Question

Describe the companies Apple Inc. and Samsung Inc. what do they do, review the most recent annual report financial statements for both companies and answer

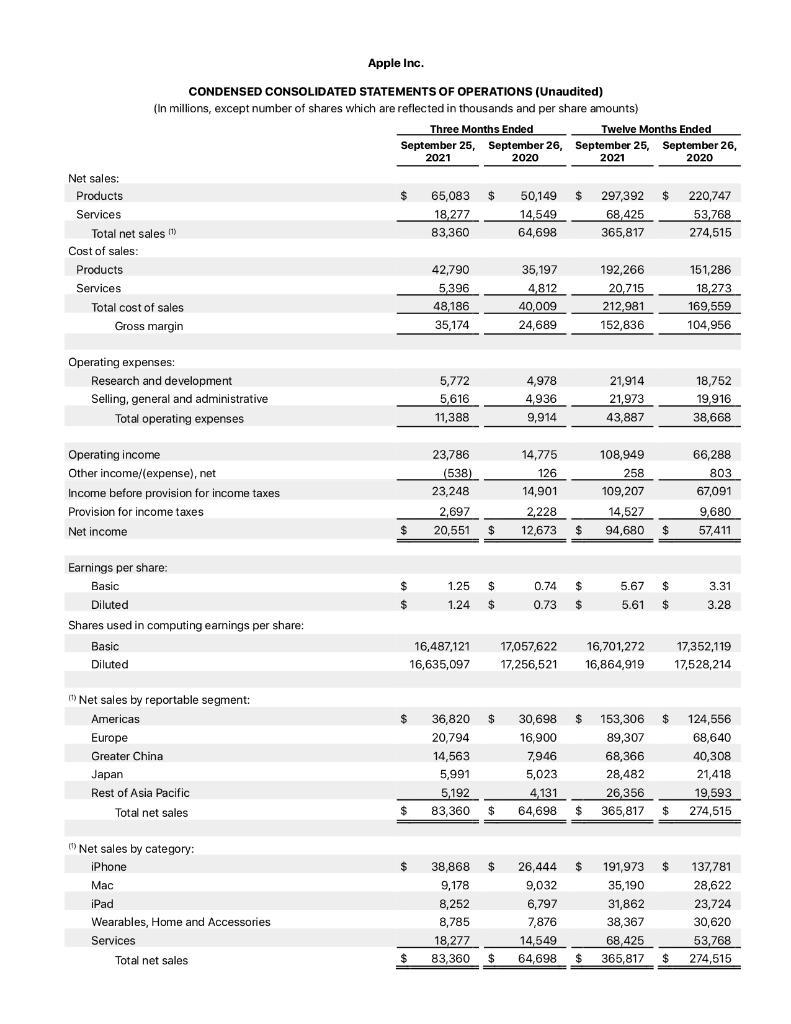

Describe the companies Apple Inc. and Samsung Inc. what do they do, review the most recent annual report financial statements for both companies and answer the following questions:

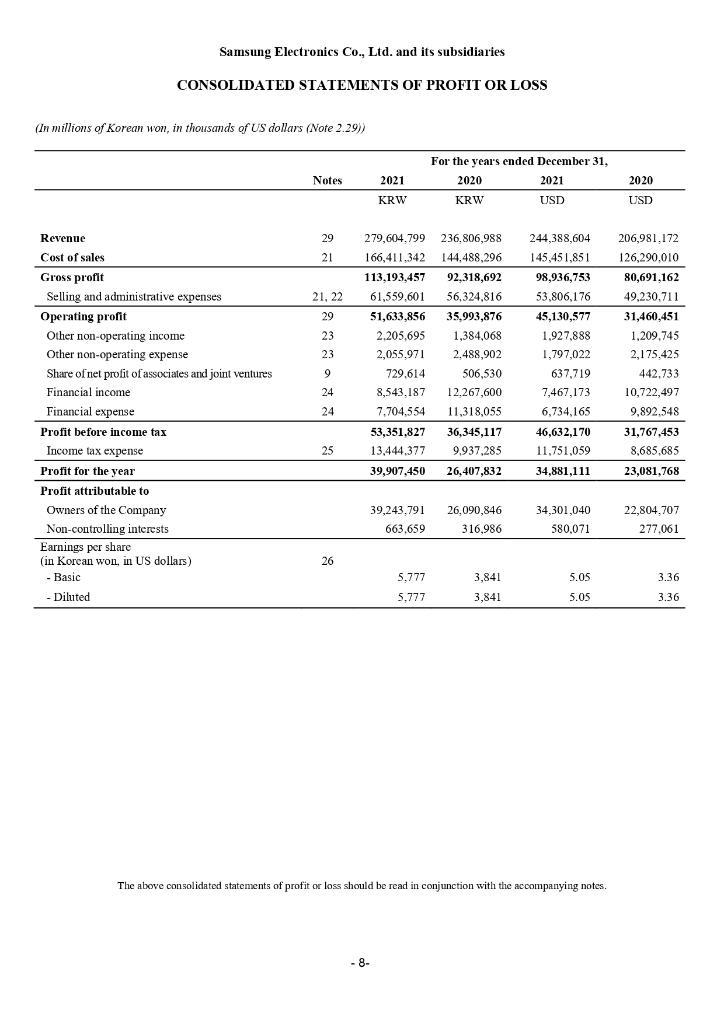

1.Comment on the liquidity of the Samsung and Apple Inc. companies. For which company is liquidity more important? Why?

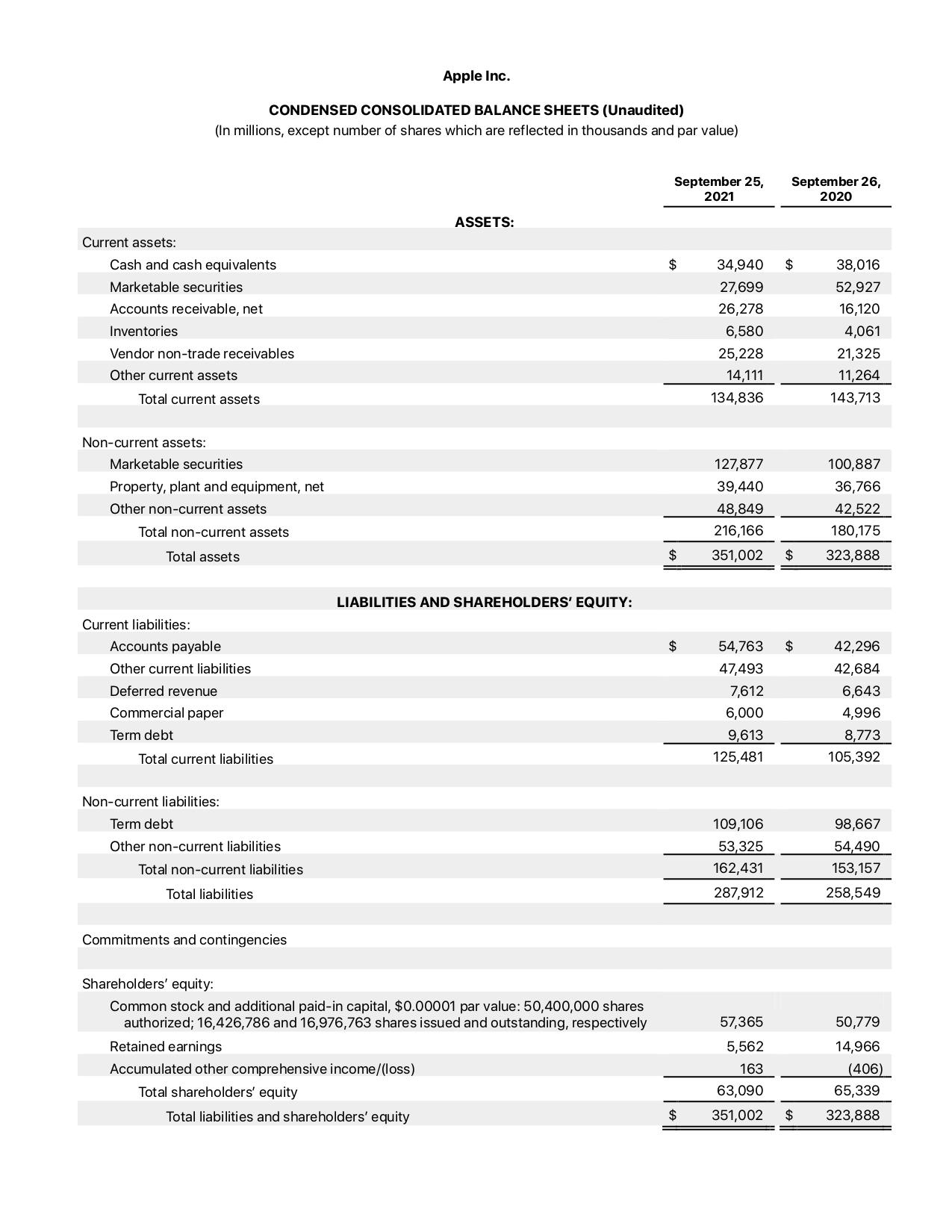

2.For which company Samsung or Apple Inc are the management of current assets and current liabilities most important? Why? Which company has the largest investment in fixed assets? For both companies, what percentage of total assets are current and fixed? What is the implication of this analysis regarding the management of assets for the two companies?

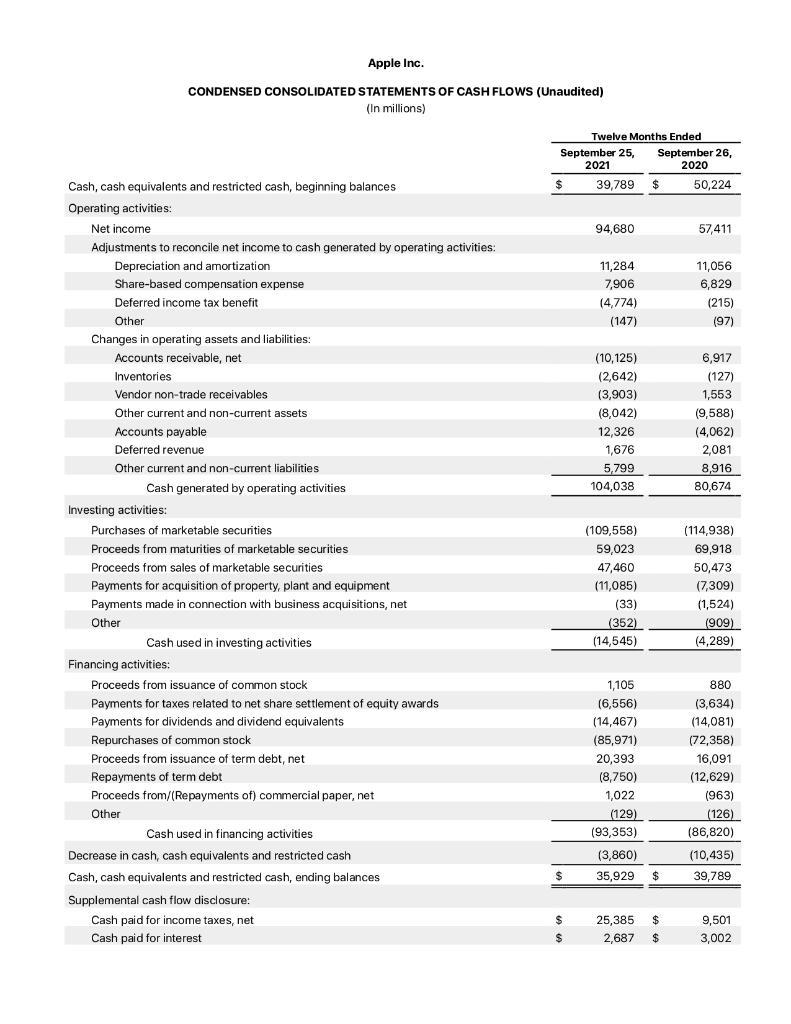

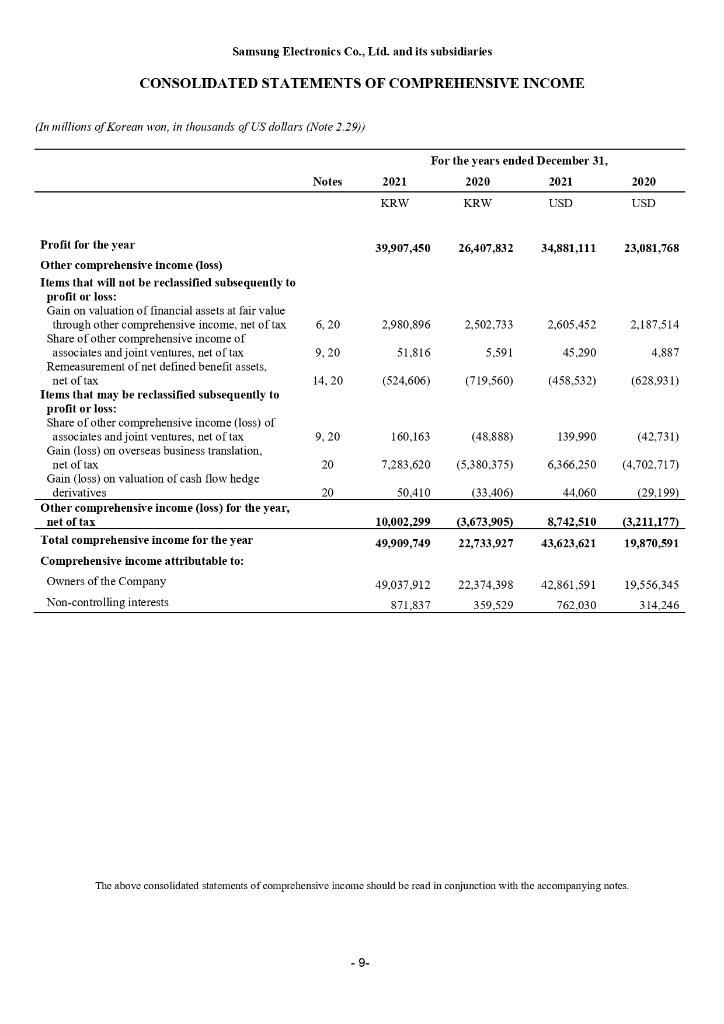

3.How have Samsung and Apple Inc. financed the investment in assets? Are both companies able to cover their financing costs? What does this analysis imply about the profitability of the two companies?

4.How profitable are Samsung and Apple Inc. relative to total sales, assets, common equity, and share price? What do the price/earnings multiples for the two companies suggest about investors' attitudes toward the companies?

5.What does a DuPont Analysis suggest about the companies?

6.Any new project(s) would you propose? How should be they analyzed and evaluated in terms of potential return and risk? Provide comprehensive explanations based on studied materials of the course FIN342. XD

Net sales: Products Services Total net sales (1) Cost of sales: Products Services Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) Three Months Ended (In millions, except number of shares which are reflected in thousands and per share amounts) Twelve Months Ended September 25, September 26, September 25, September 26, 2021 2020 2021 2020 Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted () Net sales by reportable segment: Americas Europe Greater China Japan Rest of Asia Pacific Total net sales (1) Net sales by category: iPhone Mac iPad Wearables, Home and Accessories Services Total net sales $ $ $ $ $ $ $ $ 65,083 18,277 83,360 42,790 5,396 48,186 35,174 5,772 5,616 11,388 23,786 (538) 23,248 2,697 20,551 16,487,121 16,635,097 1.25 $ 1.24 $ 36,820 20,794 14,563 5,991 $ 38,868 9,178 8,252 8,785 18,277 83,360 50,149 $ 14,549 64,698 $ 35,197 4,812 40,009 24,689 14,775 126 14,901 2,228 $ 12,673 4,978 4,936 9,914 0.74 $ 0.73 $ 17,057,622 17,256,521 297,392 $ 68,425 365,817 $ 192,266 20,715 212,981 152,836 108,949 258 109,207 14,527 $ 94,680 21,914 21,973 43,887 30,698 16,900 7,946 5,023. 5,192 4,131 26,356 83,360 $ 64,698 $ 365,817 $ 5.67 $ 5.61 $ 16,701,272 16,864,919 153,306 89,307 68,366 28,482 $ 35,190 31,862 38,367 68,425 365,817 $ 26,444 $191,973 $ 9,032 6,797 7,876 14,549 $ 64.698 $ 220,747 53,768 274,515 $ 151,286 18,273 169,559 104,956 18,752 19,916 38,668 66,288. 803 67,091 9,680 57,411 $ 124,556 68,640 40,308 21,418 19,593 274,515 3.31 3.28 17,352,119 17,528,214 137,781 28,622 23,724 30,620 53,768 274,515

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Based on the most recent annual report financial statements Samsung appears to have better liquidity than Apple Inc This is likely due to Samsu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started