Describe the companys history, products, and major competitors by accessing the Mergent Ashford University Library online database which offers company financials, descriptions, history, property, subsidiaries, officers and directors and by accessing the Business Insights database. (View the Mergent tipsheet and Business Insights tipsheet documents for suggested methods of searching Ashford University Library databases generally as well as specific advice for searching these two databases).

Assess the financial performance and condition of the organization.

Assess the financial performance and condition of the organization.

Assess the financial performance and condition of the organization.

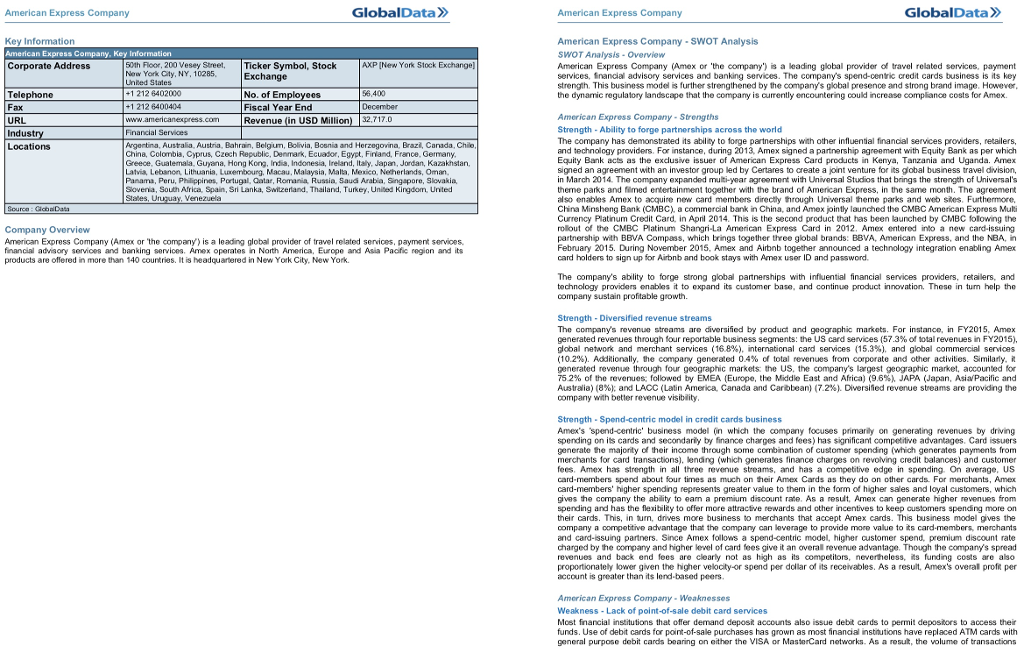

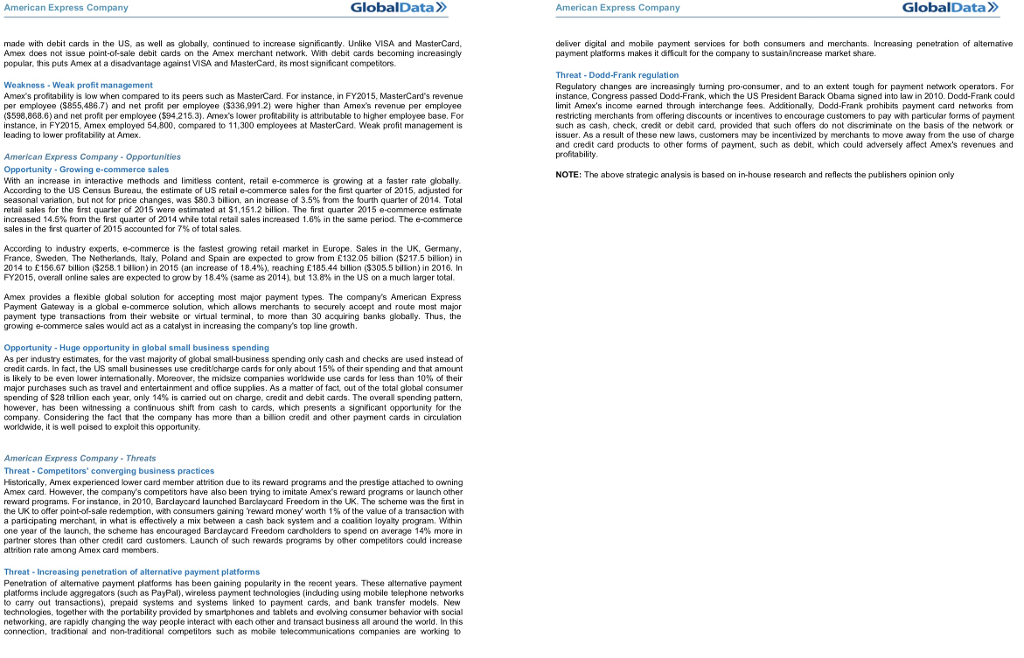

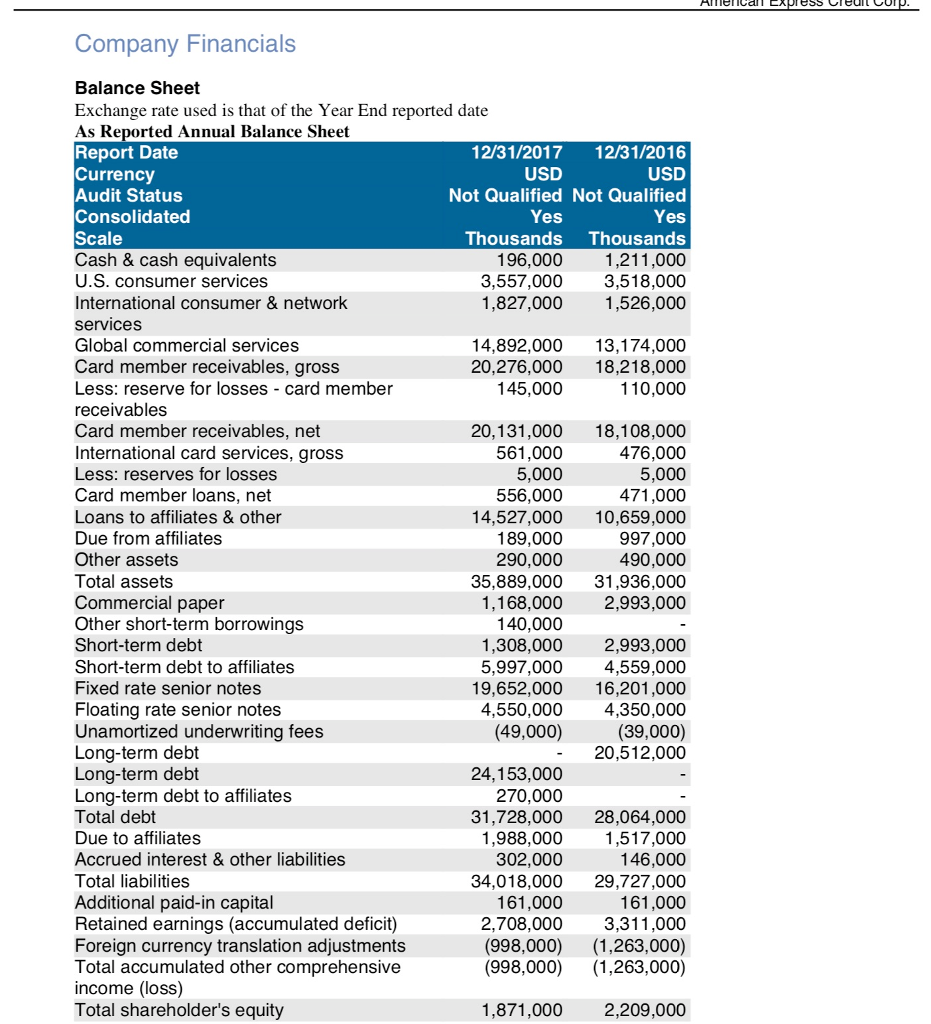

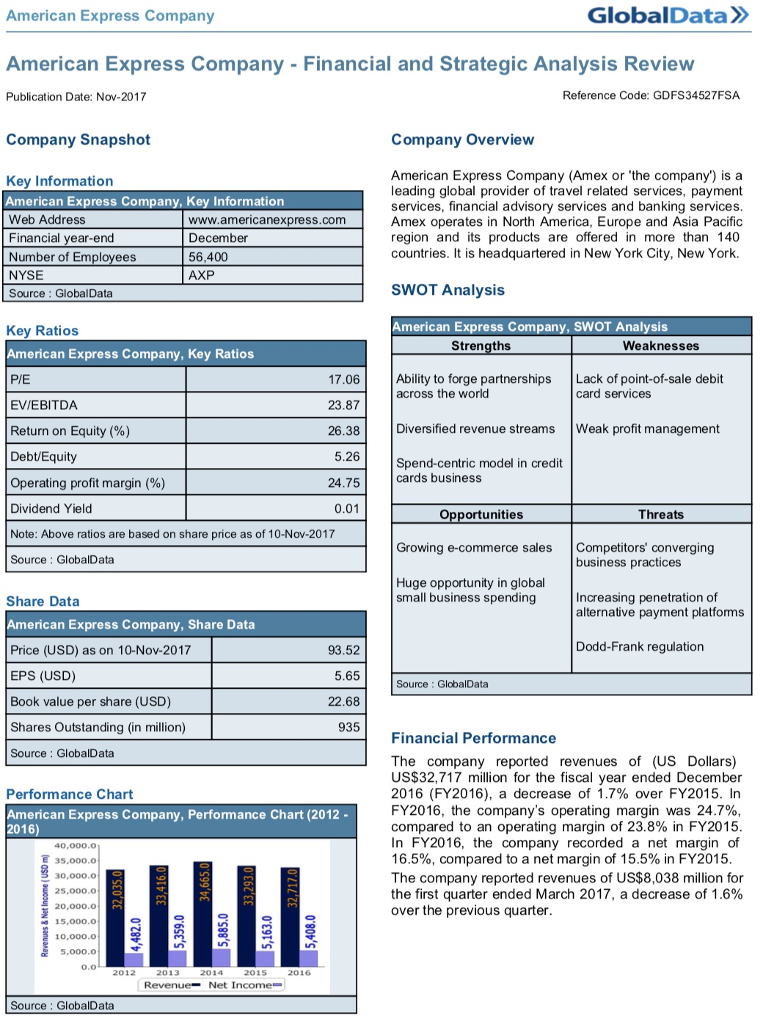

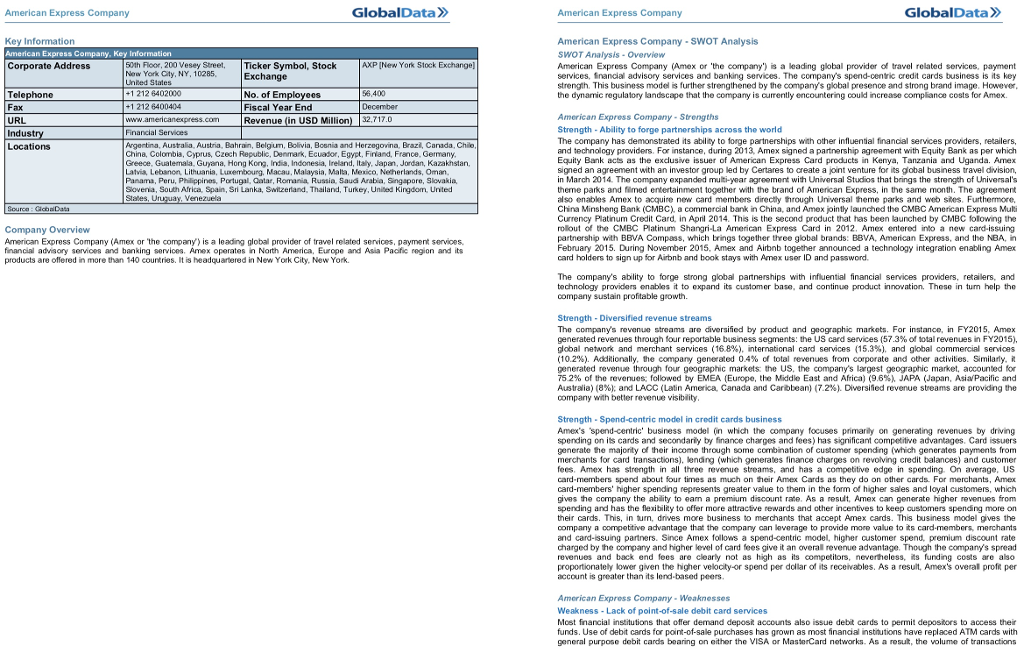

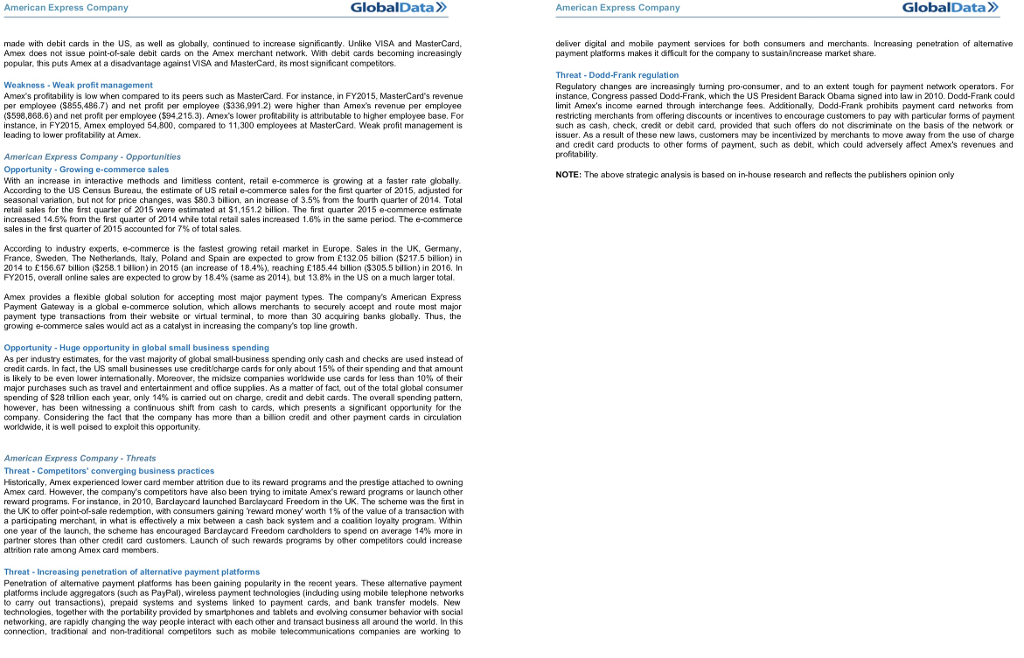

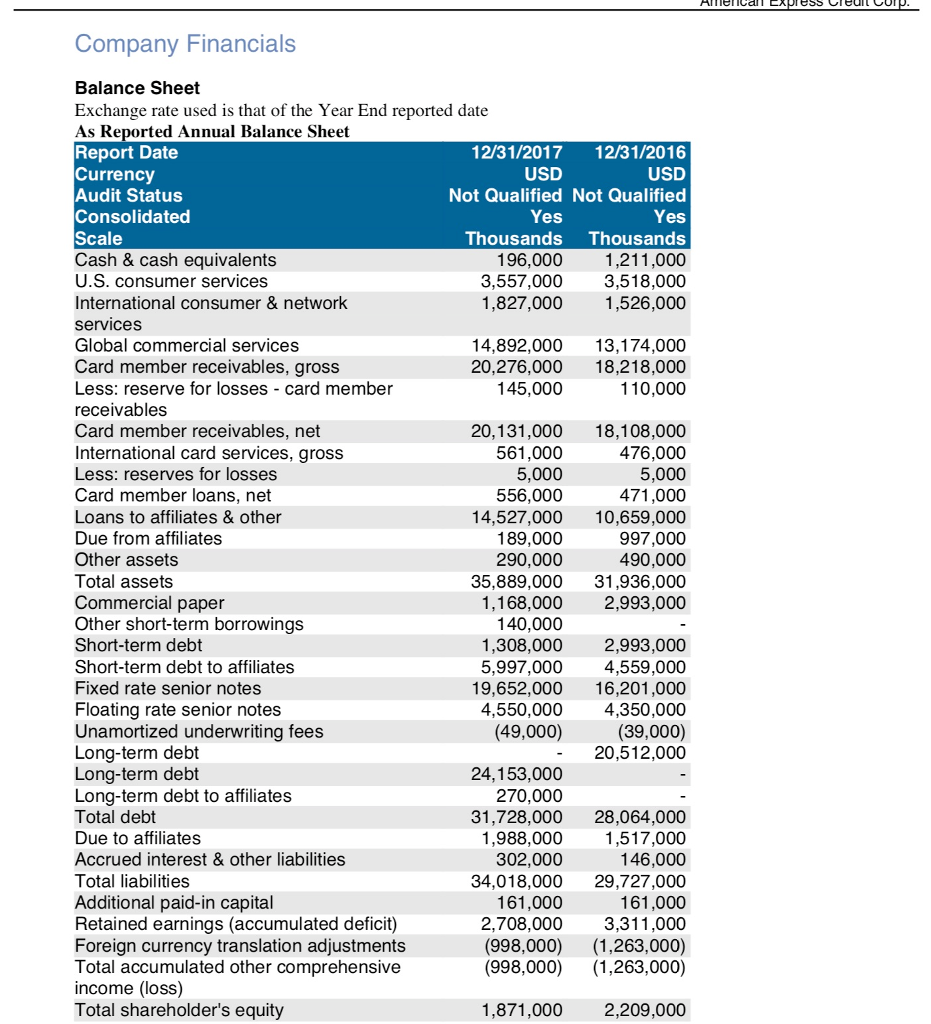

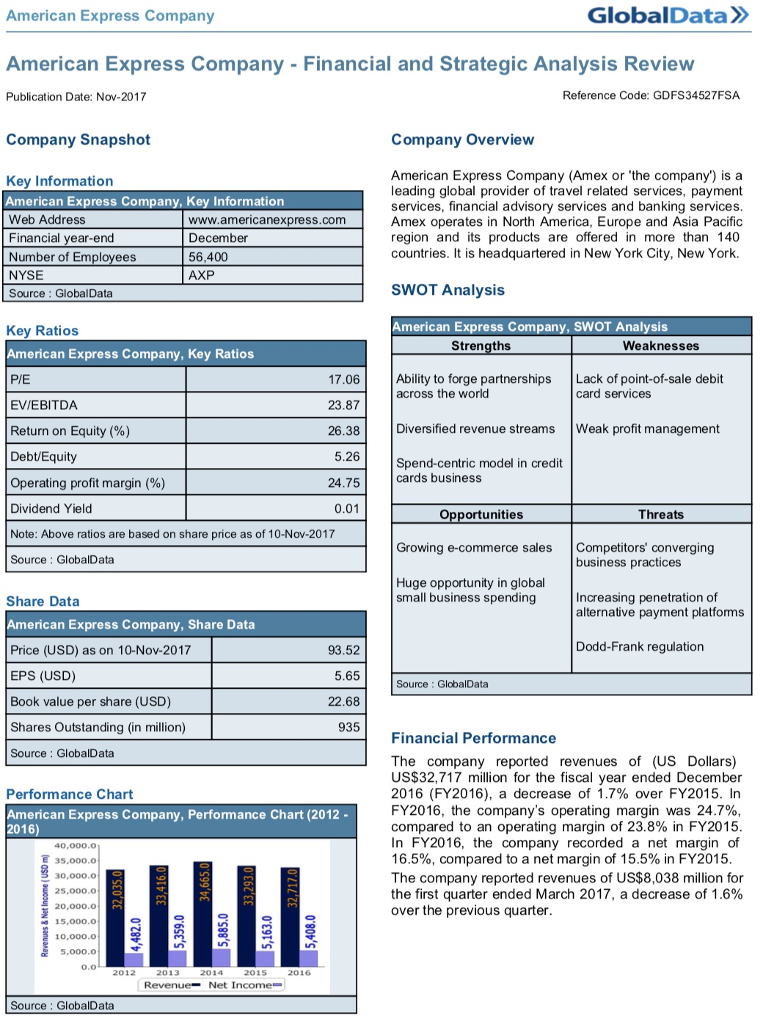

American Express Company GlobalData American Express Company - Financial and Strategic Analysis Review Publication Date: Nov-2017 Reference Code: GDFS34527FSA Company Snapshot Company Overview Key Information American Express Company, Key Information Web Address Financial year-end Number of Em NYSE Source: GlobalData www.americanexpress.com December 56,400 AXP American Express Company (Amex or 'the company') is a leading global provider of travel related services, payment services, financial advisory services and banking services. Amex operates in North America, Europe and Asia Pacifio region and its products are offered in more than 140 countries. It is headquartered in New York City, New York. ees SWOT Analysis American Express Company, SWOT Analysis Key Ratios American Express Company, Key Ratios Strengths Weaknesses 17.06Ability to forge partnerships Lack of point-of-sale debit across the world card services EVIEBITDA Return on Equity (%) Debt/Equity Operating profit margin (%) Dividend Yield Note: Above ratios are based on share price as of 10-Nov-2017 Source : GlobalData Diversified revenue streams Weak profit management 5.26 Spend-centric model in credit cards business Opportunities Threats Growing e-commerce sales Competitors' converging business practices Huge opportunity in global small business spending Increasing penetration of alternative payment platforms Share Data American Express Company, Share Data Price (USD) as on 10-Nov-2017 EPS (USD) Book value per share (USD) Shares Outstanding (in million) Source: GlobalData 93.52 Dodd-Frank regulation Source: GlobalData 22.68 935 Financial Performance The company reported revenues of (US Dollars) US$32,717 million for the fiscal year ended December 2016 (FY2016), a decrease of 1.7% over FY2015. In FY2016, the company's operating margin was 24.7% compared to an operating margin of 23.8% in FY2015 In FY2016, the company recorded a net margin of 16.5%, compared to a net margin of 15.5% in FY2015 The company reported revenues of US$8,038 million for the first quarter ended March 2017, a decrease of 1.6% over the previous quarter Performance Chart American Express Company, Performance Chart (2012- 40,000.0 5,000.0 5 30,000.0 25,000.0 20,000.o e 15,000.0 10,000.0 5,000.0 o.0 2012 2013 2015 2016 Revenue Net Income Source : GlobalData

Assess the financial performance and condition of the organization.

Assess the financial performance and condition of the organization.