Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Description: In this Case Study, students will take on the role of a credit counselor (Maitha) to assist a borrower who finds himself in serious

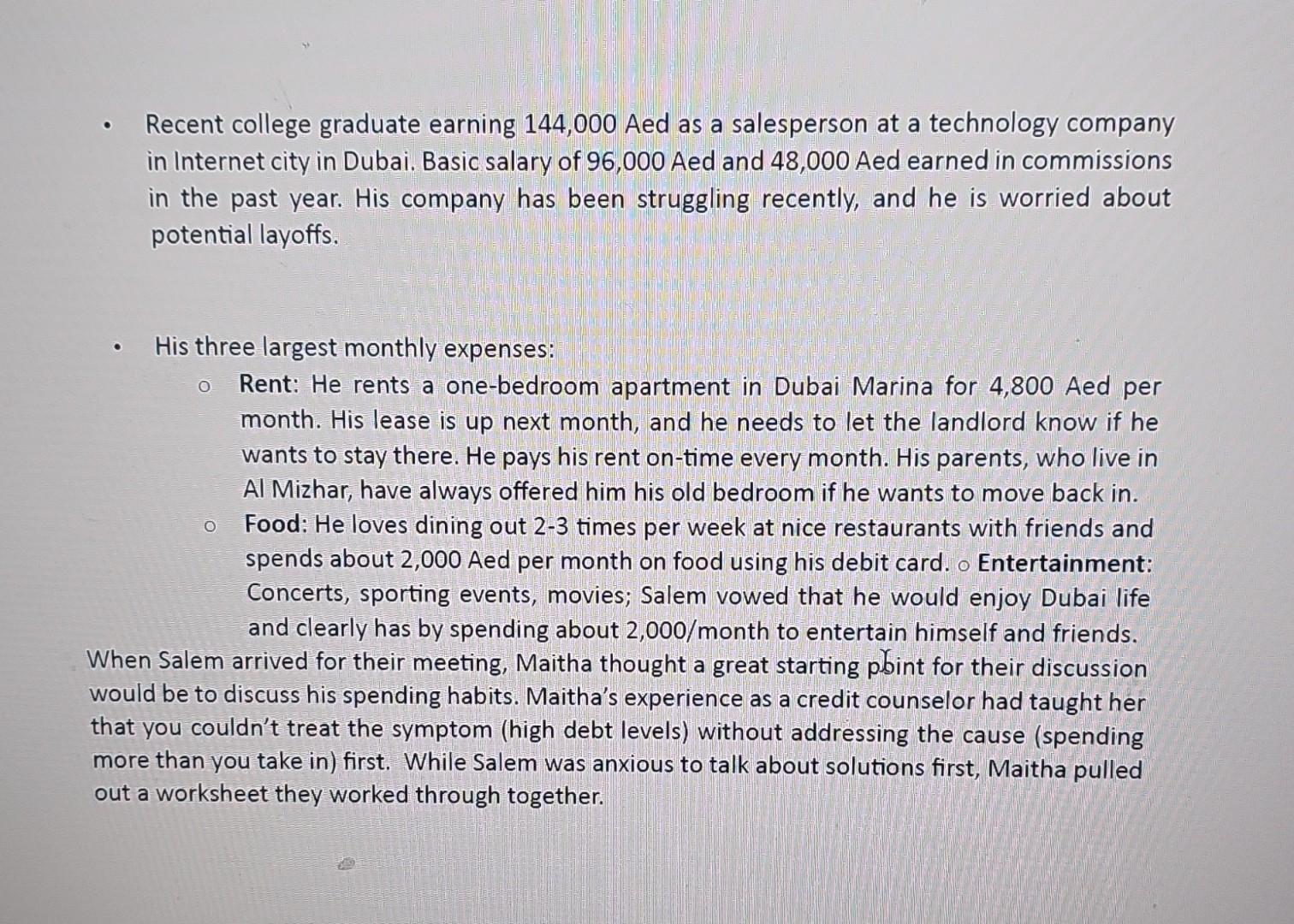

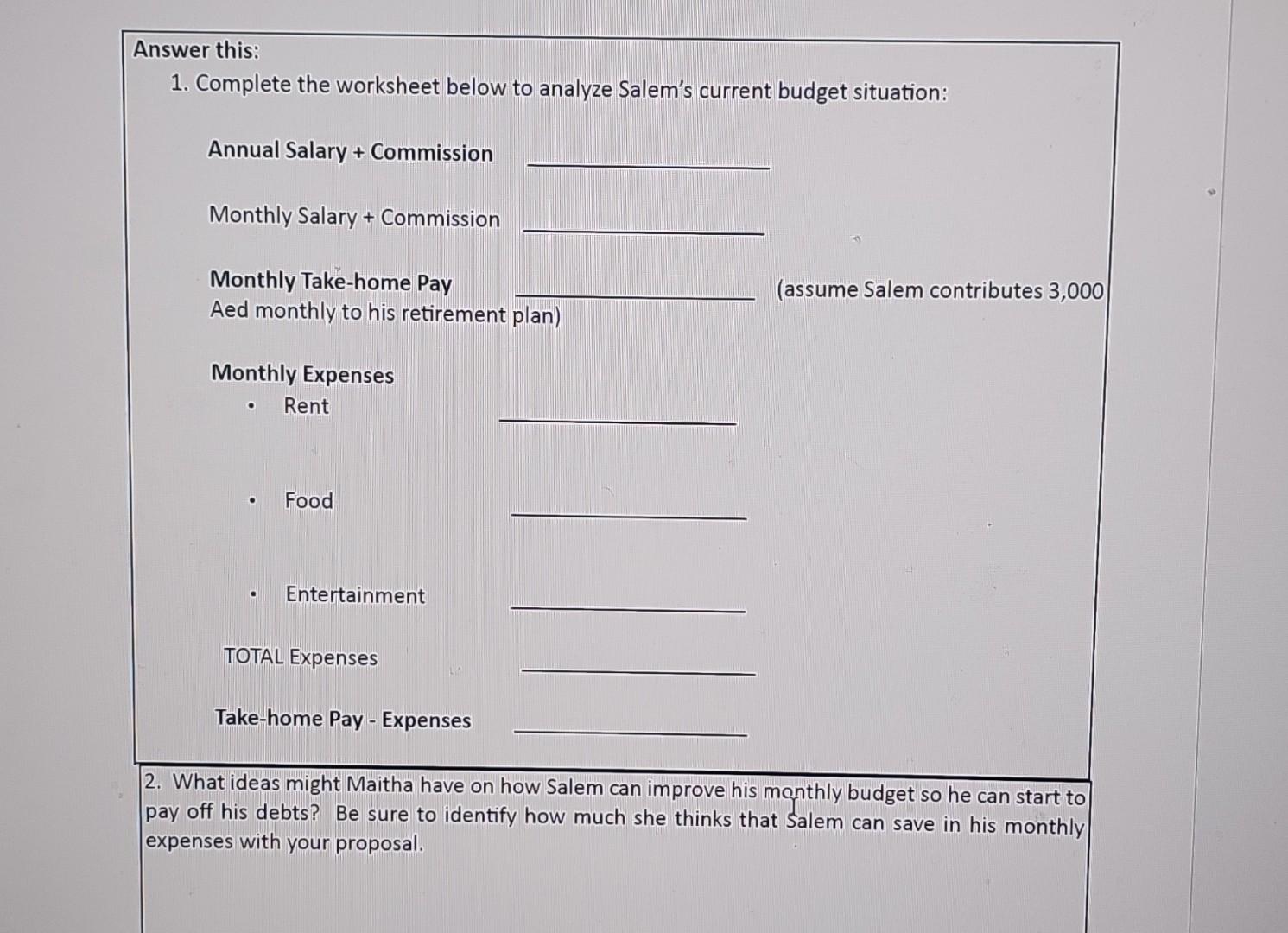

Description: In this Case Study, students will take on the role of a credit counselor (Maitha) to assist a borrower who finds himself in serious financial distress (Salem). Students should answer all questions ( 1 to 6). Students should work in group to collect information about Salem situation to advise him appropriately on how to get relieved from his debt burden. Help me with My Debt Burden Maitha, a credit counselor, has been approached by Salem, who is facing his own financial storm with debts mounting and no clear solution in sight. Salem is seeking Maitha's help to relieve him from his debt burden. Maitha reviewed her notes summarizing Salem's current situation: inswer this: 1. Complete the worksheet below to analyze Salem's current budget situation: Annual Salary + Commission Monthly Salary + Commission Monthly Take-home Pay (assume Salem contributes 3,000 Aed monthly to his retirement plan) Monthly Expenses - Rent - Food - Entertainment TOTAL Expenses Take-home Pay - Expenses 2. What ideas might Maitha have on how Salem can improve his monthly budget so he can start to pay off his debts? Be sure to identify how much she thinks that Salem can save in his monthly expenses with your proposal. - Recent college graduate earning 144,000 Aed as a salesperson at a technology company in Internet city in Dubai. Basic salary of 96,000 Aed and 48,000 Aed earned in commissions in the past year. His company has been struggling recently, and he is worried about potential layoffs. - His three largest monthly expenses: - Rent: He rents a one-bedroom apartment in Dubai Marina for 4,800 Aed per month. His lease is up next month, and he needs to let the landlord know if he wants to stay there. He pays his rent on-time every month. His parents, who live in Al Mizhar, have always offered him his old bedroom if he wants to move back in. - Food: He loves dining out 2-3 times per week at nice restaurants with friends and spends about 2,000 Aed per month on food using his debit card. o Entertainment: Concerts, sporting events, movies; Salem vowed that he would enjoy Dubai life and clearly has by spending about 2,000/month to entertain himself and friends. When Salem arrived for their meeting, Maitha thought a great starting phint for their discussion would be to discuss his spending habits. Maitha's experience as a credit counselor had taught her that you couldn't treat the symptom (high debt levels) without addressing the cause (spending more than you take in) first. While Salem was anxious to talk about solutions first, Maitha pulled out a worksheet they worked through together

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started