Answered step by step

Verified Expert Solution

Question

1 Approved Answer

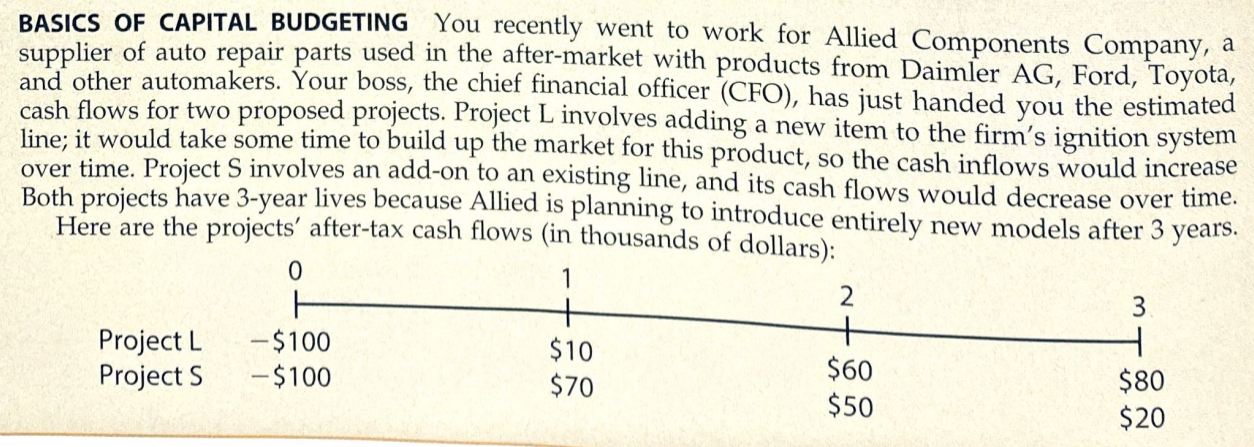

Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. The CFO also made subjective risk assessments

Depreciation, salvage values, net operating working capital requirements, and tax effects are all

included in these cash flows. The CFO also made subjective risk assessments of each project, and he

concluded that both projects have risk characteristics that are similar to the firm's average project.

Allied's WACC is You must determine whether one or both of the projects should be accepted.

a Draw NPV profiles for Projects L and S At what discount rate do the profiles cross?

bLook at your NPY profile graph without referring to the actual NPVs and IRRs. Which projects should be accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any WACC less than

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started