Answered step by step

Verified Expert Solution

Question

1 Approved Answer

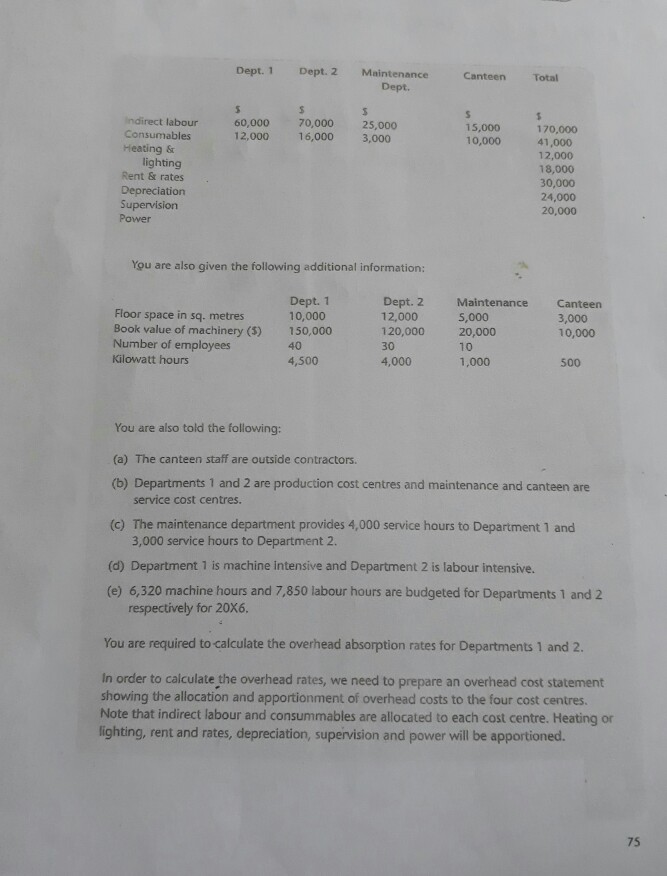

Dept. 1 Dept. 2 Maintenance Canteen Toal Dept. Indirect labour 60,000 70,000 25,000 Consumables 15,000 10,000 170,000 41,000 12,000 18,000 30,000 24,000 20,000 12,000 16,000

Dept. 1 Dept. 2 Maintenance Canteen Toal Dept. Indirect labour 60,000 70,000 25,000 Consumables 15,000 10,000 170,000 41,000 12,000 18,000 30,000 24,000 20,000 12,000 16,000 3,000 Heating & lighting Rent & rates Depreciation Supervisiorn Power You are also given the following additional information: Floor space in sq. metres Book value of machinery (5) Number of employees Kilowatt hours Dept. 1 10,000 150,000 40 4,500 Dept. 2 Maintenance Canteen 12,000 120,000 20,000 30 4,000 5,000 3,000 10,000 10 1,000 500 You are also told the following: (a) The canteen staff are outside contractors (b) Departments 1 and 2 are production cost centres and maintenance and canteen are service cost centres. (c) The maintenance department provides 4,000 service hours to Department 1 and 3,000 service hours to Department 2. (d) Department 1 is machine intensive and Department 2 is labour intensive (e) 6,320 machine hours and 7,850 labour hours are budgeted for Departments 1 and 2 respectively for 20X6. You are required to calculate the overhead absorption rates for Departments 1 and 2. In order to calculate the overhead rates, we need to prepare an overhead cost statement showing the allocation and apportionment of overhead costs to the four cost centres. Note that indirect labour and consummables are allocated to each cost centre. Heating or lighting, rent and rates, depreciation, supervision and power will be apportioned. 75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started