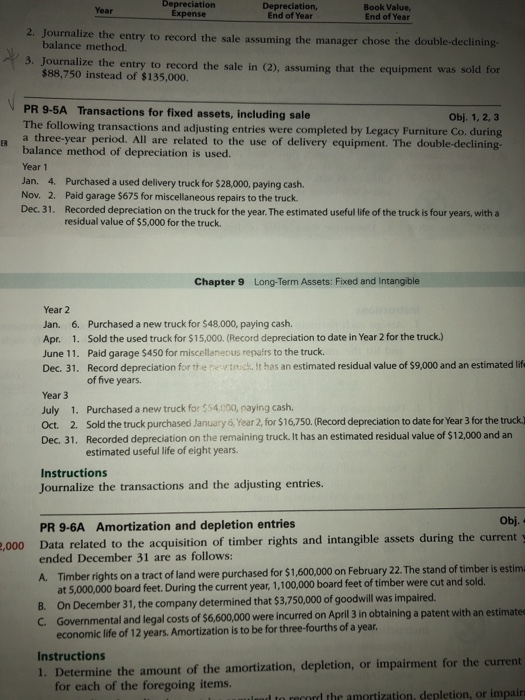

Depreciation Depreciation, End of Year Book Value, End of Year Year Expense 2. Journalize the entry to record the sale assuming the manager chose the double-declining balance method. 3. Journalize the entry to record the sale in (2), assuming that the equipment was $88,750 instead of $135,000. PR 9-5A Transactions for fixed assets, including sale Obj. 1, 2, 3 The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining balance method of depreciation is used. Year 1 Jan. 4. Purchased a used delivery truck for $28,000, paying cash. Nov. 2. Paid garage $675 for miscellaneous repairs to the truck Dec. 31. Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $5,000 for the truck. Chapter 9 Long-Term Assets: Fixed and Intangible Year 2 Jan. 6. Purchased a new truck for $48,000, paying cash Apr. 1. Sold the used truck for $15,000. (Record depreciation to date in Year 2 for the truck.) June 11. Paid garage $450 for miscellaneous repairs to the truck Dec. 31. Record depreciation forthe ney tck, It has an estimated residual value of $9,000 and an estimated lif of five years. Year 3 July 1. Purchased a new truck for $54,000, paying cash. Oct. 2. Sold the truck purchased January 6, Year 2, for $16,750. (Record depreciation to date for Year 3 for the truck) Dec. 31. Recorded depreciation on the remaining truck. It has an estimated residual value of $12,000 and an estimated useful life of eight years. Instructions Journalize the transactions and the adjusting entries. Obj. PR 9-6A Amortization and depletion entries Data related to the acquisition of timber rights and intangible assets during the current y ended December 31 are as follows: A. Timber rights on a tract of land were purchased for $1,600,000 on February 22. The stand of timber is estima ,000 at 5,000,000 board feet. During the current year, 1,100,000 board feet of timber were cut and sold. 8. On December 31, the company determined that $3,750,00 of goodwill was impaired C. Governmental and legal costs of $6,600,000 were incurred on April 3 in obtaining a patent with an estimate economic life of 12 years. Amortization is to be for three-fourths of a year. Instructions 1. Determine the amount of the amortization, depletion, or impairment for the current for each of the foregoing items. to record the amortization, depletion, or impain