Answered step by step

Verified Expert Solution

Question

1 Approved Answer

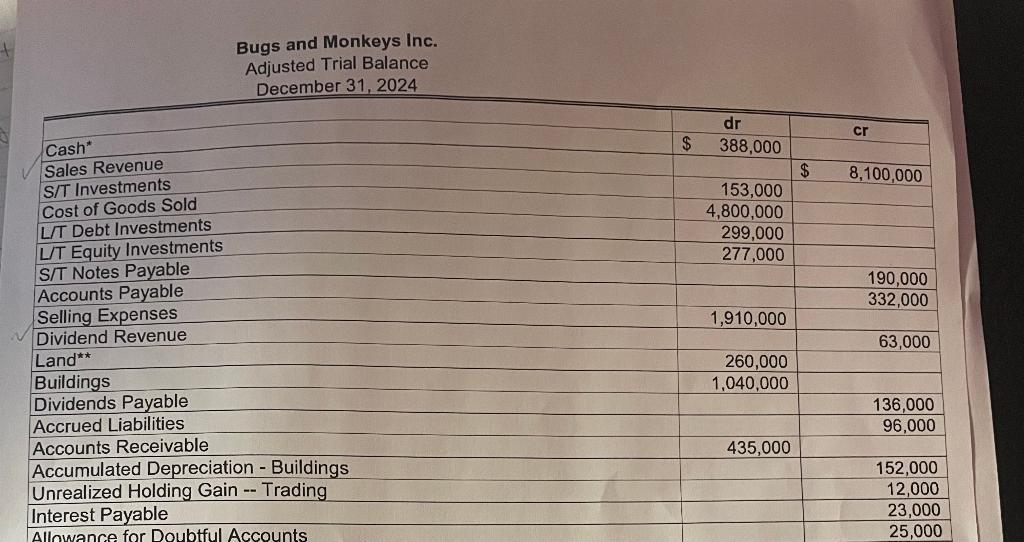

Cash Sales Revenue S/T Investments Cost of Goods Sold LIT Debt Investments LIT Equity Investments S/T Notes Payable Accounts Payable Selling Expenses Dividend Revenue

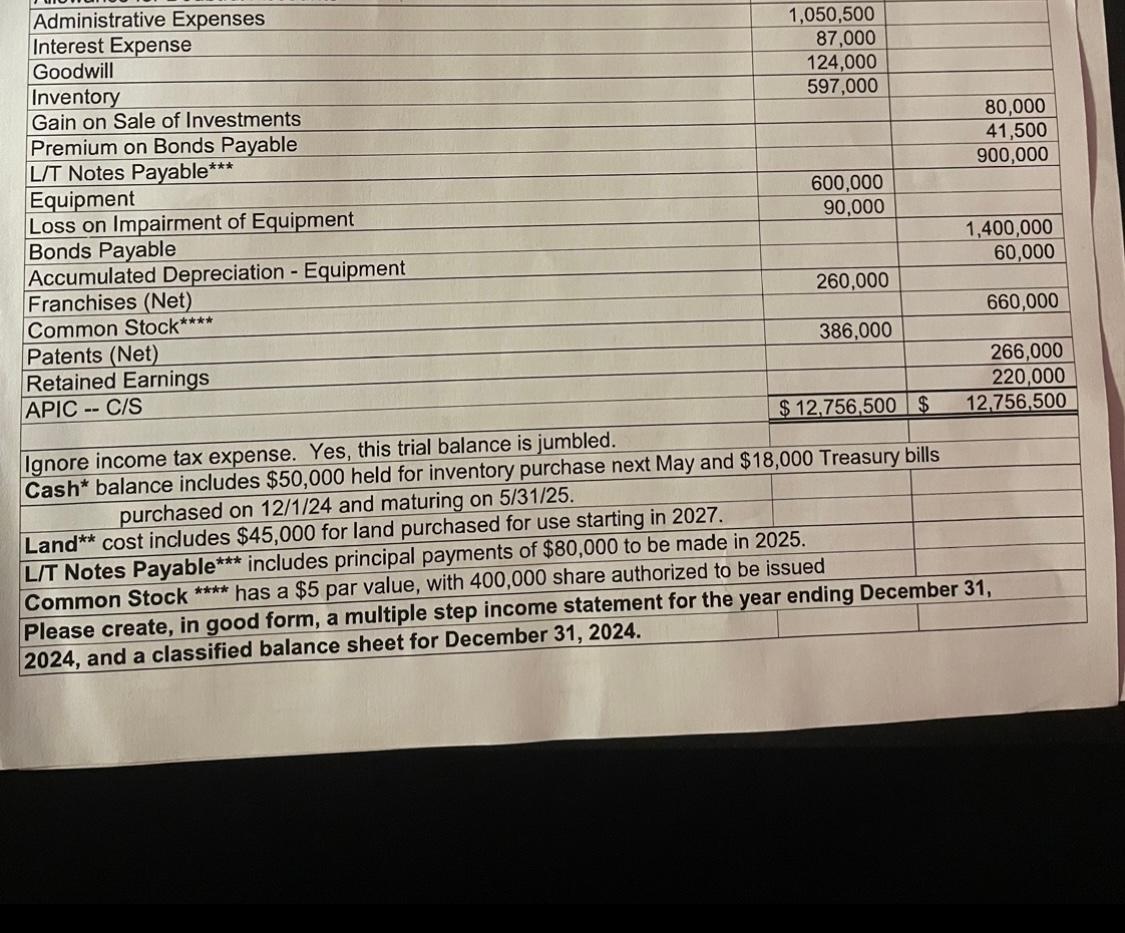

Cash Sales Revenue S/T Investments Cost of Goods Sold LIT Debt Investments LIT Equity Investments S/T Notes Payable Accounts Payable Selling Expenses Dividend Revenue Land** Bugs and Monkeys Inc. Adjusted Trial Balance December 31, 2024 Buildings Dividends Payable Accrued Liabilities Accounts Receivable Accumulated Depreciation - Buildings Unrealized Holding Gain-- Trading Interest Payable Allowance for Doubtful Accounts $ dr 388,000 153,000 4,800,000 299,000 277,000 1,910,000 260,000 1,040,000 435,000 $ cr 8,100,000 190,000 332,000 63,000 136,000 96,000 152,000 12,000 23,000 25,000 Administrative Expenses Interest Expense Goodwill Inventory Gain on Sale of Investments Premium on Bonds Payable L/T Notes Payable*** Equipment Loss on Impairment of Equipment Bonds Payable Accumulated Depreciation - Equipment Franchises (Net) Common Stock**** Patents (Net) Retained Earnings APIC -- C/S 1,050,500 87,000 124,000 597,000 600,000 90,000 260,000 386,000 $12,756,500 $ Ignore income tax expense. Yes, this trial balance is jumbled. Cash* balance includes $50,000 held for inventory purchase next May and $18,000 Treasury bills purchased on 12/1/24 and maturing on 5/31/25. Land** cost includes $45,000 for land purchased for use starting in 2027. L/T Notes Payable*** includes principal payments of $80,000 to be made in 2025. Common Stock **** has a $5 par value, with 400,000 share authorized to be issued 80,000 41,500 900,000 1,400,000 60,000 660,000 266,000 220,000 12,756,500 Please create, in good form, a multiple step income statement for the year ending December 31, 2024, and a classified balance sheet for December 31, 2024.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

BUGS AND MONKEYS INC INCOME STATEMENT FOR THE YEAR ENDINA DECEMBER 31 2024 No I INTEREST INCOME 1 Ur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started