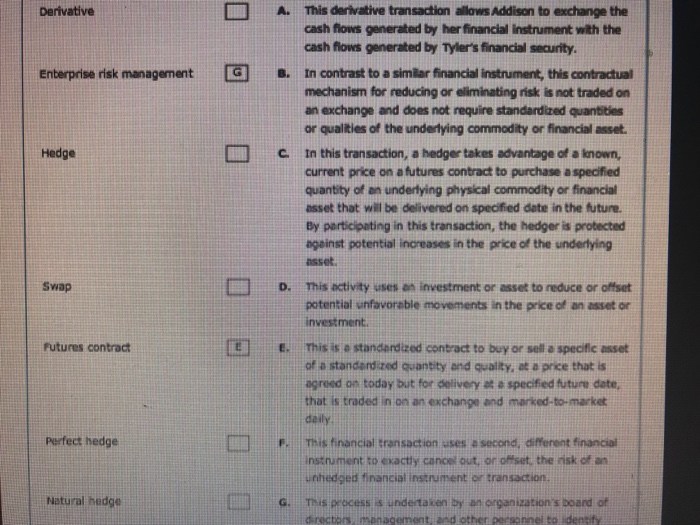

Derivative A. This derivative transaction allows Addison to exchange the cash flows generated by her financial instrument with the cash fiows generated by Tylers financial security Enterprise risk management GB. In contrast to a similar financial instrument, this contractual mechanism for reducing or eliminating risk is not traded on an exchange and does not require standardized quantities or qualities of the underlying commodity or financial asset Hedge C In this transaction, a hedger takes advantage of a known, current price on a futures contract to purchase a specified quantity of an underlying physical commodity or financial asset that will be delivered on specified date in the future. By participating in this transaction, the hedger is protected ngeinst potential increases in the price of the underlying nsset Swap D. This activity uses an investment or asset to reduce or offset potential unfavorable movements in the price of an asset or investment. Futures contract EE This is o standerdized contract to buy or sell a specific asset of a standardized quantity and quality, at a price that is agreed on today but for delivery at e specified future date, that is traded in on an exchange and marked-to-market deily purfect hedge r. This financial tran saction uses a second, different financiul instrument to exactly cancel out, or ofiset, the risk of an unhedged financial instrument or transaction. THS process is undertaken by an organization's board of Natural hedge G. Derivative A. This derivative transaction allows Addison to exchange the cash flows generated by her financial instrument with the cash fiows generated by Tylers financial security Enterprise risk management GB. In contrast to a similar financial instrument, this contractual mechanism for reducing or eliminating risk is not traded on an exchange and does not require standardized quantities or qualities of the underlying commodity or financial asset Hedge C In this transaction, a hedger takes advantage of a known, current price on a futures contract to purchase a specified quantity of an underlying physical commodity or financial asset that will be delivered on specified date in the future. By participating in this transaction, the hedger is protected ngeinst potential increases in the price of the underlying nsset Swap D. This activity uses an investment or asset to reduce or offset potential unfavorable movements in the price of an asset or investment. Futures contract EE This is o standerdized contract to buy or sell a specific asset of a standardized quantity and quality, at a price that is agreed on today but for delivery at e specified future date, that is traded in on an exchange and marked-to-market deily purfect hedge r. This financial tran saction uses a second, different financiul instrument to exactly cancel out, or ofiset, the risk of an unhedged financial instrument or transaction. THS process is undertaken by an organization's board of Natural hedge G