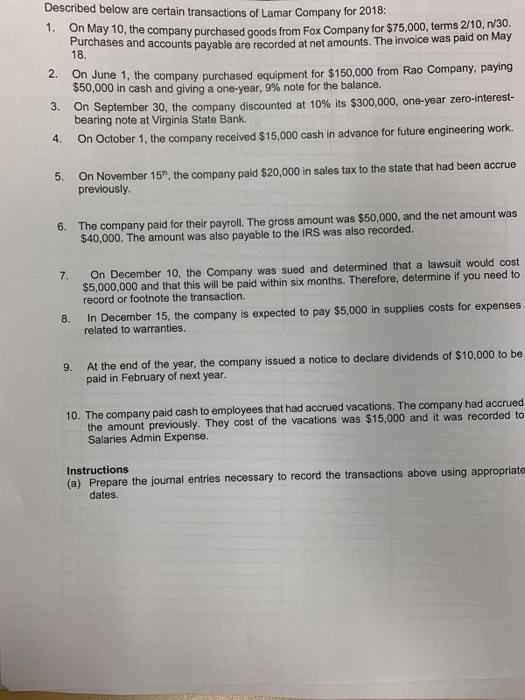

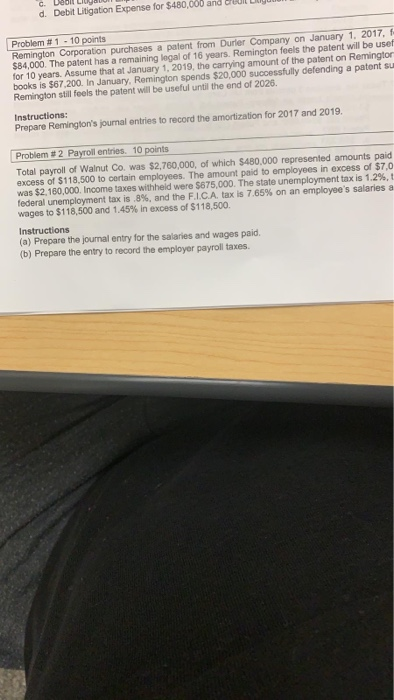

Described below are certain transactions of Lamar Company for 2018: 1. On May 10, the company purchased goods from Fox Company for $75,000, terms Purchases and accounts payable are recorded at net amounts. The invoice was pa 2. On June 1, th 3. On September 30, the company 4. O e company purchased equipment for $150,000 from Rao Company, paying discounted at 10% its $300,000, one-year zero-interest n October 1, the company received $15,000 cash in advance for future engineering work. On November 15, the company paid $20,000 in sales tax to the state that had been accrue 18. $50,000 in cash and giving a one-year, 9% note for the balance. bearing note at Virginia State Bank 5. previously. 6. The company paid for their payroll. The gross amount was $50,000, and the net amount was 7. On December 10, the Company was sued and determined that a lawsuit would cost 8. In December 15, the company is expected to pay $5,000 in supplies costs for expenses $40,000. The amount was also payable to the IRS was also recorded. $5,000,000 and that this will be paid within six months. Therefore, determine if you need to record or footnote the transaction. related to warranties. At the end of the year, the company issued a notice to declare dividends of $10,000 to be paid in February of next year 9. 10. The company paid cash to employees that had accrued vacations. The company had accrued the amount previously. They cost of the vacations was $15,000 and it was recorded to Salaries Admin Expense. Instructions (a) Prepare the journal entries necessary to record the transactions above using appropriate dates C. d. Debit Litigation Expense for $480,000 and reUll L Problem # 1-10 points gton Corporation purchases a patent from Durler Company on January 1. 2017, f $84,000. The patent has a remaining legal of 16 years. Remington feels the patent will be uset for 10 years. Assume that at January 1, 2019, the carrying amount of the patent on Remingtor books is $67,200. In January, Remington spends $20,000 successfully defending a patent su Remington still foels the patent will be useful until the end of 2026. Instructions: Prepare Remington's journal entries to record the amortization for 2017 and 2019. Problem # 2 Payroll entres, 10 points Total payroll of Walnut Co. was $2,760,000, of which $480,000 represented amounts paid excess of $118,500 to certain employees. The amount paid to employees in excess of $7,0 was $2,160,000. Income taxes withheld were S675.000. The state unemployment tax is 1.2%, t federal unemployment tax is .8%, and the F.1CA, tax is 7.65% on an employee's salaries a wages to $118,500 and 1.45% in excess of $118,500. Instructions (a) Prepare the journal entry for the salaries and wages paid (b) Prepare the entry to record the employer payroll taxes