Answered step by step

Verified Expert Solution

Question

1 Approved Answer

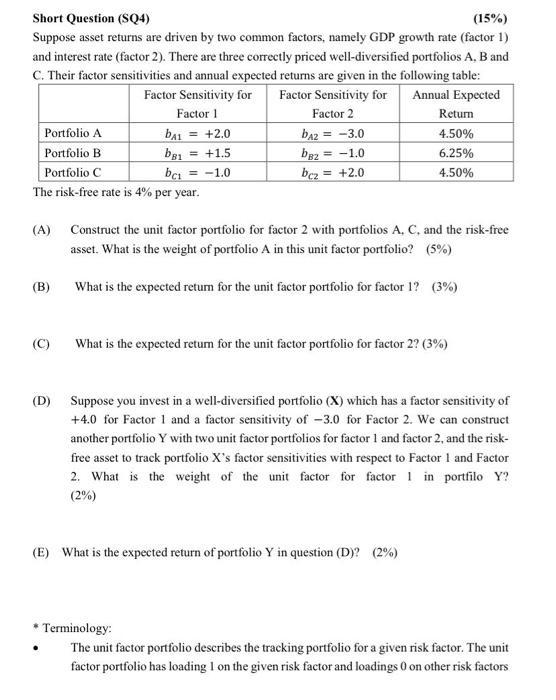

Short Question (SQ4) (15%) Suppose asset returns are driven by two common factors, namely GDP growth rate (factor 1) and interest rate (factor 2).

Short Question (SQ4) (15%) Suppose asset returns are driven by two common factors, namely GDP growth rate (factor 1) and interest rate (factor 2). There are three correctly priced well-diversified portfolios A, B and C. Their factor sensitivities and annual expected returns are given in the following table: Annual Expected Factor Sensitivity for Factor 1 Factor Sensitivity for Factor 2 Portfolio A Portfolio B Portfolio C The risk-free rate is 4% per year. (B) (C) BAL= +2.0 bB = +1.5 bc= -1.0 bA2 = -3.0 bB2 -1.0 bcz = +2.0 (A) Construct the unit factor portfolio for factor 2 with portfolios A, C, and the risk-free asset. What is the weight of portfolio A in this unit factor portfolio? (5%) What is the expected return for the unit factor portfolio for factor 1? (3%) = . Return 4.50% 6.25% 4.50% What is the expected return for the unit factor portfolio for factor 2? (3%) (D) Suppose you invest in a well-diversified portfolio (X) which has a factor sensitivity of +4.0 for Factor 1 and a factor sensitivity of -3.0 for Factor 2. We can construct another portfolio Y with two unit factor portfolios for factor 1 and factor 2, and the risk- free asset to track portfolio X's factor sensitivities with respect to Factor 1 and Factor 2. What is the weight of the unit factor for factor 1 in portfilo Y? (2%) (E) What is the expected return of portfolio Y in question (D)? (2%) *Terminology: The unit factor portfolio describes the tracking portfolio for a given risk factor. The unit factor portfolio has loading 1 on the given risk factor and loadings 0 on other risk factors

Step by Step Solution

★★★★★

3.49 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

A Let the portfolio has weights Wa Wc and Wf Hence 2Wa Wc 1 3Wa 2Wc 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started