.522 4.462* 10 6.55 3.28 11 12 5.90 5.91 5.90 4.461 4.462 4.461 13 14 15 5.91 5.90 5.91 4.462 4.461 4.462 2.95 16 17 18 4.461 4.462 4.461 19 20 21 4.462 4.461 2.231 Computation method The 3-, 5-, 7-, and 10-year classes use 200% and the 15- and 20-year classes use 150% declining balance depreciation. All classes convert to straight-line depreciation in the optimal year, shown with asterisk (*). A half-year of depreciation is allowed in the first and last recovery years. TABLE 11-1 MACRS GDS Property Classes Property Class Personal Property (all property except real estate) 3-year property Special handling devices for food and beverage manufacture Special tools for the manufacture of finished plastic products, fabricated metal products, and motor vehicles 5-year property Automobiles and trucks Aircraft (of non-air-transport companies) Equipment used in research and experimentation Computers Petroleum drilling equipment 7-year property All other property not assigned to another class Office furniture, fixtures, and equipment 10-year property Assets used in petroleum refining and certain food products Vessels and water transportation equipment 15-year property Telephone distribution plants Municipal sewage treatment plants 20-year property Municipal sewers For more detail, see Tables B1 & B2 in IRS Publication 946, How to Depreciate Property (www.irs.gov). TABLE 11-2 MACRS Depreciation for Personal Property: Half-Year Convention Recovery Year 3-Year Property Applicable Percentage for Property Class 5-Year 7-Year 10-Year 15-Year Property Property Property Property 20-Year Property 1 2 3 33.33 44.45 14.81* 20.00 32.00 19.20 14.29 24.49 17.49 10.00 18.00 14.40 5.00 9.50 8.55 3.750 7.219 6.677 7.41 4 5 6 11.52* 11.52 5.76 12.49 8.93* 8.92 11.52 9.22 7.37 7.70 6.93 6.23 6.177 5.713 5.285 7 8 9 8.93 4.46 6.55* 6.55 6.56 5.90* 5.90 5.91 4.888 4.522 4.462* 10 6.55 3.28 11 12 5.90 5.91 5.90 4.461 4.462 4.461 13 14 15 5.91 5.90 5.91 4.462 4.461 4.462 2.95 16 17 18 4.461 4.462 4.461 19 20 21 4.462 4.461 2.231 Computation method The 3-, 5-, 7-, and 10-year classes use 200% and the 15- and 20-year classes use 150% declining balance depreciation. All classes convert to straight-line depreciation in the optimal year, shown with asterisk (*). A half-year of depreciation is allowed in the first and last recovery yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started