Answered step by step

Verified Expert Solution

Question

1 Approved Answer

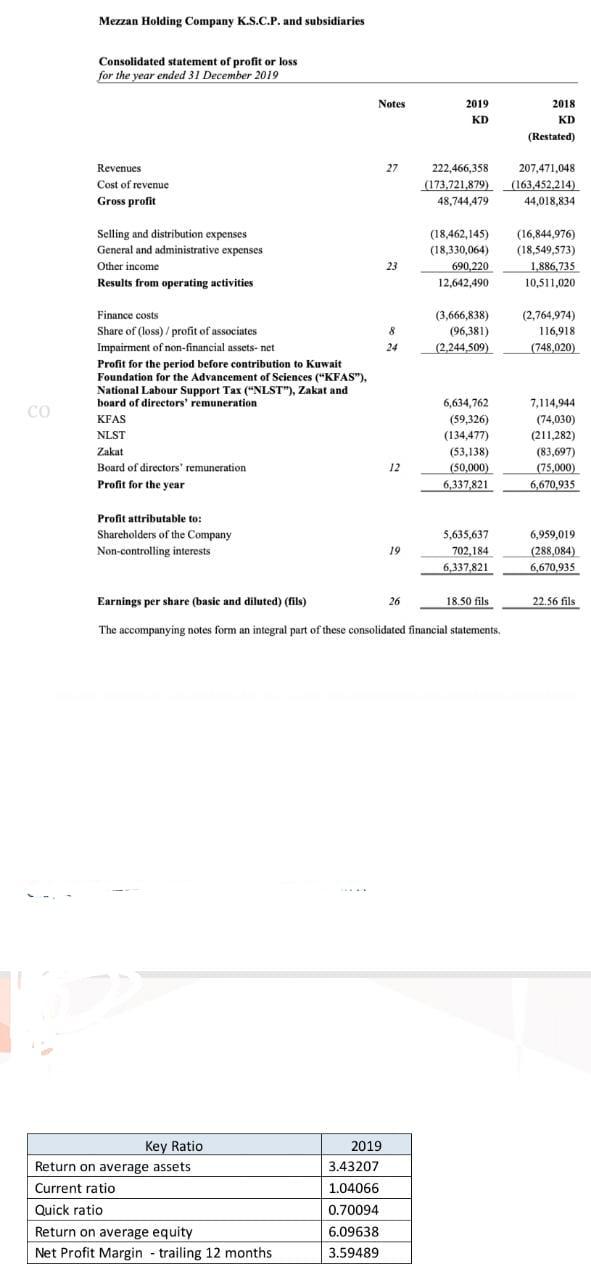

Describe the weaknesses and strength of the company's financial data. 2 Provide suggestions on how to improve company's performance Mezzan Holding Company K.S.C.P. and subsidiaries

Describe the weaknesses and strength of the company's financial data.

2 Provide suggestions on how to improve company's performance

Mezzan Holding Company K.S.C.P. and subsidiaries Consolidated statement of profit or loss for the year ended 31 December 2019 Notes 2019 2018 KD KD (Restated) Revenues Cost of revenue Gross profit 27 222,466,358 207,471,048 (173,721,879) (163,452,214) 48,744,479 44,018,834 Selling and distribution expenses (18,462,145) (16,844,976) General and administrative expenses (18,330,064) (18,549,573) Other income 23 690,220 1,886,735 Results from operating activities 12,642,490 10,511,020 Finance costs (3,666,838) (2,764,974) Share of (loss)/profit of associates 8 (96,381) 116,918 Impairment of non-financial assets-net 24 (2,244,509) (748,020) Profit for the period before contribution to Kuwait Foundation for the Advancement of Sciences ("KFAS"), CO National Labour Support Tax ("NLST"), Zakat and board of directors' remuneration KFAS NLST Zakat Board of directors' remuneration Profit for the year Profit attributable to: Shareholders of the Company Non-controlling interests 6,634,762 7,114,944 (59,326) (74,030) (134,477) (211,282) (53,138) (83,697) 12 (50,000) (75,000) 6,337,821 6,670,935 Earnings per share (basic and diluted) (fils) 5,635,637 6,959,019 19 702,184 (288,084) 6,337,821 6,670,935 26 18.50 fils 22.56 fils The accompanying notes form an integral part of these consolidated financial statements. Key Ratio 2019 Return on average assets 3.43207 Current ratio 1.04066 Quick ratio 0.70094 Return on average equity 6.09638 Net Profit Margin - trailing 12 months 3.59489

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided financial data here are the weaknesses and strengths of the companys financial situation Weaknesses 1 Decreasing Revenues The companys revenues decreased from KD 207471048 in 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started