Question

Deshmuk Ltd provides you with the following figures: The company has undistributed reserves of Rs.6,00,000. Deshmuk Ltd requires Rs.4,00,000 for expansion. This amount will earn

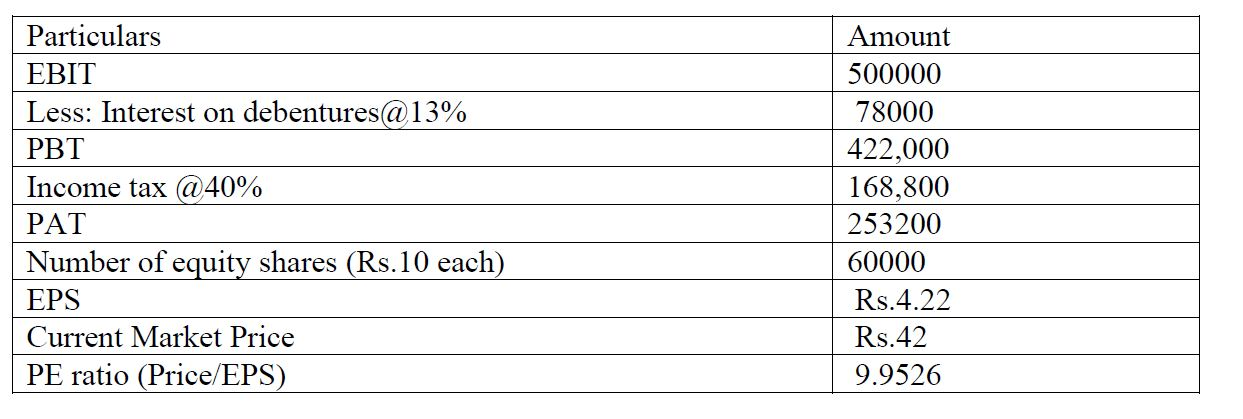

Deshmuk Ltd provides you with the following figures:  The company has undistributed reserves of Rs.6,00,000. Deshmuk Ltd requires Rs.4,00,000 for expansion. This amount will earn at the same rate as funds already employed. You are informed that a Debt/(Debt + Equity) higher than 35% will push the P/E ratio down to 8% and raise the interest rate on additional borrowings to 15%.You are required to ascertain the EPS and Probable Market Price of the Share: a) If the additional Funds are raised through debt financing b) If the additional Funds are raised through equity financing

The company has undistributed reserves of Rs.6,00,000. Deshmuk Ltd requires Rs.4,00,000 for expansion. This amount will earn at the same rate as funds already employed. You are informed that a Debt/(Debt + Equity) higher than 35% will push the P/E ratio down to 8% and raise the interest rate on additional borrowings to 15%.You are required to ascertain the EPS and Probable Market Price of the Share: a) If the additional Funds are raised through debt financing b) If the additional Funds are raised through equity financing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started