Question

Derivative markets 3.A trader takes a long position in two January gold futures contracts when the futures price is $1,000 per ounce on Day 1.

Derivative markets

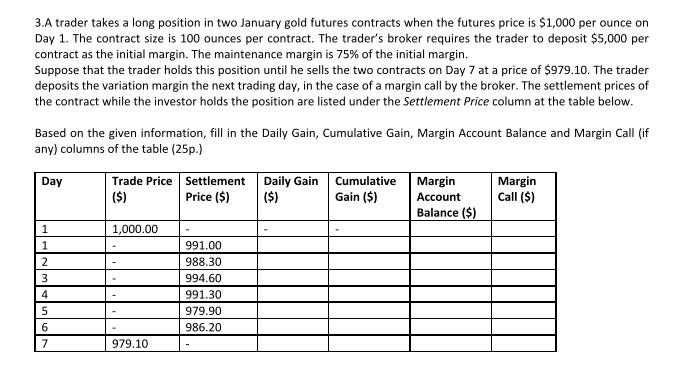

3.A trader takes a long position in two January gold futures contracts when the futures price is $1,000 per ounce on Day 1. The contract size is 100 ounces per contract. The traders broker requires the trader to deposit $5,000 per contract as the initial margin. The maintenance margin is 75% of the initial margin. Suppose that the trader holds this position until he sells the two contracts on Day 7 at a price of $979.10. The trader deposits the variation margin the next trading day, in the case of a margin call by the broker. The settlement prices of the contract while the investor holds the position are listed under the Settlement Price column at the table below. Based on the given information, fill in the Daily Gain, Cumulative Gain, Margin Account Balance and Margin Call (if any) columns of the table.

3.A trader takes a long position in two January gold futures contracts when the futures price is $1,000 per ounce on Day 1. The contract size is 100 ounces per contract. The trader's broker requires the trader to deposit $5,000 per contract as the initial margin. The maintenance margin is 75% of the initial margin. Suppose that the trader holds this position until he sells the two contracts on Day 7 at a price of $979.10. The trader deposits the variation margin the next trading day, in the case of a margin call by the broker. The settlement prices of the contract while the investor holds the position are listed under the Settlement Price column at the table below. Based on the given information, fill in the Daily Gain, Cumulative Gain, Margin Account Balance and Margin Call (if any) columns of the table (25p.) Day Trade Price Settlement ($) Price ($) Daily Gain Cumulative ($) Gain ($) Margin Account Balance ($) Margin Call ($) 1,000.00 1 1 2 3 4 5 6 7 991.00 988.30 994.60 991.30 979.90 986.20 979.10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started