Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Desani, a public limited company, operates many of its activities overseas. The directors have asked for advice on the correct accounting treatment of several aspects

Desani, a public limited company, operates many of its activities overseas. The directors have asked for advice on the correct accounting treatment of several aspects of Desani's overseas operations. Desani's functional currency is the Ringgit. Based on the information given, ADVISE the directors of Desani on their various requests below, showing suitable calculations where necessary.

- a) Desani has created a new subsidiary, which is incorporated in the same country as Desani. The subsidiary has issued 2 million dinars of equity capital to Desani, which paid for these shares in dinars. The subsidiary has also raised 100,000 dinars of equity capital from external sources and has deposited the whole of the capital with a bank in an overseas country whose currency is the dinar. The capital is to be invested in dinar-denominated bonds. The subsidiary has a small number of staff and its operating expenses, which are low, are incurred in Ringgit. The profits are under the control of Desani. Any income from the investment is either passed on to Desani in the form of a dividend or reinvested under instruction from Desani. The subsidiary does not make any decisions as to where to place the investments. Desani would like advice on how to determine the functional currency of the subsidiary.

- b) Desani has a foreign branch which has the same functional currency as Desani. The branch's taxable profits are determined in dinars. On 1 May 2020, the branch acquired a property for 6 million dinars. The property had an expected useful life of 12 years with a zero residual value. The asset is written off for tax purposes over eight years. The tax rate in Desani's jurisdiction is 30% and in the branch's jurisdiction is 20%. The foreign branch uses the cost model for valuing its property and measures the tax base at the exchange rate at the reporting date. Desani would like an explanation (including a calculation) as to why a deferred tax charge relating to the asset arises in the group financial statements for the year ended 30 April 2021 and the impact on the financial statements if the tax base had been translated at the historical rate.

- c) On 1 May 2020, Desani purchased 70% of a multi-national group whose functional currency was the dinar. The purchase consideration was RM 1,045 million. At acquisition, the net assets at cost were 1,000 million dinars. Page 5 of 10 BAA 3813 Advance Corporate Reporting-FE2021's fair values of the net assets were 1,100 million dinars and the fair value of the non-controlling interest was 250 million dinars. Desani uses the full goodwill method. Desani wishes to know how to deal with goodwill arising from the above acquisition in the group financial statements for the year ended 30 April 2021.

- d) Desani took out a foreign currency loan of 5 million dinars at a fixed interest rate of 8% on 1 May 2020. The interest is paid at the end of each year. The loan will be repaid after two years on 30 April 2022. The interest rate is the current market rate for similar two-year fixed interest loans. Desani requires advice on how to account for the loan and interest in the financial statements for the year ended 30 April 2021.

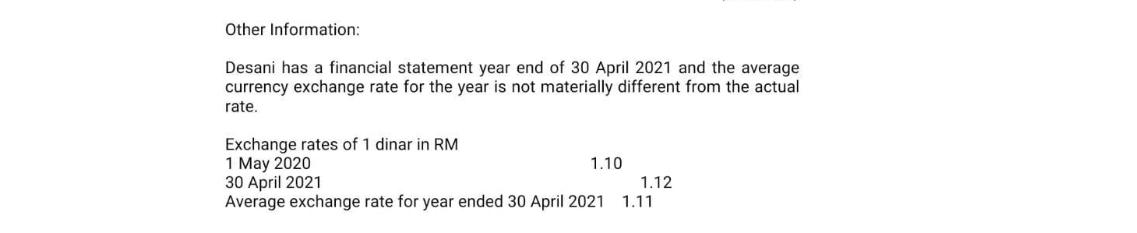

Other Information: Desani has a financial statement year end of 30 April 2021 and the average currency exchange rate for the year is not materially different from the actual rate. Exchange rates of 1 dinar in RM 1 May 2020 30 April 2021 1.12 Average exchange rate for year ended 30 April 2021 1.11 1.10

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The functional currency of the subsidiary is the din ar because the subsidiary s equity capital and operating expenses are den ominated in din ars a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started