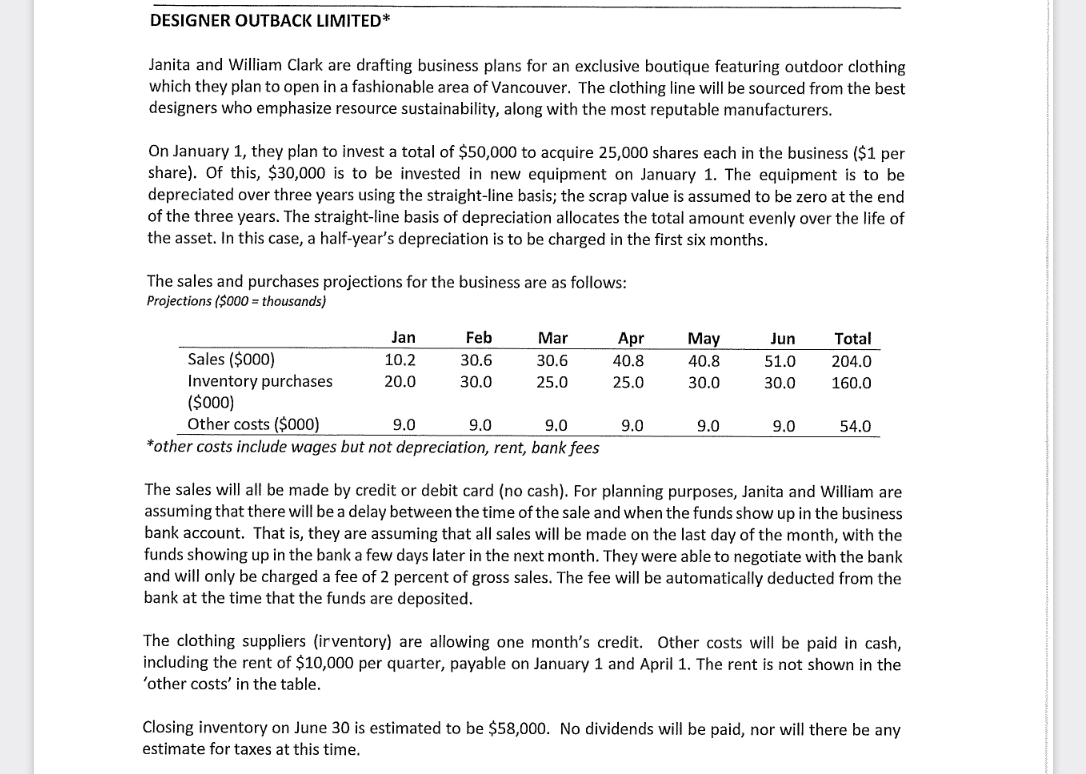

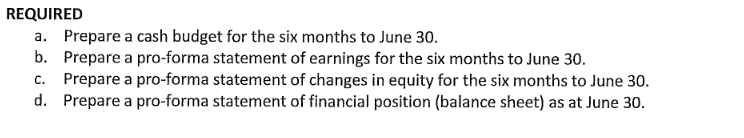

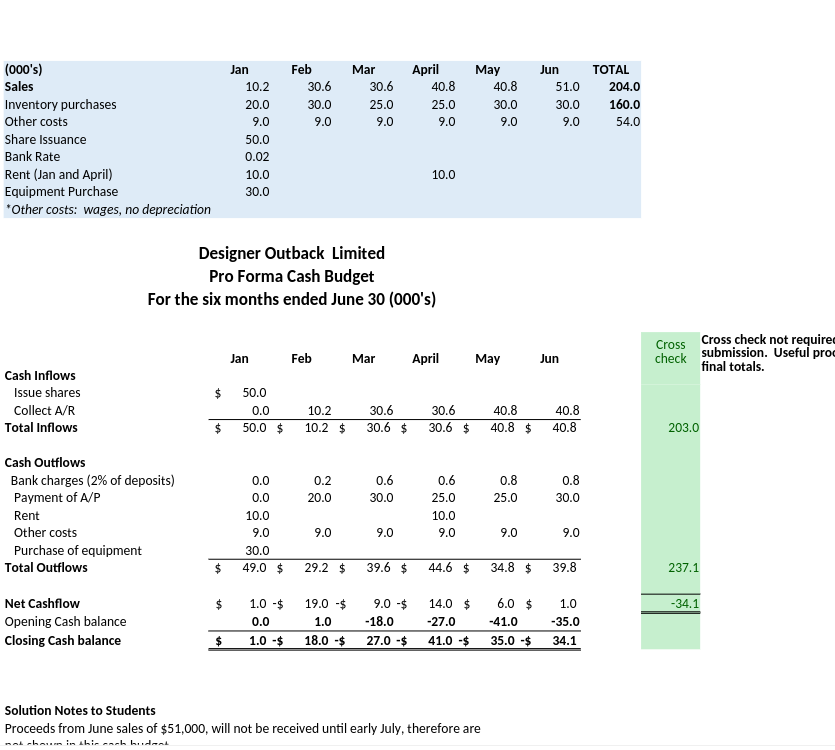

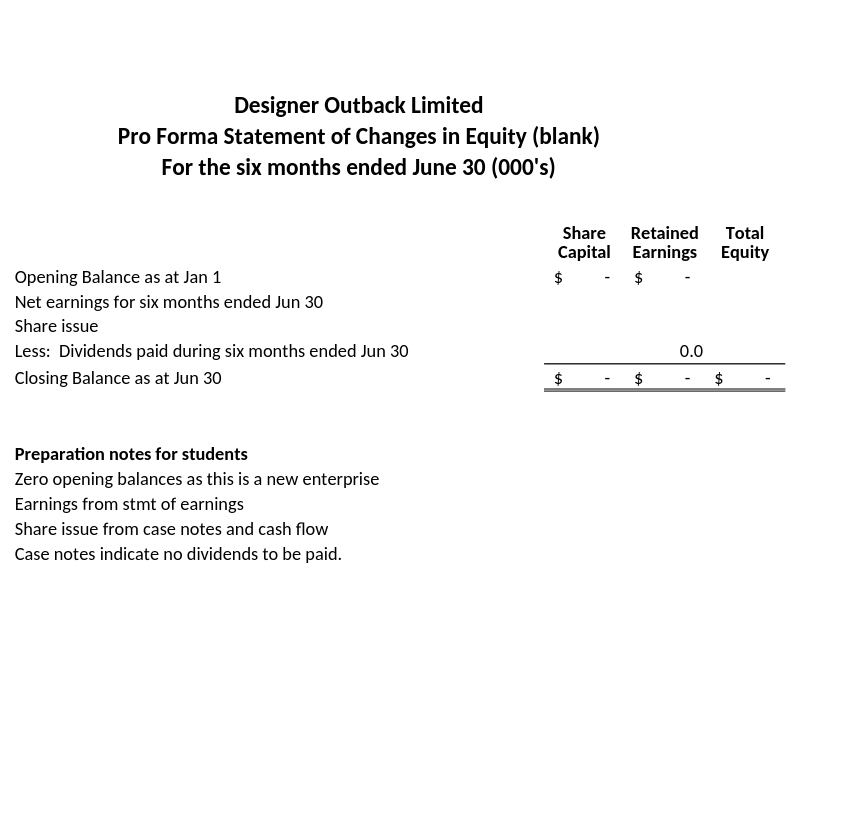

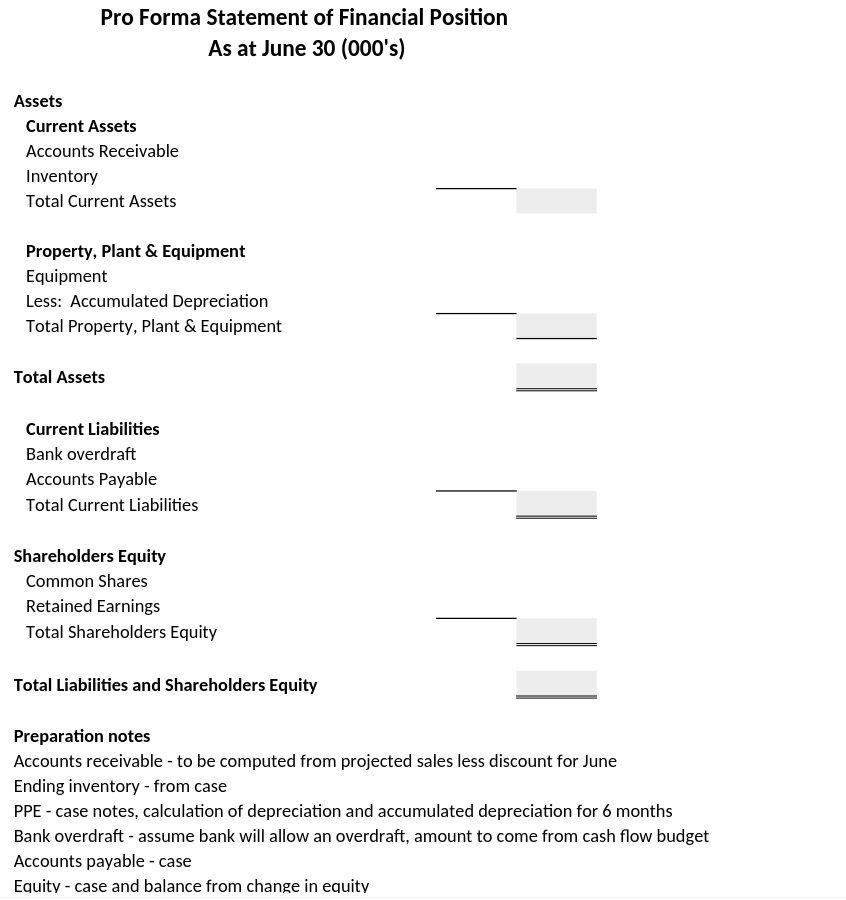

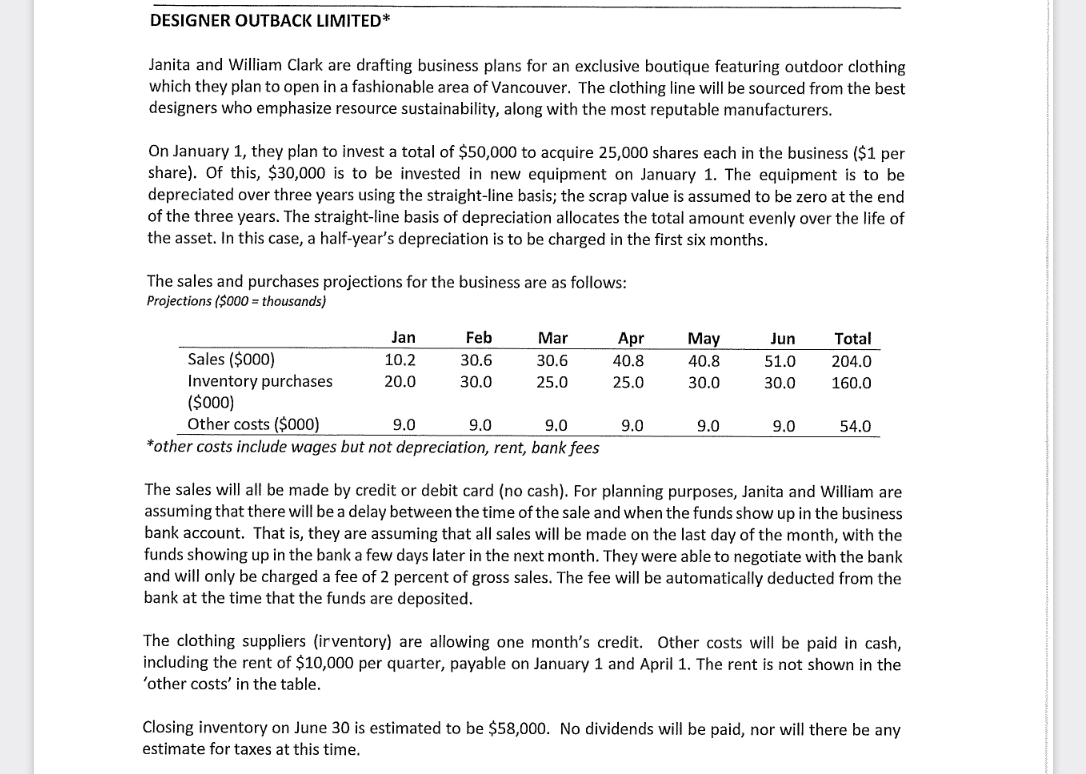

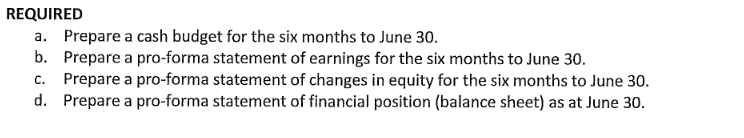

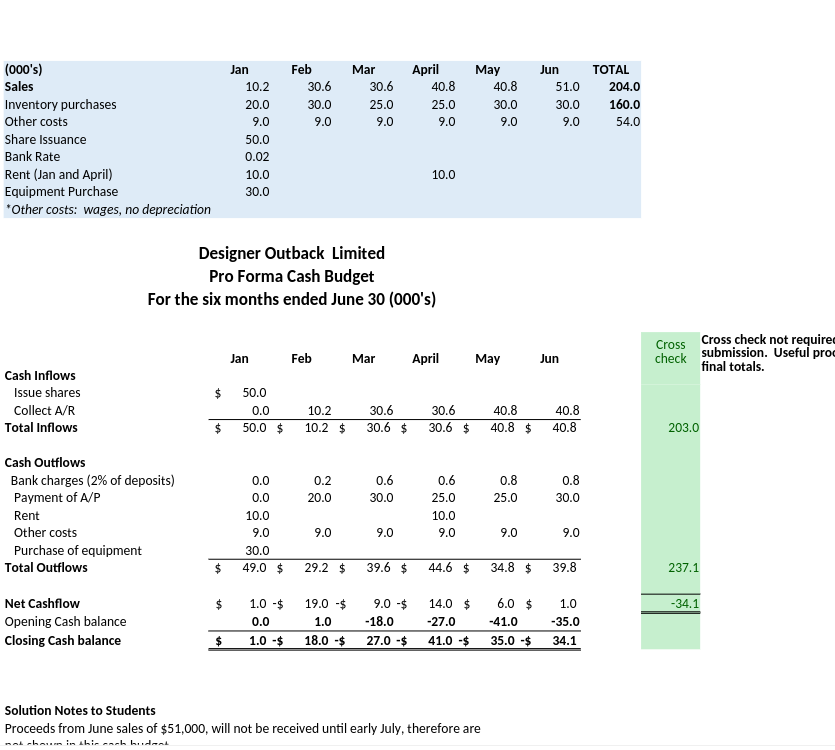

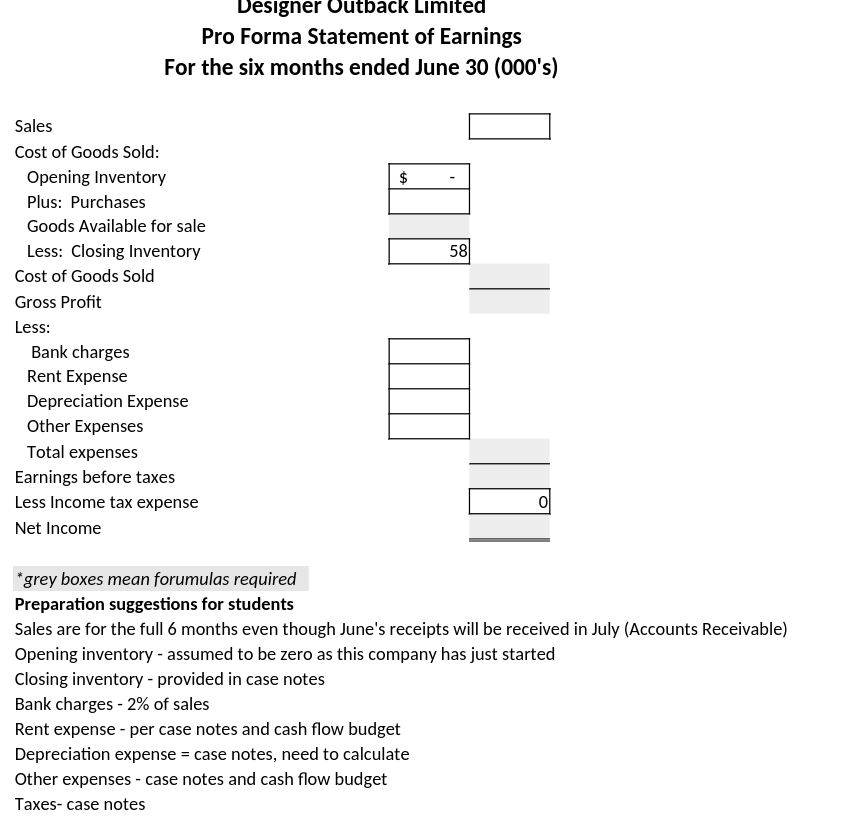

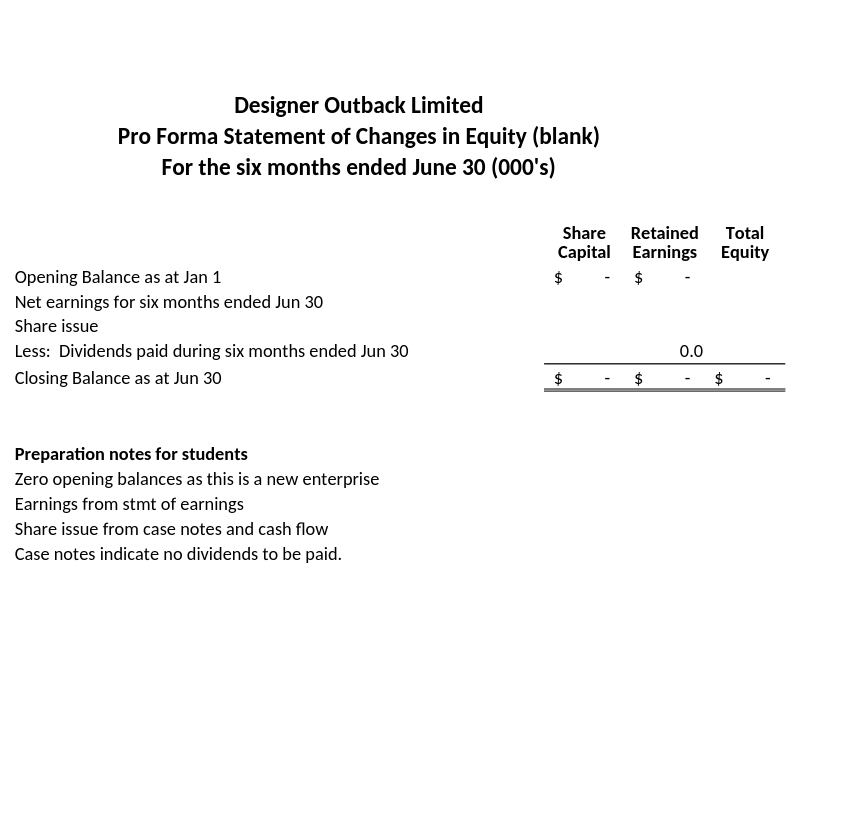

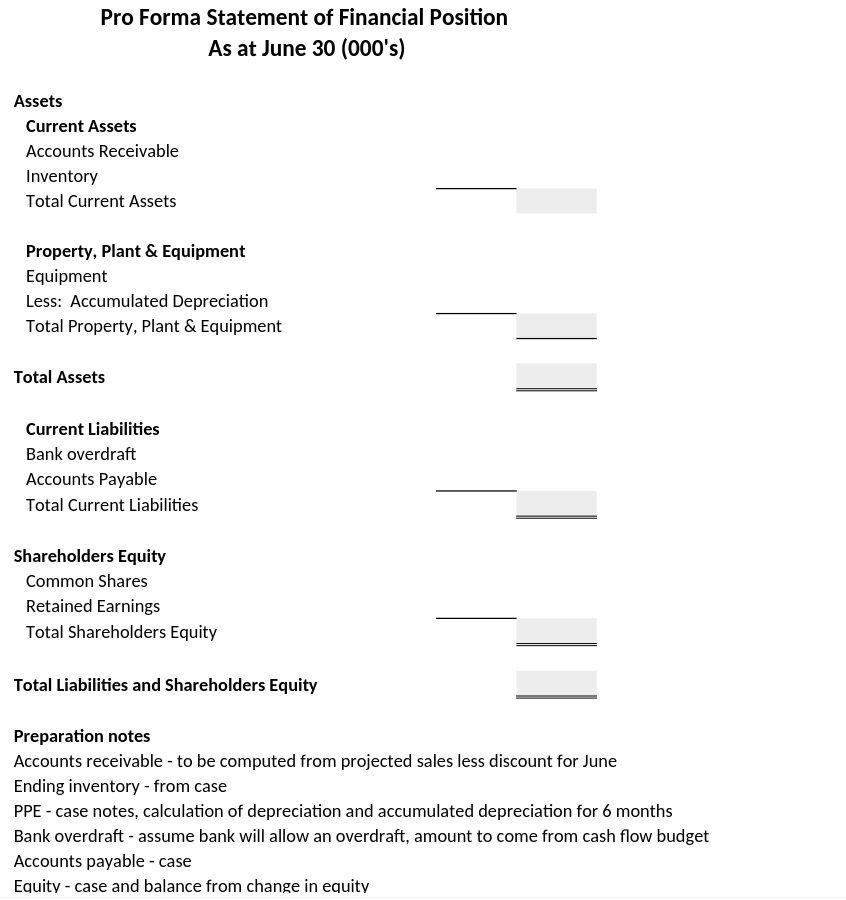

DESIGNER OUTBACK LIMITED* Janita and William Clark are drafting business plans for an exclusive boutique featuring outdoor clothing which they plan to open in a fashionable area of Vancouver. The clothing line will be sourced from the best designers who emphasize resource sustainability, along with the most reputable manufacturers. On January 1 , they plan to invest a total of $50,000 to acquire 25,000 shares each in the business ( $1 per share). Of this, $30,000 is to be invested in new equipment on January 1 . The equipment is to be depreciated over three years using the straight-line basis; the scrap value is assumed to be zero at the end of the three years. The straight-line basis of depreciation allocates the total amount evenly over the life of the asset. In this case, a half-year's depreciation is to be charged in the first six months. The sales and purchases projections for the business are as follows: Projections ( $000= thousands) The sales will all be made by credit or debit card (no cash). For planning purposes, Janita and William are assuming that there will be a delay between the time of the sale and when the funds show up in the business bank account. That is, they are assuming that all sales will be made on the last day of the month, with the funds showing up in the bank a few days later in the next month. They were able to negotiate with the bank and will only be charged a fee of 2 percent of gross sales. The fee will be automatically deducted from the bank at the time that the funds are deposited. The clothing suppliers (irventory) are allowing one month's credit. Other costs will be paid in cash, including the rent of $10,000 per quarter, payable on January 1 and April 1 . The rent is not shown in the 'other costs' in the table. Closing inventory on June 30 is estimated to be $58,000. No dividends will be paid, nor will there be any estimate for taxes at this time. REQUIRED a. Prepare a cash budget for the six months to June 30 . b. Prepare a pro-forma statement of earnings for the six months to June 30 . c. Prepare a pro-forma statement of changes in equity for the six months to June d. Prepare a pro-forma statement of financial position (balance sheet) as at June 30 . Designer Outback Limited Pro Forma Cash Budget For the six months ended June 30 (000's) Cross Cross check not requires check submission. Useful pro final totals. 203.0 237.134.1 Solution Notes to Students Proceeds from June sales of $51,000, will not be received until early July, therefore are Pro Forma Statement of Earnings For the six months ended June 30 (000's) * grey boxes mean forumulas required Preparation suggestions for students Sales are for the full 6 months even though June's receipts will be received in July (Accounts Receivable) Opening inventory - assumed to be zero as this company has just started Closing inventory - provided in case notes Bank charges 2% of sales Rent expense - per case notes and cash flow budget Depreciation expense = case notes, need to calculate Other expenses - case notes and cash flow budget Taxes- case notes Designer Outback Limited Pro Forma Statement of Changes in Equity (blank) For the six months ended June 30 (000's) Pro Forma Statement of Financial Position As at June 30 (000's) Preparation notes Accounts receivable - to be computed from projected sales less discount for June Ending inventory - from case PPE - case notes, calculation of depreciation and accumulated depreciation for 6 months Bank overdraft - assume bank will allow an overdraft, amount to come from cash flow budget Accounts payable - case Equity - case and balance from change in equity DESIGNER OUTBACK LIMITED* Janita and William Clark are drafting business plans for an exclusive boutique featuring outdoor clothing which they plan to open in a fashionable area of Vancouver. The clothing line will be sourced from the best designers who emphasize resource sustainability, along with the most reputable manufacturers. On January 1 , they plan to invest a total of $50,000 to acquire 25,000 shares each in the business ( $1 per share). Of this, $30,000 is to be invested in new equipment on January 1 . The equipment is to be depreciated over three years using the straight-line basis; the scrap value is assumed to be zero at the end of the three years. The straight-line basis of depreciation allocates the total amount evenly over the life of the asset. In this case, a half-year's depreciation is to be charged in the first six months. The sales and purchases projections for the business are as follows: Projections ( $000= thousands) The sales will all be made by credit or debit card (no cash). For planning purposes, Janita and William are assuming that there will be a delay between the time of the sale and when the funds show up in the business bank account. That is, they are assuming that all sales will be made on the last day of the month, with the funds showing up in the bank a few days later in the next month. They were able to negotiate with the bank and will only be charged a fee of 2 percent of gross sales. The fee will be automatically deducted from the bank at the time that the funds are deposited. The clothing suppliers (irventory) are allowing one month's credit. Other costs will be paid in cash, including the rent of $10,000 per quarter, payable on January 1 and April 1 . The rent is not shown in the 'other costs' in the table. Closing inventory on June 30 is estimated to be $58,000. No dividends will be paid, nor will there be any estimate for taxes at this time. REQUIRED a. Prepare a cash budget for the six months to June 30 . b. Prepare a pro-forma statement of earnings for the six months to June 30 . c. Prepare a pro-forma statement of changes in equity for the six months to June d. Prepare a pro-forma statement of financial position (balance sheet) as at June 30 . Designer Outback Limited Pro Forma Cash Budget For the six months ended June 30 (000's) Cross Cross check not requires check submission. Useful pro final totals. 203.0 237.134.1 Solution Notes to Students Proceeds from June sales of $51,000, will not be received until early July, therefore are Pro Forma Statement of Earnings For the six months ended June 30 (000's) * grey boxes mean forumulas required Preparation suggestions for students Sales are for the full 6 months even though June's receipts will be received in July (Accounts Receivable) Opening inventory - assumed to be zero as this company has just started Closing inventory - provided in case notes Bank charges 2% of sales Rent expense - per case notes and cash flow budget Depreciation expense = case notes, need to calculate Other expenses - case notes and cash flow budget Taxes- case notes Designer Outback Limited Pro Forma Statement of Changes in Equity (blank) For the six months ended June 30 (000's) Pro Forma Statement of Financial Position As at June 30 (000's) Preparation notes Accounts receivable - to be computed from projected sales less discount for June Ending inventory - from case PPE - case notes, calculation of depreciation and accumulated depreciation for 6 months Bank overdraft - assume bank will allow an overdraft, amount to come from cash flow budget Accounts payable - case Equity - case and balance from change in equity