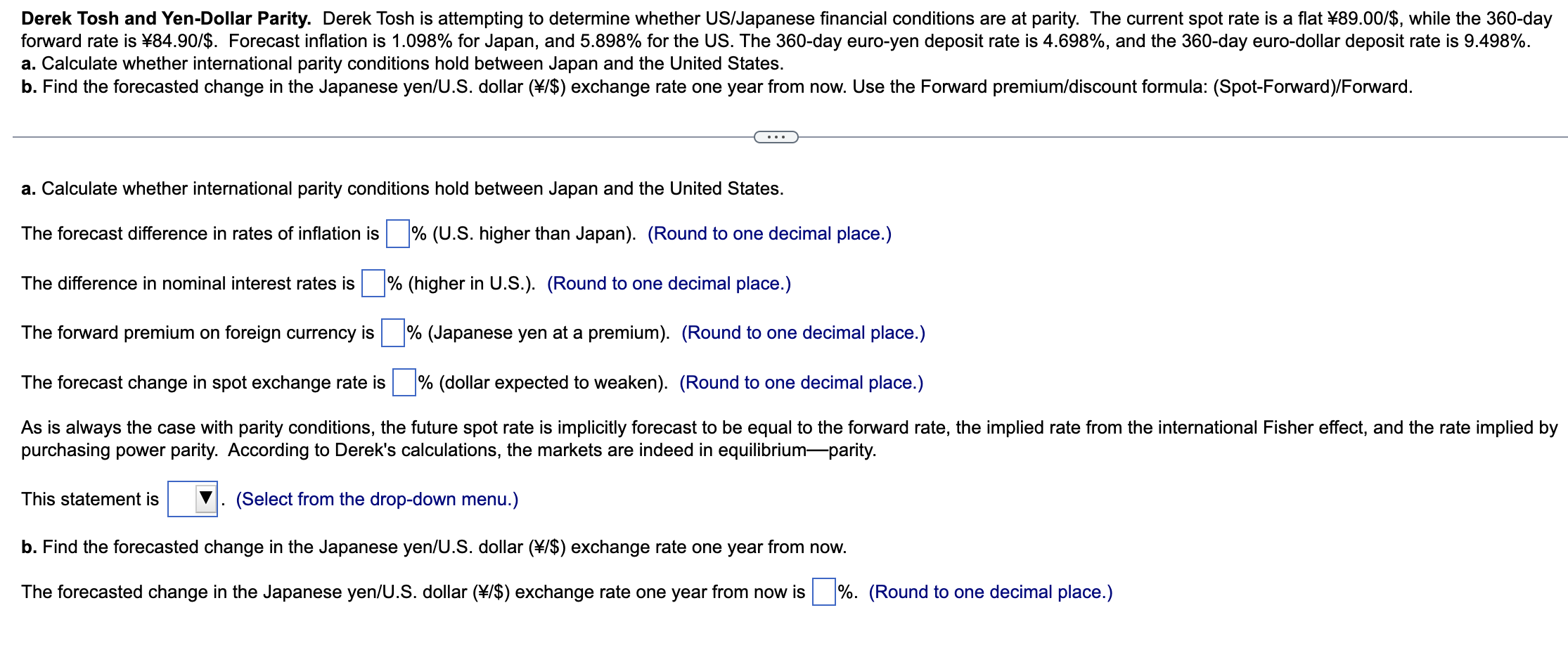

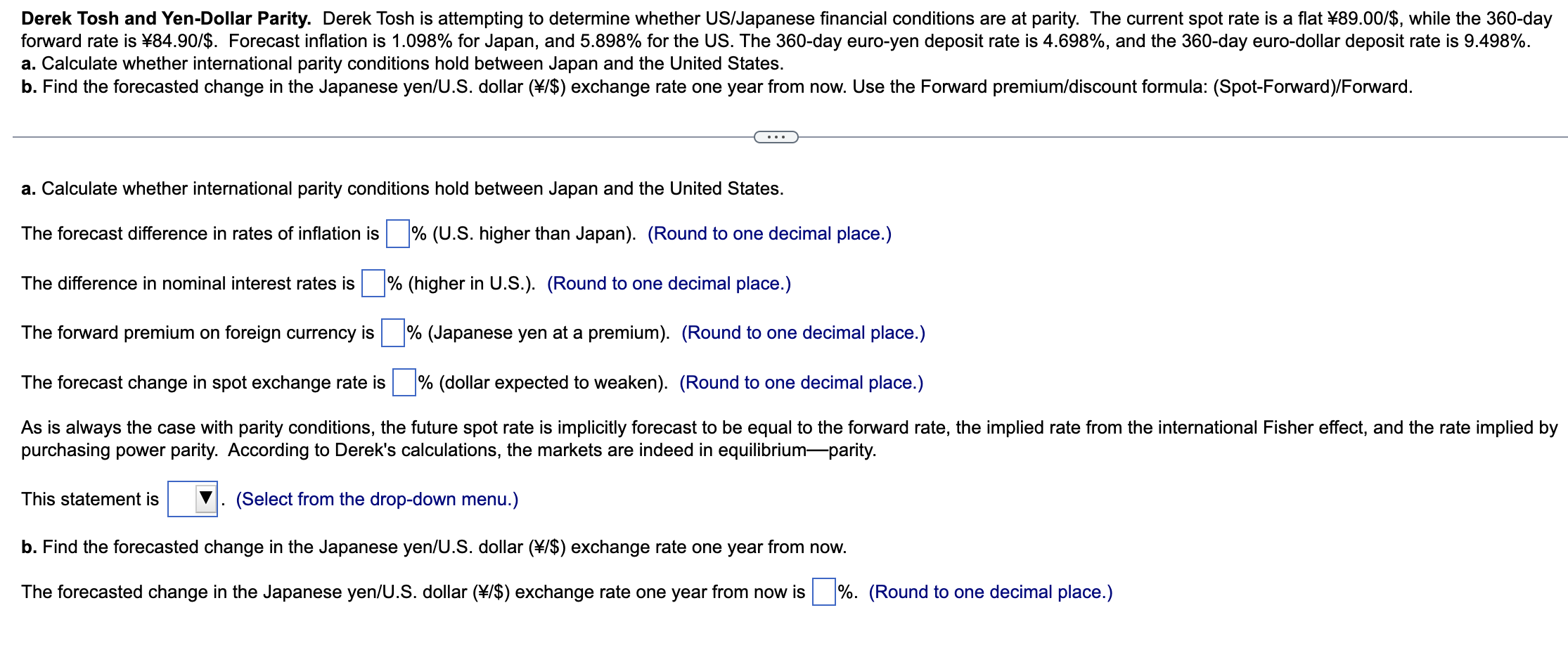

Derek Tosh and Yen-Dollar Parity. Derek Tosh is attempting to determine whether US/Japanese financial conditions are at parity. The current spot rate is a flat 89.00/$, while the 360 -day forward rate is 84.90/$. Forecast inflation is 1.098% for Japan, and 5.898% for the US. The 360 -day euro-yen deposit rate is 4.698%, and the 360 -day euro-dollar deposit rate is 9.498%. a. Calculate whether international parity conditions hold between Japan and the United States. b. Find the forecasted change in the Japanese yen/U.S. dollar (/\$) exchange rate one year from now. Use the Forward premium/discount formula: (Spot-Forward)/Forward. a. Calculate whether international parity conditions hold between Japan and the United States. The forecast difference in rates of inflation is % (U.S. higher than Japan). (Round to one decimal place.) The difference in nominal interest rates is 6 (higher in U.S.). (Round to one decimal place.) The forward premium on foreign currency is \% (Japanese yen at a premium). (Round to one decimal place.) The forecast change in spot exchange rate is % (dollar expected to weaken). (Round to one decimal place.) As is always the case with parity conditions, the future spot rate is implicitly forecast to be equal to the forward rate, the implied rate from the international Fisher effect, and the rate implied by purchasing power parity. According to Derek's calculations, the markets are indeed in equilibrium-parity. This statement is (Select from the drop-down menu.) b. Find the forecasted change in the Japanese yen/U.S. dollar (/\$) exchange rate one year from now. The forecasted change in the Japanese yen/U.S. dollar (/\$) exchange rate one year from now is \%. (Round to one decimal place.) Derek Tosh and Yen-Dollar Parity. Derek Tosh is attempting to determine whether US/Japanese financial conditions are at parity. The current spot rate is a flat 89.00/$, while the 360 -day forward rate is 84.90/$. Forecast inflation is 1.098% for Japan, and 5.898% for the US. The 360 -day euro-yen deposit rate is 4.698%, and the 360 -day euro-dollar deposit rate is 9.498%. a. Calculate whether international parity conditions hold between Japan and the United States. b. Find the forecasted change in the Japanese yen/U.S. dollar (/\$) exchange rate one year from now. Use the Forward premium/discount formula: (Spot-Forward)/Forward. a. Calculate whether international parity conditions hold between Japan and the United States. The forecast difference in rates of inflation is % (U.S. higher than Japan). (Round to one decimal place.) The difference in nominal interest rates is 6 (higher in U.S.). (Round to one decimal place.) The forward premium on foreign currency is \% (Japanese yen at a premium). (Round to one decimal place.) The forecast change in spot exchange rate is % (dollar expected to weaken). (Round to one decimal place.) As is always the case with parity conditions, the future spot rate is implicitly forecast to be equal to the forward rate, the implied rate from the international Fisher effect, and the rate implied by purchasing power parity. According to Derek's calculations, the markets are indeed in equilibrium-parity. This statement is (Select from the drop-down menu.) b. Find the forecasted change in the Japanese yen/U.S. dollar (/\$) exchange rate one year from now. The forecasted change in the Japanese yen/U.S. dollar (/\$) exchange rate one year from now is \%. (Round to one decimal place.)