Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Design Layout References Mailings A A Aav abe X X AY A Concept Check Questions - Chapter 7 Review View Search in Document Share^

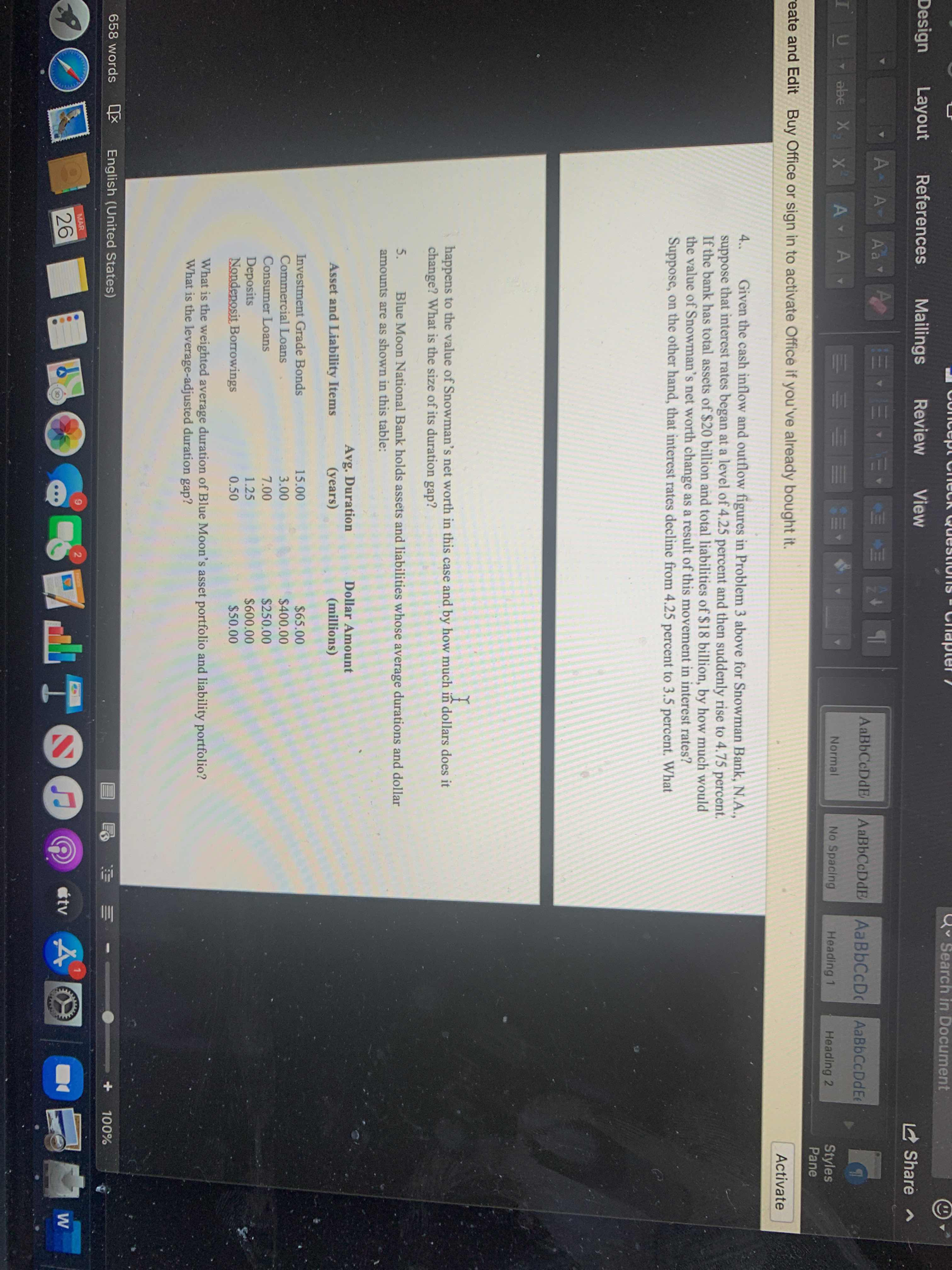

Design Layout References Mailings A A Aav abe X X AY A Concept Check Questions - Chapter 7 Review View Search in Document Share^ AaBbCcDdE Normal AaBbCcDdE AaBbCcDd No Spacing AaBbCcDdEe Heading 1 Heading 2 Styles Pane Activate reate and Edit Buy Office or sign in to activate Office if you've already bought it. 4.. Given the cash inflow and outflow figures in Problem 3 above for Snowman Bank, N.A., suppose that interest rates began at a level of 4.25 percent and then suddenly rise to 4.75 percent. If the bank has total assets of $20 billion and total liabilities of $18 billion, by how much would the value of Snowman's net worth change as a result of this movement in interest rates? Suppose, on the other hand, that interest rates decline from 4.25 percent to 3.5 percent. What 658 words IX I happens to the value of Snowman's net worth in this case and by how much in dollars does it change? What is the size of its duration gap? 5. Blue Moon National Bank holds assets and liabilities whose average durations and dollar amounts are as shown in this table: Asset and Liability Items Investment Grade Bonds Commercial Loans Consumer Loans Deposits Nondeposit Borrowings Avg. Duration (years) Dollar Amount (millions) 15.00 $65.00 3.00 $400.00 7.00 $250.00 1.25 $600.00 0.50 $50.00 What is the weighted average duration of Blue Moon's asset portfolio and liability portfolio? What is the leverage-adjusted duration gap? English (United States) MAR 26 100% TOG tv A W

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started