Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Describe the various steps involved in structuring a 5-year inverse floating rate note. (25 marks) b. How does the risk of an inverse floater

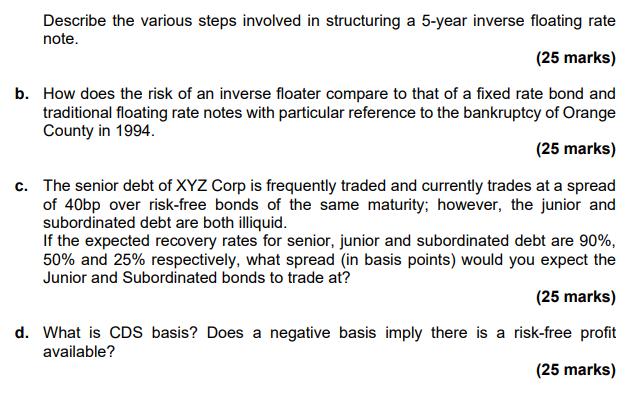

Describe the various steps involved in structuring a 5-year inverse floating rate note. (25 marks) b. How does the risk of an inverse floater compare to that of a fixed rate bond and traditional floating rate notes with particular reference to the bankruptcy of Orange County in 1994. (25 marks) c. The senior debt of XYZ Corp is frequently traded and currently trades at a spread of 40bp over risk-free bonds of the same maturity; however, the junior and subordinated debt are both illiquid. If the expected recovery rates for senior, junior and subordinated debt are 90%, 50% and 25% respectively, what spread (in basis points) would you expect the Junior and Subordinated bonds to trade at? (25 marks) d. What is CDS basis? Does a negative basis imply there is a risk-free profit available? (25 marks)

Step by Step Solution

★★★★★

3.23 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Structuring a 5year inverse floating rate note typically involves several steps including Determining the underlying reference rate The first step is to determine the reference rate that the inverse ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started