Answered step by step

Verified Expert Solution

Question

1 Approved Answer

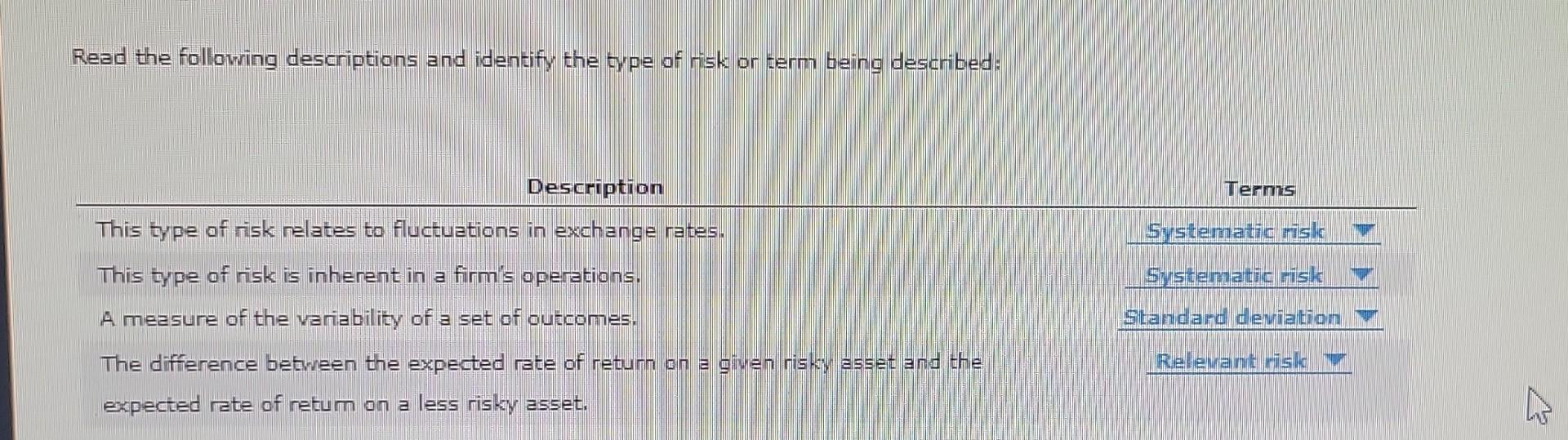

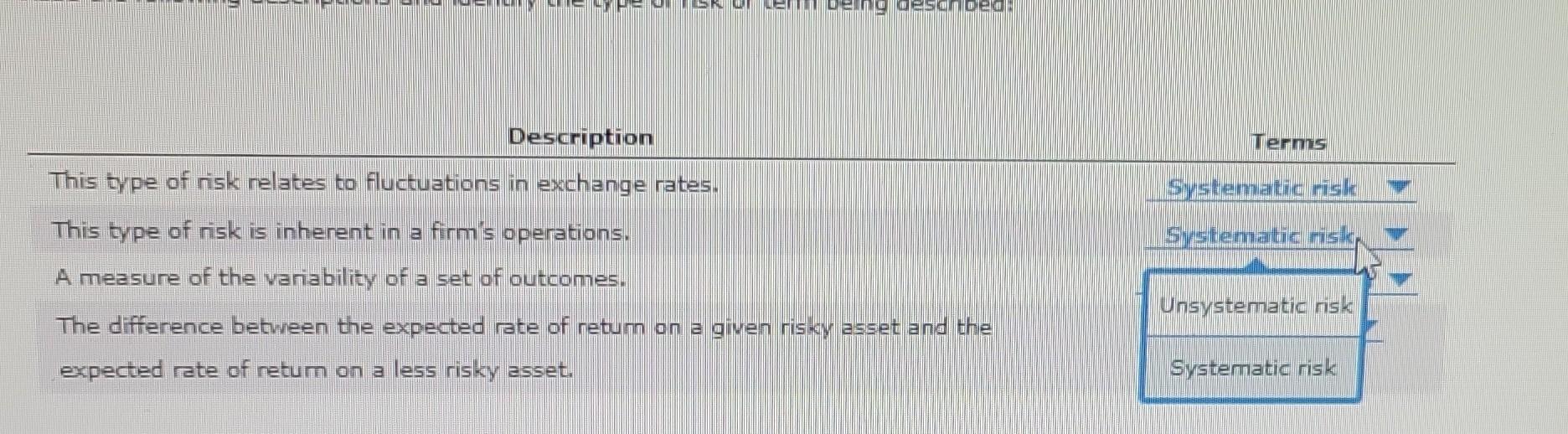

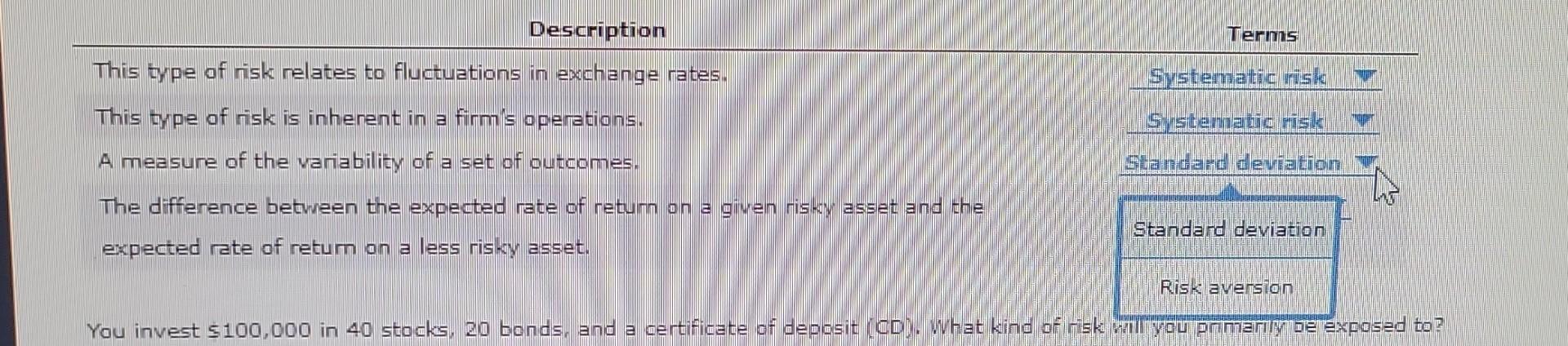

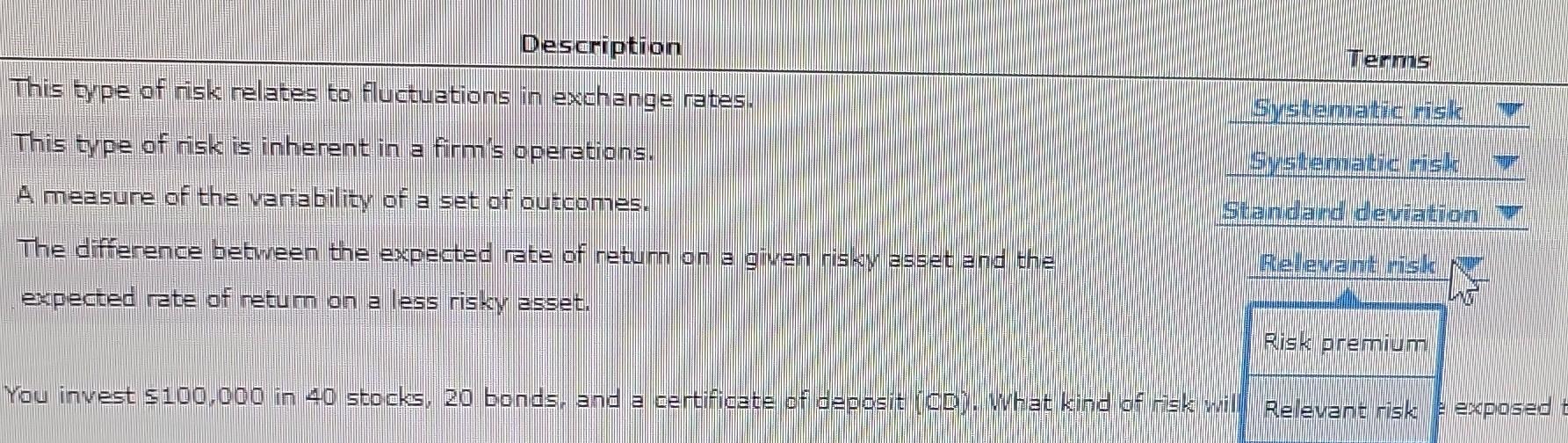

Description Terms This type of risk relates to fluctuations in exchange rates. This type of risk is inherent in a firm's operations. A measure of

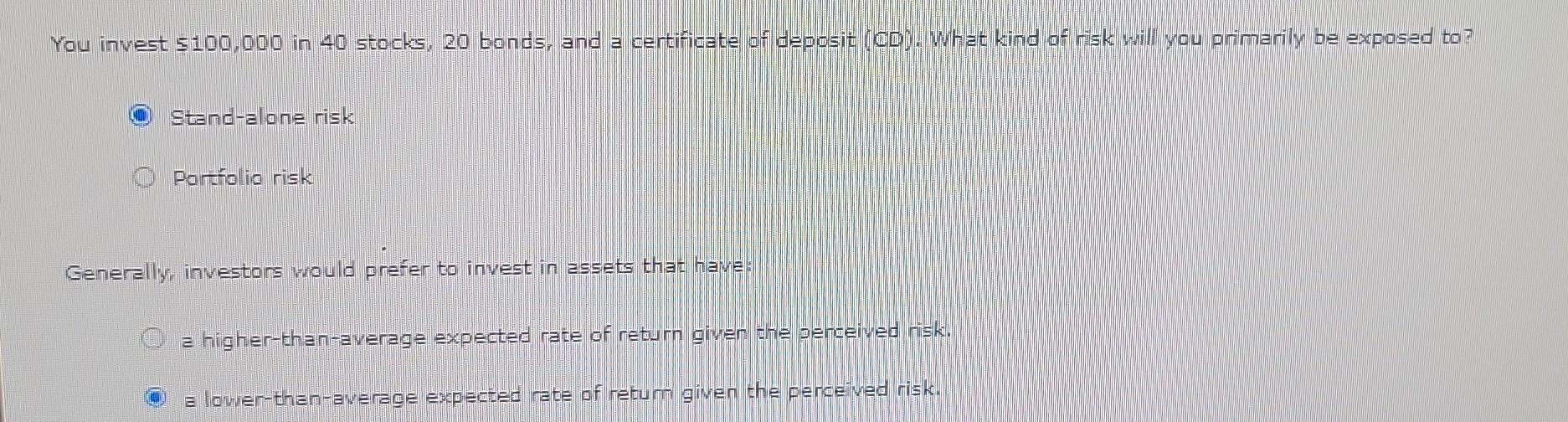

Description Terms This type of risk relates to fluctuations in exchange rates. This type of risk is inherent in a firm's operations. A measure of the variability of a set of outcomes. The difference between the expected rate of return on a given risky asset and the expected rate of return on a less risky asset. Read the following descriptions and identify the type of risk or term being described: Stend-alone risk Parnnolio risk Generelly, investors would prefer to invest in assets that, have: a higher-than-average expected rate of return giver grne penceived risk. a lower-then-averrage expected rete of refurm given the perceived risk. This type of risk relates to fluctuations in exchange rates. This type of risk is inherent in a firm's operetions. Sysitematic rislic Sisitementic risk A measure of the variability of a set of outcomes. Standard devilation The diffierence between the expected rate of neturn on a given risky asset and the expected rete of returm on a less risky asset. Risk premium Description Terms This type of risk relates to fluctuations in exchange rates. This type of risk is inherent in a firm's operations. A measure of the variability of a set of outcomes. The difference between the expected rate of return on a given risky asset and the expected rate of return on a less risky asset. You invest $100,000 in 40 stocks, 20 bonds, and a certificate of deposit (CD). What kind of risk hillyouprimariy ale exposed to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started