Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Desert Rose Cosmetics, Inc. (DRC) is a U.S. multinational company with the following debt and equity components in its consolidated capital section. DRC evaluates

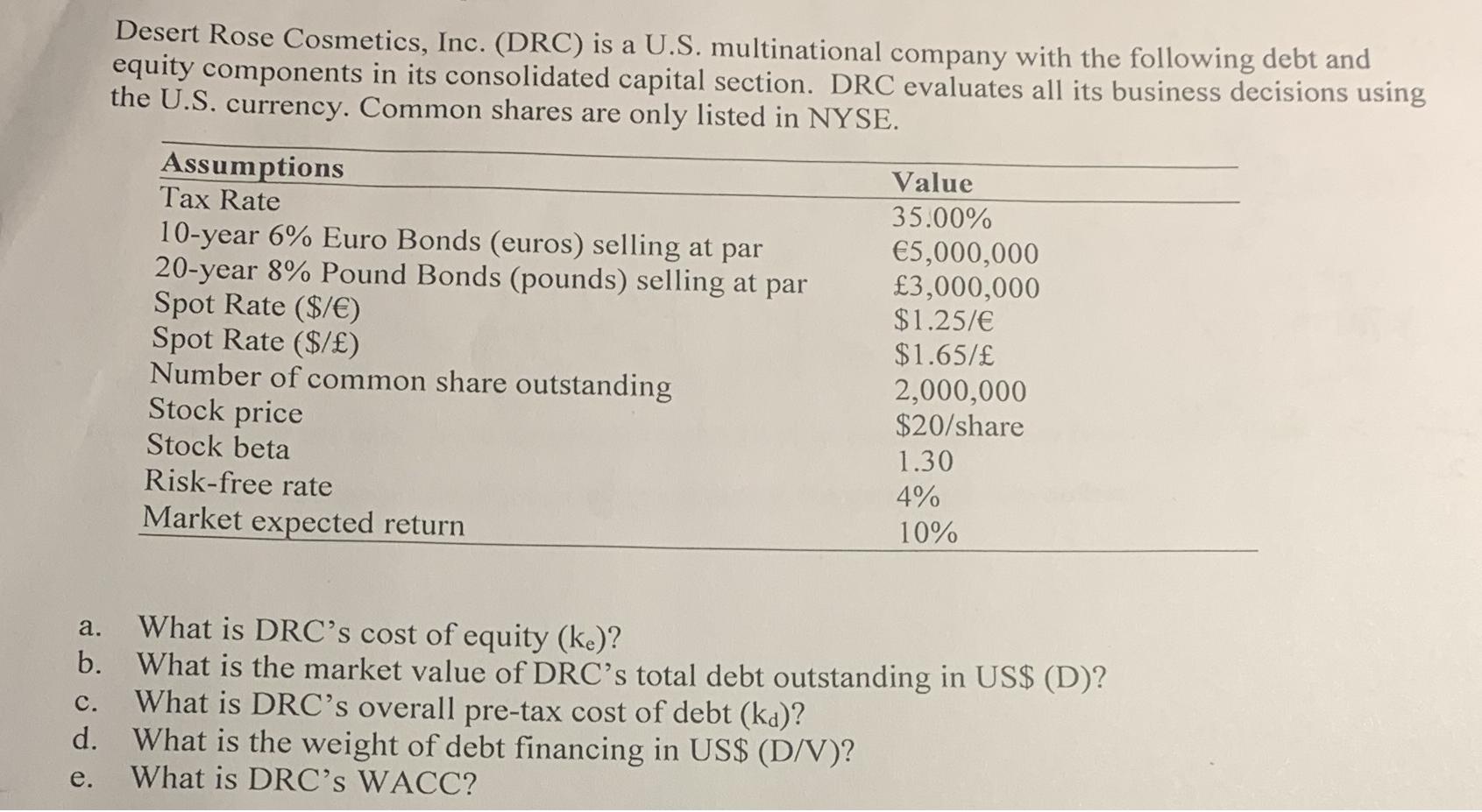

Desert Rose Cosmetics, Inc. (DRC) is a U.S. multinational company with the following debt and equity components in its consolidated capital section. DRC evaluates all its business decisions using the U.S. currency. Common shares are only listed in NYSE. Assumptions Tax Rate 10-year 6% Euro Bonds (euros) selling at par 20-year 8% Pound Bonds (pounds) selling at par Spot Rate ($/) Spot Rate ($/) Number of common share outstanding Stock price Stock beta Risk-free rate Market expected return Value 35.00% 5,000,000 3,000,000 $1.25/ $1.65/ 2,000,000 $20/share 1.30 4% 10% a. What is DRC's cost of equity (ke)? C. What is DRC's overall pre-tax cost of debt (ka)? d. b. What is the market value of DRC's total debt outstanding in US$ (D)? What is the weight of debt financing in US$ (D/V)? e. What is DRC's WACC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets break down each part of the analysis for Desert Rose Cosmetics Inc DRC a Cost of Equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started