Answered step by step

Verified Expert Solution

Question

1 Approved Answer

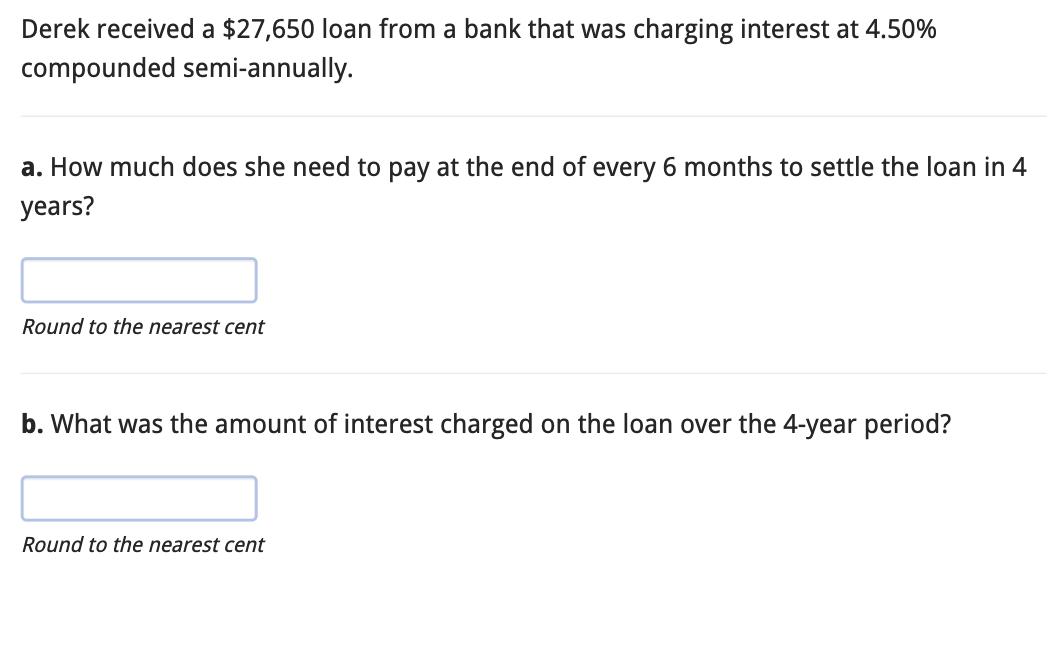

Derek received a $27,650 loan from a bank that was charging interest at 4.50% compounded semi-annually. a. How much does she need to pay

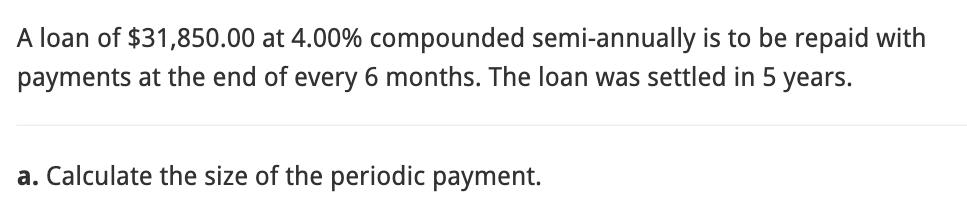

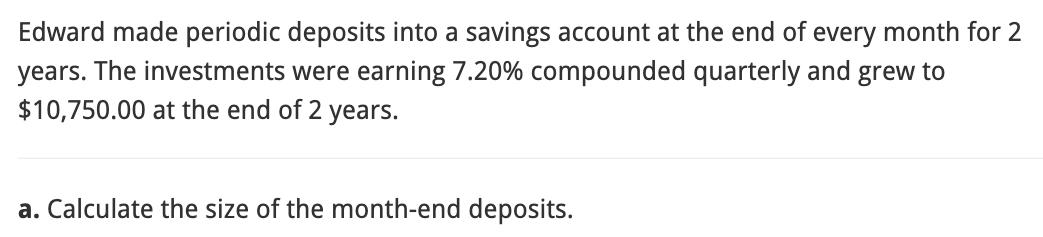

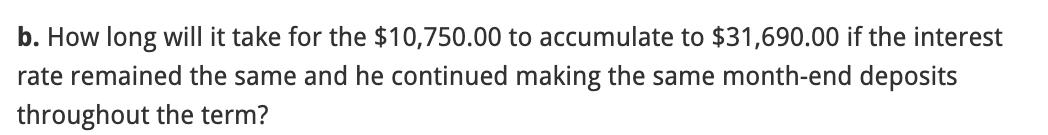

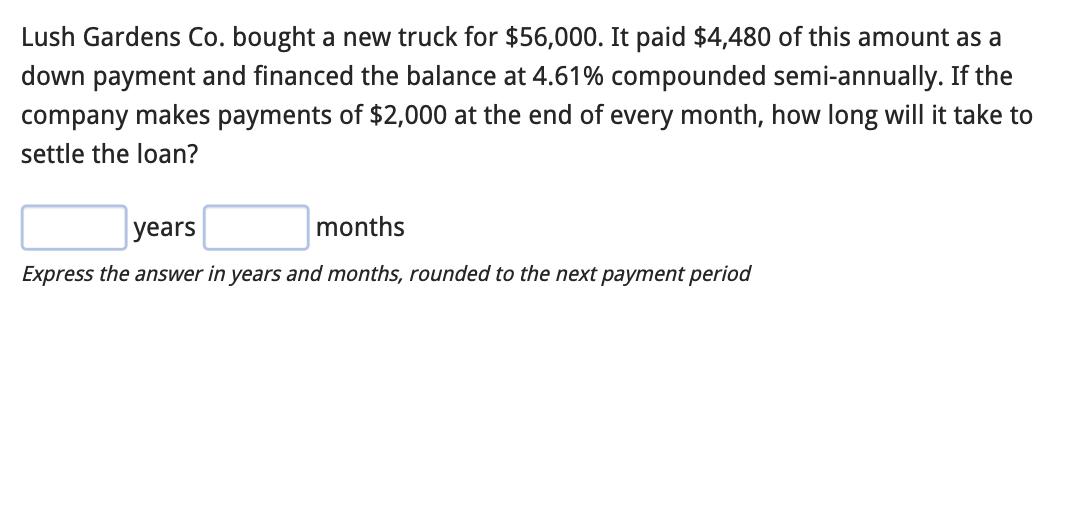

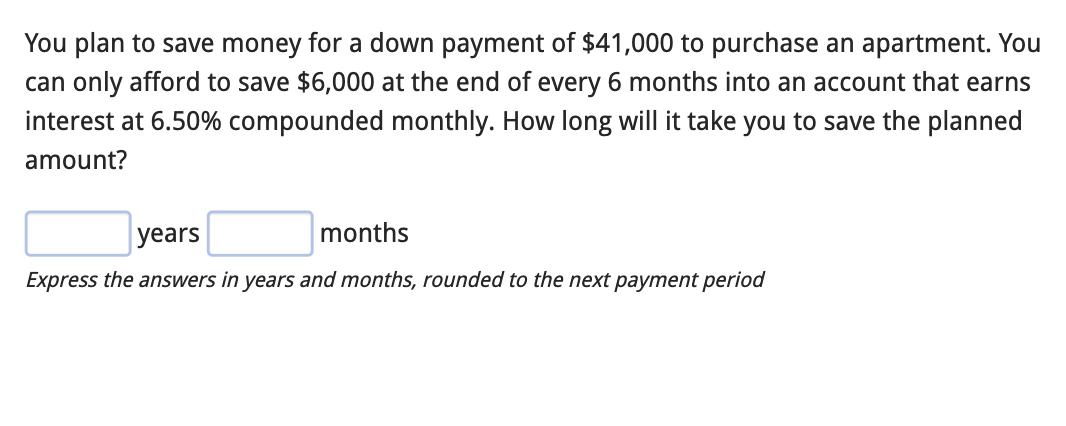

Derek received a $27,650 loan from a bank that was charging interest at 4.50% compounded semi-annually. a. How much does she need to pay at the end of every 6 months to settle the loan in 4 years? Round to the nearest cent b. What was the amount of interest charged on the loan over the 4-year period? Round to the nearest cent A loan of $31,850.00 at 4.00% compounded semi-annually is to be repaid with payments at the end of every 6 months. The loan was settled in 5 years. a. Calculate the size of the periodic payment. b. Calculate the total interest paid. Edward made periodic deposits into a savings account at the end of every month for 2 years. The investments were earning 7.20% compounded quarterly and grew to $10,750.00 at the end of 2 years. a. Calculate the size of the month-end deposits. b. How long will it take for the $10,750.00 to accumulate to $31,690.00 if the interest rate remained the same and he continued making the same month-end deposits throughout the term? Lush Gardens Co. bought a new truck for $56,000. It paid $4,480 of this amount as a down payment and financed the balance at 4.61% compounded semi-annually. If the company makes payments of $2,000 at the end of every month, how long will it take to settle the loan? years months Express the answer in years and months, rounded to the next payment period You plan to save money for a down payment of $41,000 to purchase an apartment. You can only afford to save $6,000 at the end of every 6 months into an account that earns interest at 6.50% compounded monthly. How long will it take you to save the planned amount? years months Express the answers in years and months, rounded to the next payment period

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 To calculate the payment amount at the end of every 6 months to settle the loan in 4 years we can use the formula for calculating the equal periodic payment for a loan The formula is P r A 1 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started