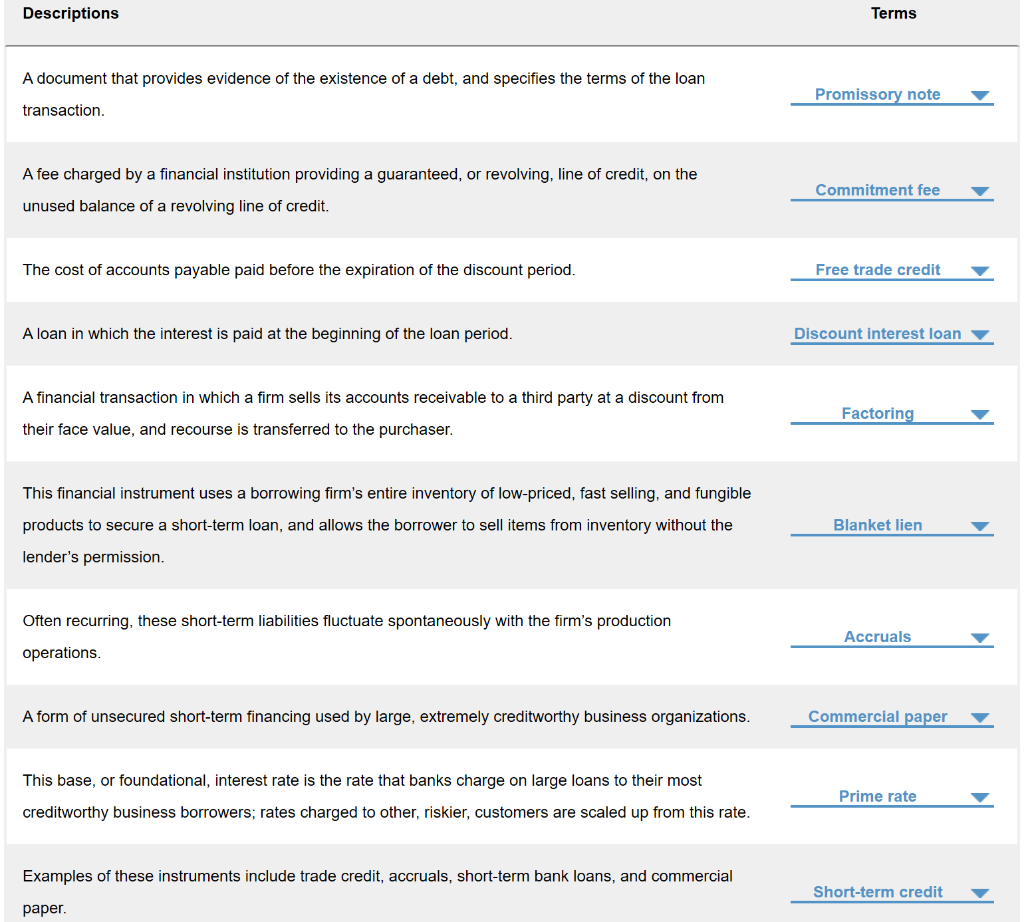

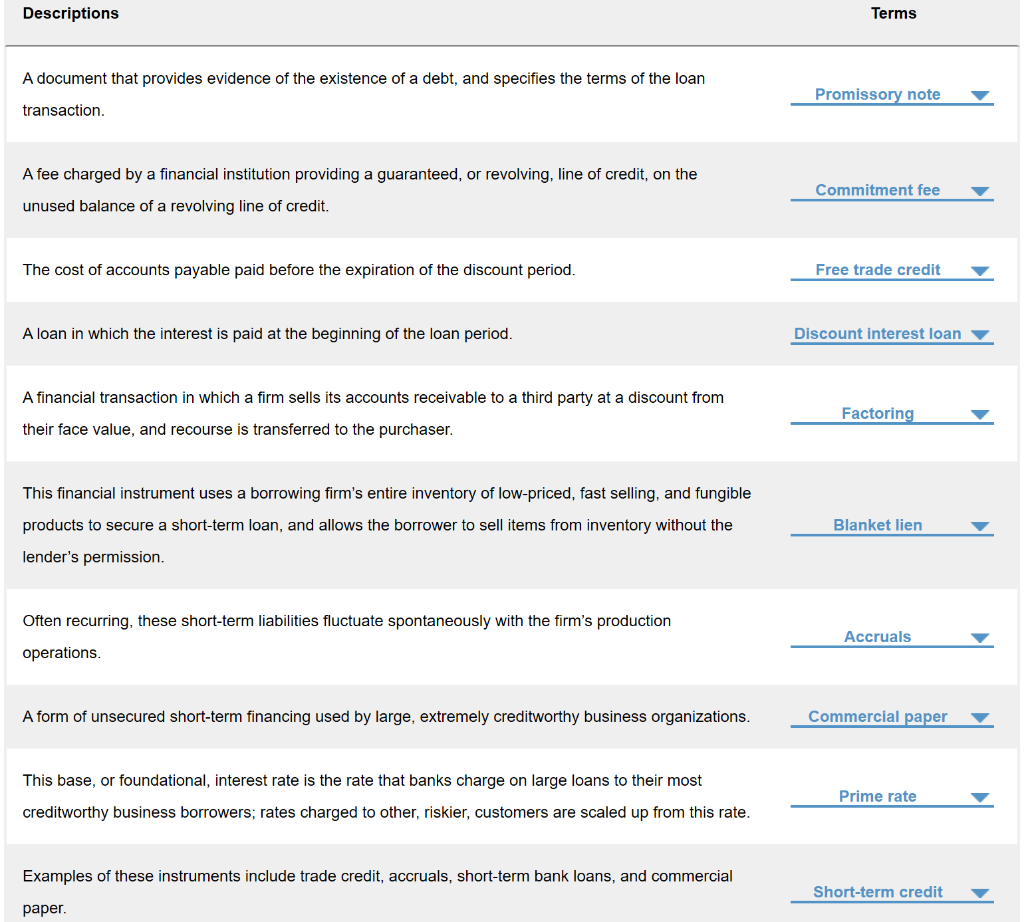

Descriptions Terms A document that provides evidence of the existence of a debt, and specifies the terms of the loan Promissory note transaction. A fee charged by a financial institution providing a guaranteed, or revolving, line of credit, on the unused balance of a revolving line of credit. Commitment fee The cost of accounts payable paid before the expiration of the discount period. Free trade credit A loan in which the interest is paid at the beginning of the loan period. Discount interest loan A financial transaction in which a firm sells its accounts receivable to a third party at a discount from Factoring their face value, and recourse is transferred to the purchaser. This financial instrument uses a borrowing firm's entire inventory of low-priced, fast selling, and fungible products to secure a short-term loan, and allows the borrower to sell items from inventory without the lender's permission. Blanket lien Often recurring, these short-term liabilities fluctuate spontaneously with the firm's production Accruals operations. A form of unsecured short-term financing used by large, extremely creditworthy business organizations. Commercial paper This base, or foundational, interest rate is the rate that banks charge on large loans to their most Prime rate creditworthy business borrowers; rates charged to other, riskier, customers are scaled up from this rate. Examples of these instruments include trade credit, accruals, short-term bank loans, and commercial Short-term credit paper. Descriptions Terms A document that provides evidence of the existence of a debt, and specifies the terms of the loan Promissory note transaction. A fee charged by a financial institution providing a guaranteed, or revolving, line of credit, on the unused balance of a revolving line of credit. Commitment fee The cost of accounts payable paid before the expiration of the discount period. Free trade credit A loan in which the interest is paid at the beginning of the loan period. Discount interest loan A financial transaction in which a firm sells its accounts receivable to a third party at a discount from Factoring their face value, and recourse is transferred to the purchaser. This financial instrument uses a borrowing firm's entire inventory of low-priced, fast selling, and fungible products to secure a short-term loan, and allows the borrower to sell items from inventory without the lender's permission. Blanket lien Often recurring, these short-term liabilities fluctuate spontaneously with the firm's production Accruals operations. A form of unsecured short-term financing used by large, extremely creditworthy business organizations. Commercial paper This base, or foundational, interest rate is the rate that banks charge on large loans to their most Prime rate creditworthy business borrowers; rates charged to other, riskier, customers are scaled up from this rate. Examples of these instruments include trade credit, accruals, short-term bank loans, and commercial Short-term credit paper