Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Desiree is 48 years old and is hoping to retire at age 60. She has saved $50,000 in her RRSP and expects to be

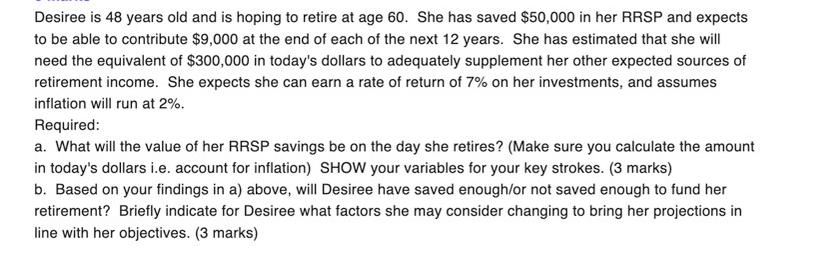

Desiree is 48 years old and is hoping to retire at age 60. She has saved $50,000 in her RRSP and expects to be able to contribute $9,000 at the end of each of the next 12 years. She has estimated that she will need the equivalent of $300,000 in today's dollars to adequately supplement her other expected sources of retirement income. She expects she can earn a rate of return of 7% on her investments, and assumes inflation will run at 2%. Required: a. What will the value of her RRSP savings be on the day she retires? (Make sure you calculate the amount in today's dollars i.e. account for inflation) SHOW your variables for your key strokes. (3 marks) b. Based on your findings in a) above, will Desiree have saved enough/or not saved enough to fund her retirement? Briefly indicate for Desiree what factors she may consider changing to bring her projections in line with her objectives. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the value of Desirees RRSP savings on the day she retires in todays dollars we need to account for both inflation and the rate of return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started