Question

Description: You recently had a client meeting with Bill & Jane Smith and gathered the attached information from your time together. The big question that

Description:

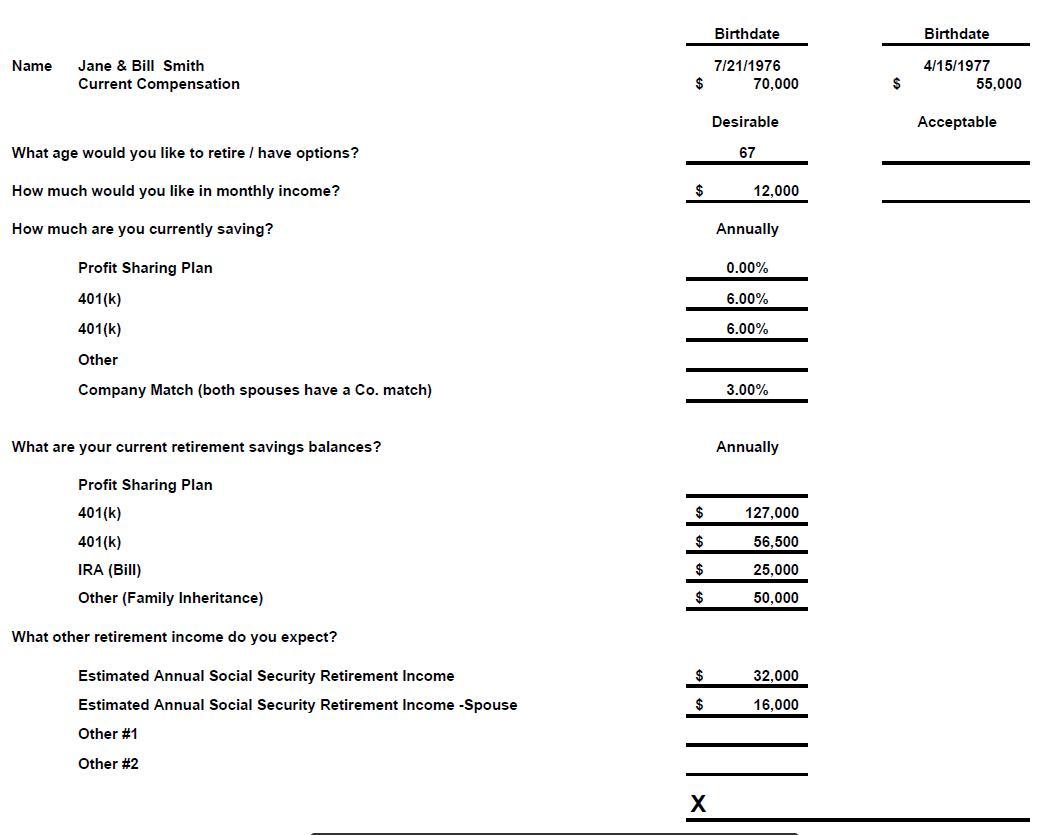

You recently had a client meeting with Bill & Jane Smith and gathered the attached information from your time together. The big question that your clients had was; Will we have enough to retire and how much is enough?

Your task is to be able to meet with them again and report back.

Note:

You are to assume a 4% portfolio yield during the distribution period, (retirement).

You gathered that during retirement they would prefer never to use capital, such that they can leave an inheritance to their children.

Q.1 How much will they need at retirement in their retirement portfolio?

Q.2 what required investment rate of return will they need to achieve this goal.

Q3 Is this realistic, how could they improve their chances for reaching their goal?

- Description:

You recently had a client meeting with Bill & Jane Smith and gathered the attached information from your time together. The big question that your clients had was; Will we have enough to retire and how much is enough?

Your task is to be able to meet with them again and report back.

Note:

You are to assume a 4% portfolio yield during the distribution period, (retirement).

You gathered that during retirement they would prefer never to use capital, such that they can leave an inheritance to their children.

Q.1 How much will they need at retirement in their retirement portfolio?

Q.2 what required investment rate of return will they need to achieve this goal.

Q3 Is this realistic, how could they improve their chances for reaching their goal?

Name Jane & Bill Smith Current Compensation What age would you like to retire / have options? How much would you like in monthly income? How much are you currently saving? Profit Sharing Plan 401(k) 401(k) Other Company Match (both spouses have a Co. match) What are your current retirement savings balances? Profit Sharing Plan 401(k) 401(k) IRA (Bill) Other (Family Inheritance) What other retirement income do you expect? Estimated Annual Social Security Retirement Income Estimated Annual Social Security Retirement Income -Spouse Other #1 Other #2 $ $ $ $ $ $ $ $ X Birthdate 7/21/1976 70,000 Desirable 67 12,000 Annually 0.00% 6.00% 6.00% 3.00% Annually 127,000 56,500 25,000 50,000 32,000 16,000 $ Birthdate 4/15/1977 55,000 Acceptable

Step by Step Solution

3.57 Rating (178 Votes )

There are 3 Steps involved in it

Step: 1

Q1 How much will they need at retirement in their retirement portfolio To calculate how much Bill Jane Smith will need at retirement we need to determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started